Editor’s Note: Over the last few years, news of world renowned geologist M. King Hubbert’s theory of peak oil theory has circulated widely. Most have now heard his theory which in a nutshell says, global production of Oil and Natural Gas will decline due to increased difficulty in getting to the Global reserves of these fossil fuels. Many have studied the peak oil phenomenon, trying to confirm (or deny) Hubbert’s timing of the peak. Oil companies and International Energy Agencies have both confirmed and denied the case for “Peak Oil” over the years. But current information from the Energy Information Administration sheds new light on the subject as Doug Hornig of Casey’s Energy Opportunities shows us in this article.

Washington Capitulates: Peak Oil Is Real

By Doug Hornig, Editor, Casey’s Energy Opportunities

Each year, generally in May, the Energy Information Administration publishes a less-than-eagerly-anticipated tome called the International Energy Outlook, 250+ pages of mind-numbing text, charts, graphs, and tables.

No one reads it. The mainstream media ignores it.

It’s the product of the best prognosticators in the Department of Energy. Okay, that may be what puts most people off. But if you’re patient enough to dig into it, it will cough up some fascinating nuggets of information.

The present edition is no exception. The report refrains from spelling out the peak oil conclusion that seems most obvious from its data. However, confirming a trend begun just last year, the 2009 edition clearly reveals that the government has been forced to admit that Peak Oil is coming. Moreover, it’s expected to arrive much faster than was believed as recently as two years ago.

This represents a remarkable turnaround in the agency’s opinion. Up until 2008, they were predicting unbroken growth in world oil supplies for the next two decades. But in ’08 and ’09, the rosy picture turned decidedly unrosier.

Peak Oil by the Numbers

Before we look at the numbers, a couple of notes on terminology. The EIA makes its projections based on what its analysts call the “reference case,” i.e., average economic growth. It also provides estimates for better- and worse-case scenarios, but the reference case represents the best guesses they have.

Oil (as we generally think of it), upon which most of the world economy depends, is termed “conventional liquids,” i.e., the stuff that comes gushing up from under Saudi sands. “Unconventional liquids” – extra-heavy oil, bitumen, coal-to-liquids, gas-to-liquids, and biofuels – are also covered in the report, as we’ll see, but conventional is far and away the most important one at this moment in history.

With that in mind, by 2007 the IEO was in its final year of irrational exuberance, confidently predicting that world production of conventional liquids would be 107.5 million barrels/day (up from 81.9 in 2005). That dovetailed nicely with a forecast for world demand of 118 million b/d, with 10.5 million barrels of unconventional liquids taking up the slack.

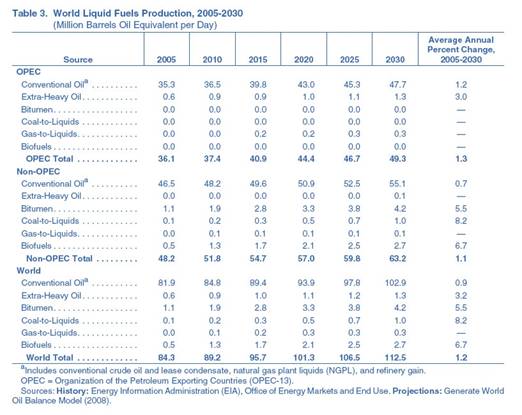

By ’08, they had put the info into table form, and look what happened:

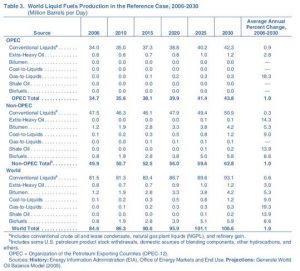

Same table, ’09:

Production Shrivels = Peak Oil

Projected production, as you can see, is suddenly shriveling up. From 107.5 million b/d of oil projected for 2030 in 2007, to 102.9 million barrels per day in 2008, to this year’s meager expectation for 93.1 million. That’s a drop of 13.4% in only two years, and posits production growth of only 11.6 million barrels per day (14.2%) from 2006 levels.

If that isn’t an admission that the era of “Peak Oil” is upon us, what is?

The report assumes that some of this stunning shortfall will be made up by development of unconventional liquids to the tune of 13.5 million b/d, including a jump of 5.9 million b/d in biofuels. At the same time, while conventional liquid production from non-OPEC nations is projected to grow only 7%, OPEC is expected to substantially increase its contribution, ramping up output by almost 25%. (All figures are for the period of 2006-2030.)

Does this seem optimistic? Well, it presupposes some heavy lifting on the part of OPEC, a dicey proposition in the best of times.

And it means creation of the infrastructure necessary to exploit extra-heavy oils, tar sands, shale, ultradeep deposits and other unconventionals, all of which require sophisticated technological know-how and face significant environmental challenges.

Biofuel production could more easily be elevated. But to reach the lofty level of nearly 6 million b/d would necessitate a huge diversion of cropland from food to energy, certain to be attended by a rise in food prices, not to mention potentially serious food shortages. The need for food being rather more primal than the need for gasoline, politicians are going to be reluctant to risk loosing angry mobs into the streets.

Peak Oil – Widening Gap Between Production and Consumption

Even if all of these developments proceed flawlessly, though, we’ll still have to face a widening gap between production and consumption. Or will we?

As it turns out, we’re in luck! Or so the EIA would have us believe. Because, accompanying that falling supply is – you guessed it – declining demand. In 2007, the IEO anticipated world demand for all liquids of 118 million b/d in 2030. This year, that estimate shrank to 107 million b/d, right in line with production.

The important point to take away from the IEO’s analysis is that the world is facing a decline in liquid fuel production and the government, after years of straight-faced denial, is now admitting it.

Peak Oil = Pay Up

Does this mean we’re going to run out of oil? No. But supply constrictions mean that the good old days of limitless, cheap oil are gone. And, though viable alternatives eventually will be developed, there’s no way of putting a timetable on that. In the interim, we’re going to have to pay up if we want to keep the family jalopy on the road.

How much? The IEO report’s reference case calls for $130/barrel oil in 2030, but that’s based on relatively modest demand increases from India, China, and other developing nations, and we find it very optimistic. It easily could be twice that.

Rising oil prices mean some belt-tightening, but they also offer investment opportunities, in both conventional and unconventional resource companies. In addition, power-generation alternatives such as solar, nuclear, and geothermal will be coming to the fore.

For more info about Casey’s Energy Opportunities

Note-

Discovering the right companies with sound fundamentals and the potential for handsome returns isn’t easy. Unless you are math prodigy Marin Katusa… Marin discovered a complex mathematical algorithm that helped him become a multimillionaire by the time he was 31. Marin now works with Casey Energy Opportunities. Click here to learn more about his secret system.