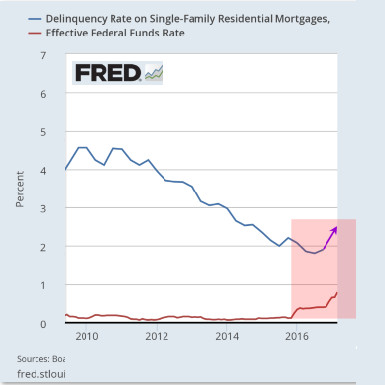

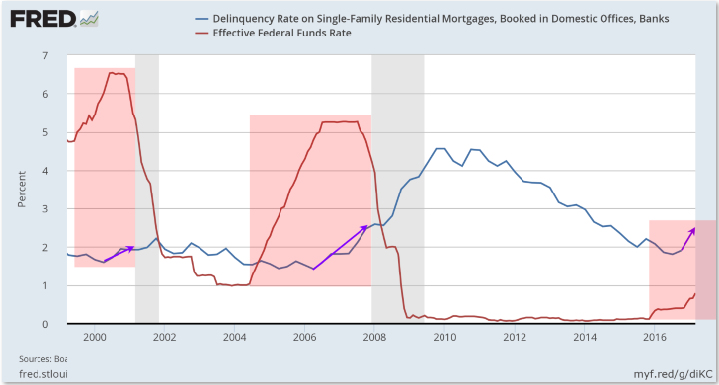

Mortgage Delinquency Rates Increase

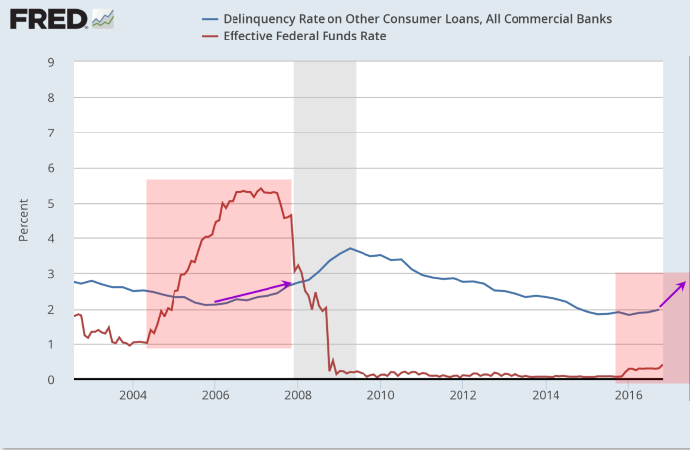

Delinquency rates in Single Family Residential Mortgages and other Consumer Loans began to climb through the later half of 2016 and early 2017. The timing of this delinquency rate increase coincided almost identically with the Fed increases in their Funds Rate. Additionally, commercial loan origination stalled for the first time since 2008-2011 (prior to that was a stall in 2000).

If you’ve been following our daily video market analysis, you’ll know that we believe the market is still in a bullish trend and that we expect this upward price action to continue for a while.

These early warning signs that the Fed rate raises may be pushing other factors of the US economy should be viewed as just that – early warning signs. It also means that Financial and Banking stocks may find some downward price pressure over the next few months. And protection assets (Gold/Silver and related ETFs) may see continued upward price movement as cash migrates from traditional financial assets into more protectionist asset classes.

Single Family Mortgage Delinquency Rate

The two charts below show the rate of mortgages defaulting. Additionally, real estate asset classes may start to see increased volatility as this segment of the economy struggles and has to deal with delinquencies. The US Fed is attempting to raise rates enough to allow for more normalized economic functions without disrupting the stability of the global markets. It is our opinion that these efforts by the US Fed will provide substantial rotation in certain sectors of the US markets that skilled traders will be able to profit handsomely from these moves.

All Other Consumer Mortgage Delinquency Rate

In particular, 3x ETFs may provide unique opportunities for profits. Let’s review a few potentials…

Throughout all of these charts, I expect you’ll notice a similar setup with regards to Financials, Oil Services and Real Estate. The Fed easing over the past 6+ years has driven asset prices to near all-time highs (or above all-time highs in some cases) and the recent oil price recovery has driven the oil service industry to near term recent highs.

The examples we are illustrating today are all contingent on the US Fed continuing to raise rates, as planned this year, which may put further pressure on these segments of the markets as well as potentially increase delinquency rates for residential, commercial and other consumer loans. In other words, we are expecting some moderate price rotation in the markets over the next few months and we are poised to take advantage of these moves if and when a setup occurs.