The Bullish Case

- The FED is close to pausing.

- The economy will avoid a “hard landing”.

- Consumers will continue to spend.

- Numerous Bullish signals since 2020.

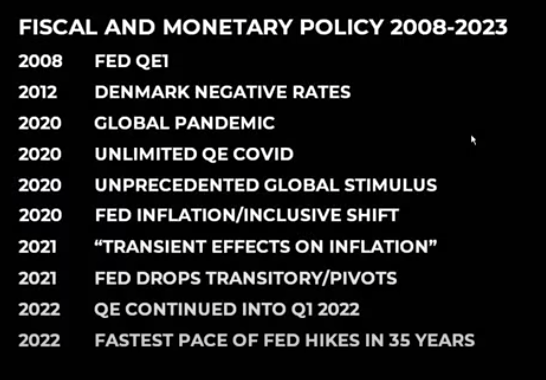

Today Chris Ciovacco looks at both the bullish and bearish cases in an objective manner and tries to come to some insights. He looks at the psychology and expectations going into 2022-23. The high volatility, failed signals and market’s feedback mechanism, policy impact, FED impact, reasons to believe the worst may be over.

He will also look at Global liquidity, Yield Curve, and new signals. In addition, Chris gives us a brief history of Quantitative Easing and how we go to where we are today.

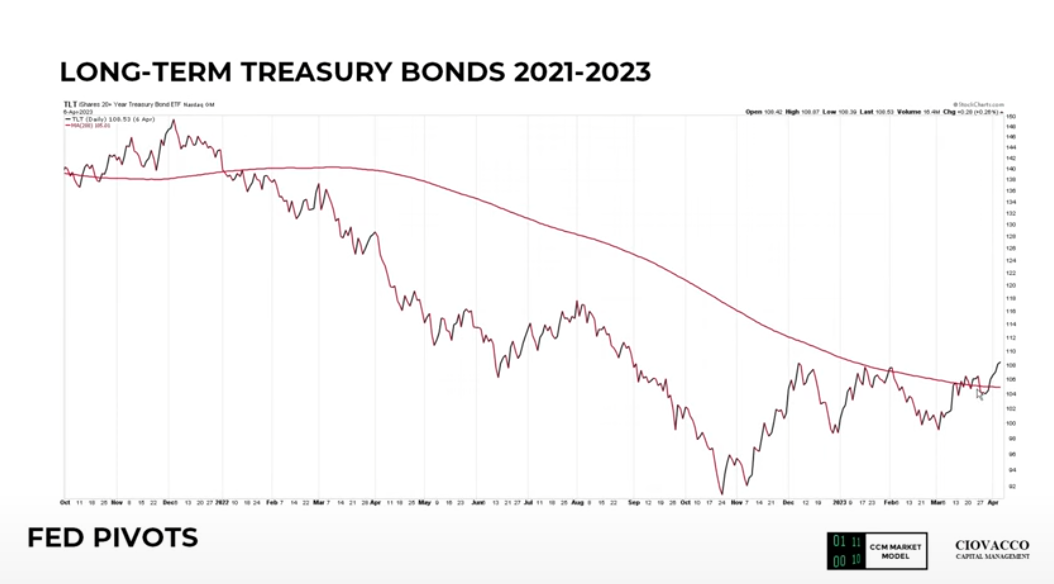

Long Term Treasury Bonds have crossed above their long-term moving average giving us some reason for hope.

The market is attempting to flip from a primary downtrend to a primary uptrend… whether it succeeds or not is the question. The sentiment indicator is starting to turn around and the VIX volatility index is telling us to expect better outcomes.

A New Type of Recession is Possible

Due to all the stimulus that was pumped into the economy in 2020-21, it is possible that we will get a different type of recession this time around. A recession with low unemployment. If this happens, spending won’t decrease as much, and so companies’ balance sheets won’t suffer as much, thus giving us a very mild recession.

The Bearish Case

- FED Rate hikes are causing a credit crunch.

- A recession will create a big hit to earnings.

- The Inverted Yield Curve Indicates Problems ahead.

- Market hasn’t fallen enough yet.

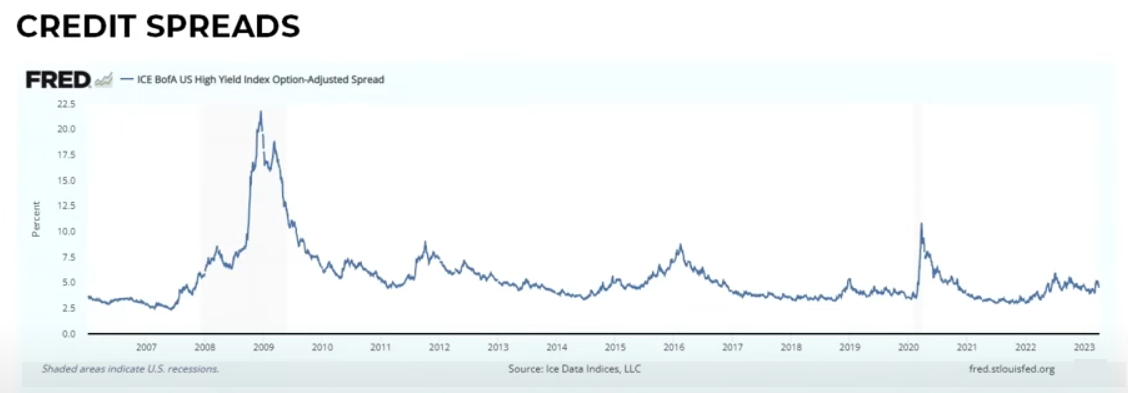

If things are going to get worse credit spreads will have to expand rapidly.

The market is setting up for a big move… the question is in which direction?

At the moment, this chart favors a bullish outcome but that can change quickly is the index (black line) falls below the colored lines.

Listen to Chris Ciovacco’s full commentary here:

You may also like: