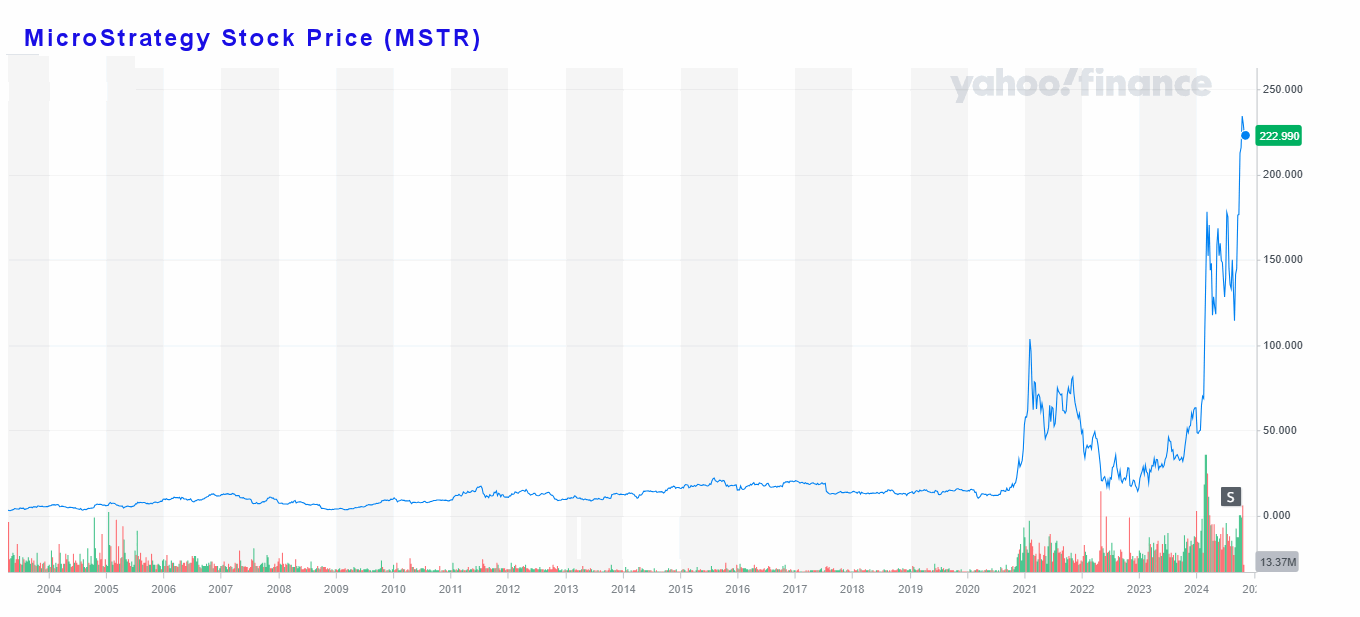

Just a few short years ago MicroStrategy (MSTR) was a run-of-the-mill software company. At that point, founder and CEO Michael Saylor realized that unless something changed, the company would remain a slowly dying cash cow. They had lots of companies paying them licensing fees for their software but eventually through attrition that would come to an end.

So, being the analytical geek that he was, he asked himself where’s the best place to put all that excess cash. And so began his investigation. Typically, companies in that position choose to either pay the cash as dividends or use it to buy back stock both of those options provide additional shareholder value but not optimal returns on investment. Saylor wanted more. He wanted real returns after inflation and he was driven to find the best returns.

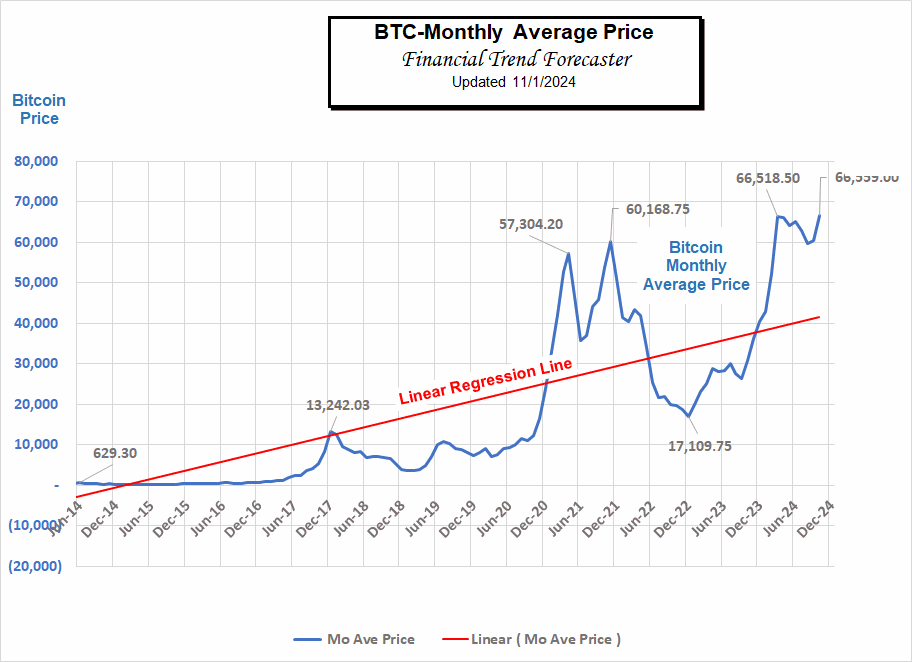

What Michael Saylor discovered was that despite all its volatility Bitcoin (BTC) had been the best performing asset for several years in a row. So, Saylor reasoned that plowing all that free cash back into BTC made sense because:

- It wouldn’t be a taxable event to shareholders, unlike paying dividends.

- It provided tremendous growth potential over the long-term despite the short-term volatility.

- BTC had a very limited supply and a growing demand.

This limited supply would eventually drive the price of BTC to astronomical heights. So, he didn’t really care what price he bought at. In the long-run he would look brilliant. And so far that is exactly what has happened.

MicroStrategy’s system is much like dollar-cost-averaging (DCA) in that at regular intervals they buy more BTC no matter the price.

Taking the Strategy a Step Further

At this point, Saylor took his plan to the next level. He turned to leverage. Typically, leverage can be a two-edged sword. It multiplies your profits on the up-side but also multiplies your loses on the downside. And if the tide is against you, you can get a margin call and be forced to liquidate at a major loss. Generally, the way margin works is that you borrow against the value of the asset you are betting on and all is fine unless that value declines below the value of the loan.

But Saylor didn’t borrow against the Bitcoin he was buying. Instead, he borrowed against the value of the company. This gave him very favorable interest rates and protection against a falling bitcoin price. Since he was borrowing against the “free cash flow” of the company (and that was very reliable) he was eligible for very low interest rates. So he was never subject to margin calls when BTC took one of its frequent dives. Instead, Saylor just saw that as another buying opportunity.

So far, this strategy has served him well, putting MicroStrategy on par with the likes of Invidia as one of the fastest growing companies in the world. Recently CoinTelegraph published an article stating, “MicroStrategy is up over 1,500% since 2020, while the S&P 500 index rose just over 111% during the same four-year period.” This means that “Microstrategy has outperformed every company in the S&P 500 since August 2020.”

But that hasn’t stopped Saylor from upping the stakes even further. According to CoinDesk, Michael Saylor’s MicroStrategy plans to raise $42B to buy more Bitcoin over the next 3 years. This will be accomplished by selling an additional $21 Billion of Stock while simultaneously borrowing an additional $21 Billion of debt. In mid-September, MicroStrategy announced that it had purchased an additional 7,420 bitcoins (BTC) for $458.2 million, which brought its holdings to 252,220 bitcoins acquired for a total of $9.9 billion, or an average price of $39,266 each. At the recent price of about $72,000, the company’s bitcoin was worth more than $18 billion.