For the last year, the media has been blaming the Semiconductor Chip shortage first on COVID and then on a supply chain nightmare. On January 25th2022, the U.S. Department of Commerce issued a report on its findings into the issue.

Some of their Key Findings Include:

- Demand is way up! i.e. 17% higher in 2021 than in 2019.

- Supply hasn’t kept up with demand (Duh)

- Inventory has fallen from 40 days supply in 2019 to 5 days in 2021

The report concluded that the major problem is a lack of production capacity. What the report didn’t say was that the problem is that most of the older chip factories are unable to produce the new chips. The newest generation of chips are much denser than the older chips so, it is necessary to either retool or build new factories to make the newest chips. Intel is the only remaining U.S. based chip maker and Intel is spending $20 billion to build two new “advanced chip technology” factories. Advanced chip technology is defined as anything smaller than 7 nanometers (nm).

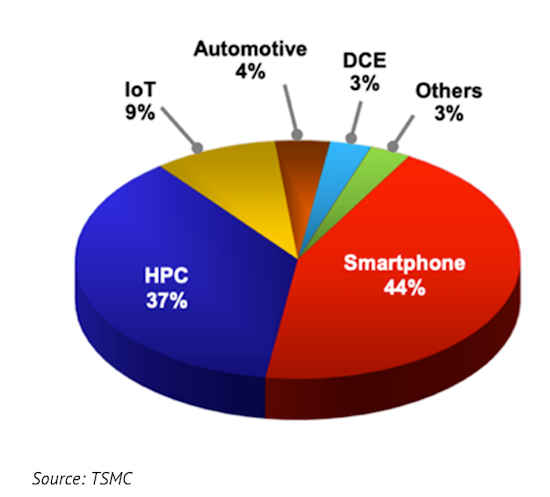

The major uses for the new chips are 5G smartphones and high-performance computing (hpc) these uses vastly eclipse the Internet of Things (IoT) that was all-the-rage a few years ago. And although we’ve heard quite a bit about how the chip shortage is affecting the auto industry recently, cars actually use a relatively small portion of total chip production. One of the few companies capable of producing the newer chips is Taiwan Semiconductor (TSMC). Their world-class chip foundry generated $15.74 billion in revenue in the fourth quarter of 2021 alone, generating a net profit of $6 billion. The following chart shows the breakdown of TSMC’s chip production.

Based on TSMC’s success, even though Intel is spending $20 billion, it shouldn’t take long to recoup that investment. The problem is that it takes so long to build the factory. Intel doesn’t expect its new factories to be online until 2024. But they expect it to create “3,000 high-tech, high-wage Intel jobs, 3,000 construction jobs, and support an estimated 15,000 additional indirect jobs in the local community”. According to Intel’s President Randhir Thakur, “75% of global capacity is concentrated in East Asia. At the same time, U.S. companies account for 48% of the world’s chip sales, but U.S.-based fabs account for only 12% of the world’s semiconductor manufacturing.” So chips manufactured in Asia have to be shipped halfway around the world to get to U.S. consumers.

But TSMC is not giving up ground to Intel so easily (currently Intel is a major customer for TSMC chips). TSMC plans to increase capital expenditures from $30 billion in 2021 to as much as $45 billion in 2022. Increasing production capacity for 7-nm but also for 5-nm, 3-nm, and even 2-nm chips. Currently, only Samsung and TSMC can produce chips at 5-nm and below.

Chip factories in Asia have a 25% to 50% cost advantage primarily due to government incentives. So, in June of 2021, the U.S. Senate declared chips to be critical to U.S. defense and proposed $52 billion in federal funding for domestic semiconductor manufacturing incentives and R&D programs.

At some point, all this new capacity may saturate the market but it certainly won’t happen for a few more years and in the meantime, we can expect 7-nm chips and below to be in short supply.

You might also like:

- Great Financial Failures in U.S. History

- Are 3D Printed Houses the Trend of the Future?

- Metaverse vs. Multiverse- What are They? And Where are They Leading?

- Speed and Affordability: Cost of Internet Access Over Time

- Top 5 Reasons Why 5G Will Change the Finance Industry

- Turning Nuclear Waste into “Perpetual” Batteries