Recent government legislation shows a trend towards regulating and controlling crypto and all other financial transactions. They want to track every account over $600, monitor crypto transactions, and otherwise pry into all your financial affairs. Of course, they say this is for your protection but…

Why Governments Villainize Assets That Protect Against Inflation

For years, in an effort to drive down prices, gold was attacked as a “barbarous relic” that paid no interest. But it was the only financial asset that wasn’t simultaneously another person’s liability. When an asset is also a liability, it’s always possible that the liable party will be unable (or unwilling) to make good on that liability. In that case, the asset becomes worthless. But if you hold physical gold, it will always be worth something. The price may fluctuate wildly, but it will never be worth zero. Being a commodity with many real-world uses (in addition to just jewelry), gold also tends to maintain its value during both inflation and deflation, plus gold tends to appreciate faster than inflation in times of crisis.

For years it seemed that governments worldwide wanted to discourage their citizens from owning gold (while simultaneously hoarding it for their own treasuries). One reason for this seemingly duplicitous behavior is that without an alternative, citizens are forced to spend (and save) using the government-sanctioned currency. If you have the choice of opting out of depreciating currencies, most logical people will do so once the benefits outweigh the costs.

Another reason governments dislike alternatives to the official currency is that alternatives reveal the actual value of the government currency. Governments with perpetually high inflation rates like Argentina often will publish dubious “official” inflation rates in an effort to convince their populace that inflation isn’t as bad as their pocketbook tells them that it is. But with a non-shifting yardstick like gold, their lies become apparent. So governments discourage gold ownership and thus leave people foolish enough to listen to their lies, defenseless to the ravages of inflation.

Along Comes Crypto

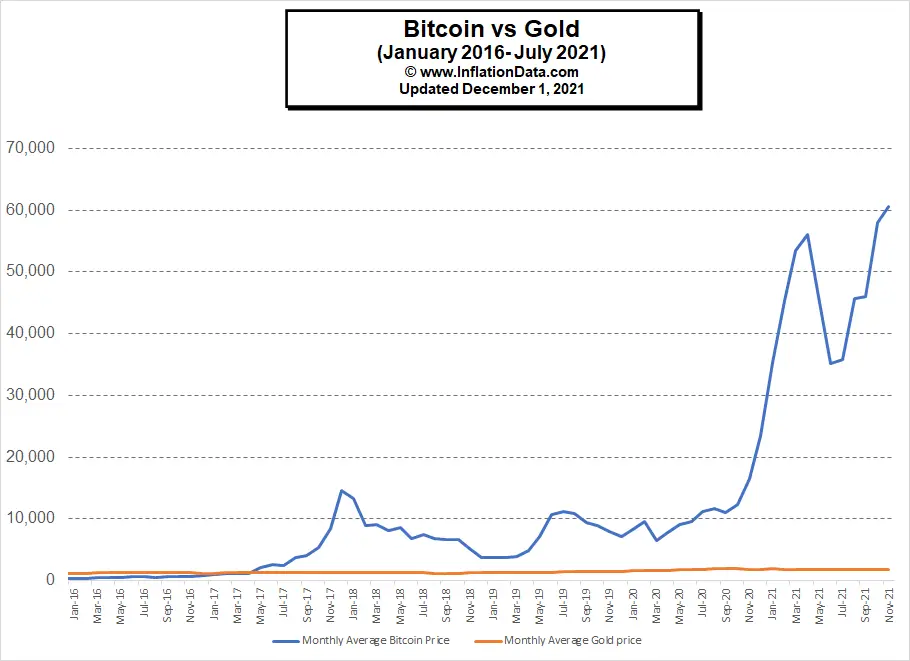

With the advent of cryptocurrencies, governments have a new villain to demonize. It almost seems that gold has fallen out of favor, and crypto has become the new gold. Millennials seem more likely to turn to modern alternatives like bitcoin rather than the antiquated (and time-tested) gold. And it is easy to see why. In recent years gold has remained relatively stable while crypto has skyrocketed.

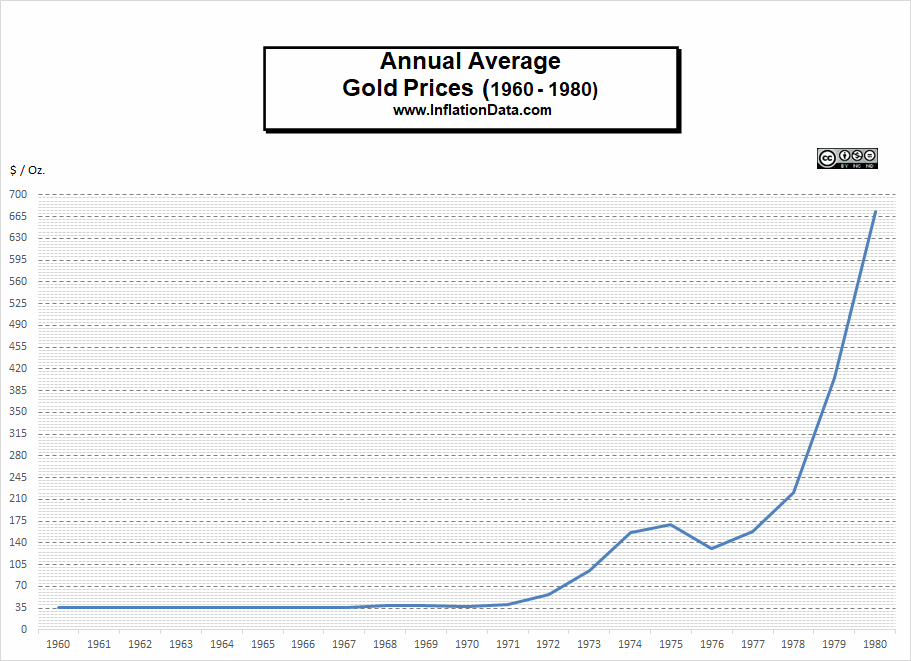

But that could be partially the result of its “newness”. Back in the 1970s, when gold ownership was once again legalized, it also skyrocketed in price.

It is said that 16% of all Americans have turned to cryptocurrencies. That is roughly 33 million Americans. But the majority of those crypto holders are young—31% of Americans under age 30 own some crypto. They also tend to be non-white; blacks and Hispanics are almost twice as likely to own crypto than are white Americans. Of course, these are early days in crypto’s life, and anything can happen.

Crypto has been billed as a way to protect against a falling dollar i.e., digital gold— as anonymous as real gold or real cash, that can never be seized or inflated. Of course, governments don’t like any of those features, so they are beginning to rally around the idea of somehow regaining control of crypto. This could be via a nationalized government-controlled “official” crypto (that they can print) as Venezuela tried recently or by taking the opposite tack and making crypto ownership illegal. At first blush, it may seem ludicrous that a government could outlaw crypto ownership, but back in the early 1930s, it seemed crazy to think that the government could prohibit gold ownership, but that is exactly what FDR did.

In our article Oil, Petrodollars, and Gold we said,

In 1933, President Franklin Roosevelt perpetrated one of the greatest frauds ever on the American public. He knew that the government had inflated the currency and the U.S. could no longer maintain the pretense that gold was still worth only $20.67 per ounce. So he hatched a scheme to nationalize all the gold in the country, by forcing the citizens to turn in their gold at the official price. Once he collected it all, he readjusted its price to the then market price of $35/oz. Thus FDR presided over a 69.33% gain in the value of the gold equivalent to a 69% tax on the ownership of gold. Not just on the gain in value but on the total value of all the gold. In those days, a government’s money supply consisted of the number of ounces of gold it held. So Roosevelt’s gold grab effectively, increased the money supply and “legitimized” the inflation that had silently been occurring behind the scenes as prices increased but gold values did not.

So although it may seem impossible that the government would confiscate your bitcoin, it is not beyond the realm of possibility. The first question is one of practicality, how could they possibly accomplish it? That is a good question, but they can make it illegal to hold bitcoins with the stroke of a pen. Thus they convert millions of law-abiding citizens into criminals. A portion of those millions will not want to become criminals and will therefore turn their bitcoins over to the government at some predetermined (probably below market) price. But unlike gold, this act in and of itself could destroy the value of bitcoin since there would no longer be much demand for it, so its price would fall.

Plus, once it is illegal to own bitcoins (even though you acquired them “legally”) the government could seize any accounts they locate. Bitcoin vending machines would no longer be legal, bitcoin exchanges would be illegal so, they could be difficult to exchange. And unlike gold, what do you actually have? Crypto only exists as an idea and a few electrons on the internet.

Cryptocurrency ownership might already be under government attack, according to this article in The Daily Signal,

“Having failed to convince the American people that greedy meatpackers and grocery stores are causing inflation in everything from used cars to houses to gasoline, the administration and Congress are now going after Americans who use cryptocurrencies with tools that could easily install a China-style surveil-and-control system on all of your financial accounts. Last week the Biden administration announced an upcoming executive order to coordinate anti-crypto rules across government agencies, including the Securities and Exchange Commission, the Office of the Comptroller of the Currency, and the Commodity Futures Trading Commission.”

Plus in the wake of financial sanctions against Russian aggression in Ukraine, Congress is proposing legislation against crypto under the guise of preventing Russian use of crypto to avoid sanctions. But it is likely that this legislation would have little to no effect on Russians and only negatively impact Americans.

You might also like:

- Is Bitcoin a Better Inflation Hedge Than Gold?

- Hyperinflation in Turkey and Argentina Today

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- Oil, Petrodollars, and Gold

- Gold is a “Crisis Hedge” not an Inflation hedge

- How has Venezuela’s Bitcoin experiment Fared?

- Who Does Inflation Hurt Most?

- What is the Velocity of Money?