In the ongoing saga of Musk vs. Twitter, we first heard that the iconic billionaire founder of X.com (aka. Paypal), Tesla, SpaceX, Hyperloop, etc., started acquiring significant quantities of shares of Twitter. On March 14, 2022, he had a 5% stake in the company. By April 1, he had 9.13% of the total outstanding shares, valued at the time at $2.64 billion, making him the largest shareholder in the company.

In the ongoing saga of Musk vs. Twitter, we first heard that the iconic billionaire founder of X.com (aka. Paypal), Tesla, SpaceX, Hyperloop, etc., started acquiring significant quantities of shares of Twitter. On March 14, 2022, he had a 5% stake in the company. By April 1, he had 9.13% of the total outstanding shares, valued at the time at $2.64 billion, making him the largest shareholder in the company.

At that point, Twitter’s Board of Directors offered Musk a seat on the Board… IF… he would agree to not acquire more than 14.9% of the company. This stipulation didn’t sit well with Musk, and so he declined the offer shortly before his appointment became official on April 9th. Sensing a profit “opportunity”, Vanguard Group upped its stake in Twitter and became the company’s largest shareholder at 10.3%, bumping Musk out of the top spot.

But Musk says this isn’t about the money but rather something much more important… i.e., freedom of speech.

“I think it’s very important for there to be an inclusive arena for free speech,” Musk said during the event. “Twitter has become kind of the de facto town square, so it’s really important that people have both the reality and perception that they’re able to speak freely within the bounds of the law.”

Musk also said that Twitter needs to make its algorithm open sourced and that any action the company takes against tweets needs to be thoroughly explained to the public to stop “behind the scenes manipulation” on the platform by the company.

Musk Offers to Buy 100% of Twitter

On April 13th, Musk made a generous offer to buy the whole company. Bloomberg News reported: Musk offered to “acquire all of the outstanding Common Stock of the Issuer… for all cash consideration valuing the Common Stock at $54.20 per share.”

Musk wrote the following letter to Twitter Chairman Bret Taylor:

Bret Taylor

Chairman of the Board,

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

/S/ Elon Musk

At $54.20 per share, the deal would cost Musk about $40 billion, but as the world’s richest person with a net worth of between $260 and $273 billion, he can probably afford it. Jeff Bezos is #2 at $188 billion.

Musk’s letter includes both a carrot and a stick. The carrot obviously is a handsome opportunity to profit. The stick, of course, is the possibility of Musk “reconsidering his position as a shareholder,” i.e., selling and driving the price down (and perhaps creating a competing platform).

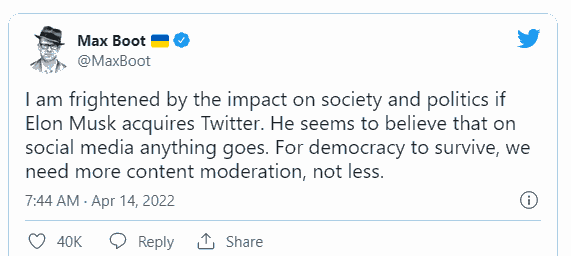

The blogosphere exploded with indignation by those who believe that censorship is a good thing…

But shareholders who bought Twitter with the idea of making money (including Vanguard?) would probably vote in favor of accepting Musk’s offer. Since their responsibility is to maximize value for shareholders, if the Board refuses Musk’s deal out of hand, they may open themselves up to a class-action lawsuit from shareholders for breach of fiduciary responsibility. To avoid this, they could open it up for a shareholder vote… of course, if you are a Saudi Prince, you can afford to reject Elon’s offer.

Saudi Pushback to Elon Musk’s Twitter Offer

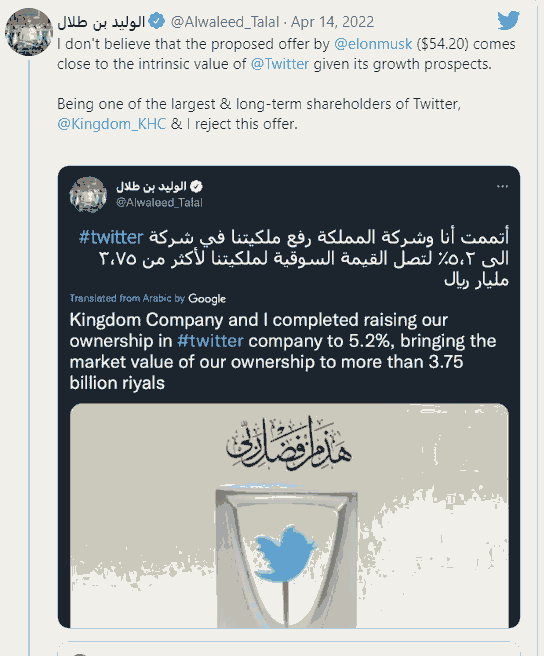

Billionaire Saudi Prince Alwaleed bin Talal Al Saud said on Thursday that he would vote to reject Elon Musk’s offer to buy the company.

“I don’t believe that the proposed offer by @elonmusk ($54.20) comes close to the intrinsic value of @Twitter given its growth prospects,” the Saudi prince tweeted. “Being one of the largest & long-term shareholders of Twitter, @Kingdom_KHC & I reject this offer.”

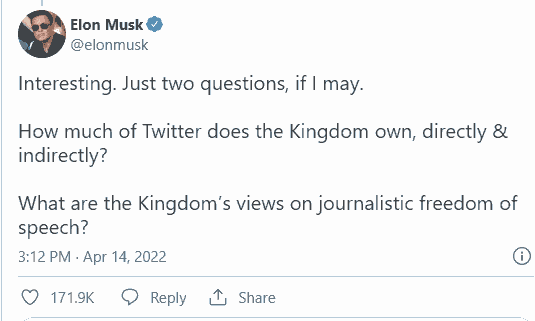

Of course, this triggered a response from Musk questioning Saudi Arabia’s position on freedom of speech, which we all know is abysmal.

In a recent TED talk, Musk was asked, is there a “Plan B” if his offer for Twitter is rejected. Musk responded with a smile, “There is”. Of course, there’s a Plan B… this is Elon Musk we’re talking about.

You might also like:

- Technology And The Semiconductor Chip Shortage

- How Blockchain’s Unique Innovations Can Prevent Money Remittance Scams

- Are 3D Printed Houses the Trend of the Future?

- Will 2022 Be the Year of Massive Social Media Upheaval?

- Metaverse vs. Multiverse- What are They? And Where are They Leading?

- Speed and Affordability: Cost of Internet Access Over Time