In the following article, The Gold and Oil Guy Chris Vermeulen looks at investor sentiment, Federal Tax Revenues, Food Stamps, Median Household income vs. Home Prices, and comes to some interesting conclusions. ~ Tim McMahon, editor

EXCHANGE-TRADED FUNDS MAKE DECISIONS EASY

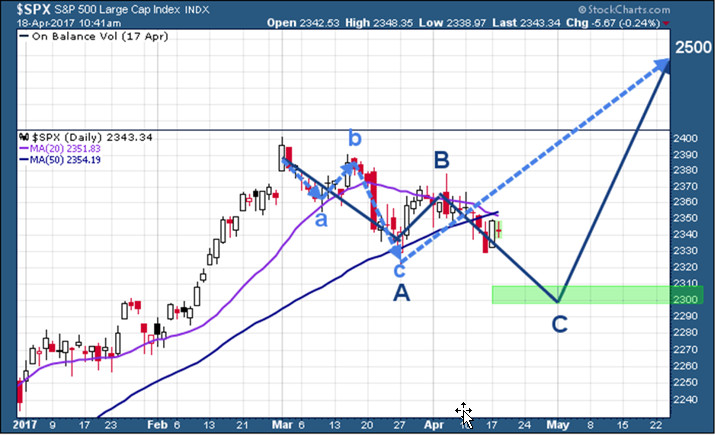

Stock Market Forecast Big Picture: The broad stock market is working through a more complex corrective price pattern. My recent forecast, as displayed in the chart below, indicates that the next leg up is toward 2500. The market may be about to start a larger A-B-C correction to test the 2300 level to fully cleanse itself, before starting the next leg up. But overall, the SPX is very bullish long-term.

Investors are among the most pessimistic they have been in 7 years! Over the past four weeks, this sentiment is nearing the lowest of all readings of the past 30 years. If it declines a bit further, it will suggest future returns of the SPX will be impressively positive over the next couple months.

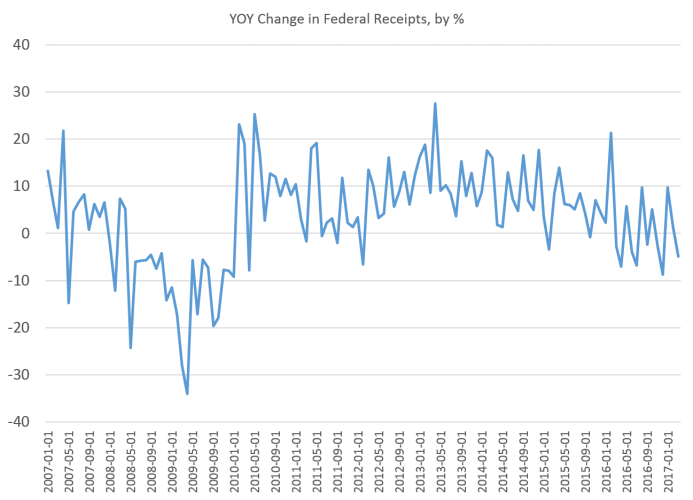

Federal Tax Revenue Falls to 80-Month Low!

The last time that Federal receipts fell this much was, in July of 2008, right before the “financial crisis”. March of 2017 was the fourth month, in a row, in which federal receipts were down year over year, while growth rates overall have been falling quickly since mid-2015. This a RED FLASHING warning sign that all is not well in the U.S. economy.

What is their solution?

Private Collection of Overdue Federal Taxes Begins this April.

The Internal Revenue Service, IRS, announced earlier this month have hired four debt collection agencies to collect on outstanding payments from taxpayers. The IRS now has employed private debt collection firms to contact taxpayers who still have not paid their previous years’ taxes.

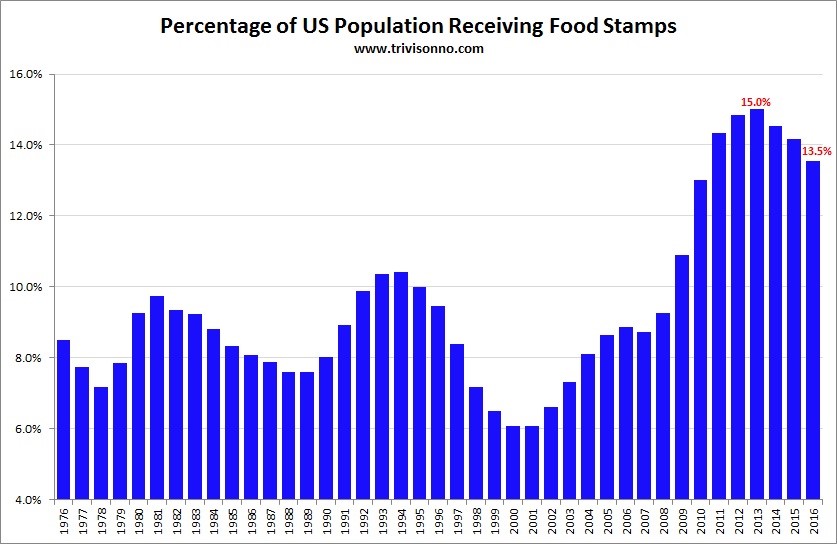

Households and employees apparently are NOT doing nearly as well as they have been told they are! I wonder if Chairwoman Yellen and Company. ( https://mises.org/library/end-ultra-easy-money), are aware of all of this? To my naked eye, this does not look like economic growth nor a healthy economic recovery!

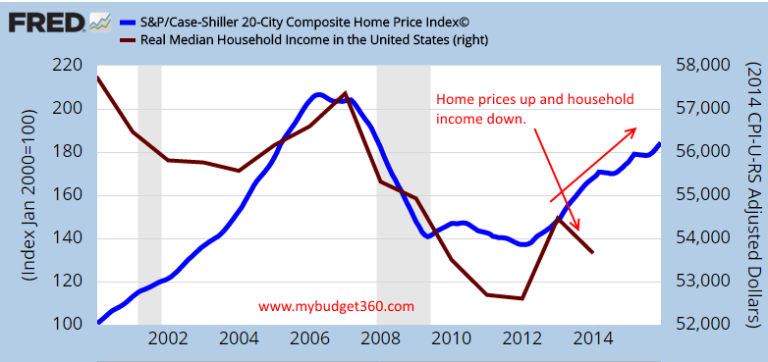

What we have invented, in order, to keep big banks afloat, for a while longer is ultra-low interest rates, NIRP, ZIRP, etc. They create the illusion of not only growth, but also of wealth. They make people believe that a home they could never have dreamt of otherwise buying not long ago is possible to fit into their ‘budget’. This is how they are lured into signing up for ever larger mortgages, which, in turn, keeps our banks from falling over.

Record low interest rates have become the only way that private banks can create new money and stay alive (because at higher rates barely anyone would be able to afford a mortgage). It is of course not just the banks that are kept alive, but the entire economy, as well.

I really do not think that we are actually returning to normal interest rates under these circumstances. I believe that based on this overview, proper interest rates in the FEDs future are going much lower than it has been historically. The FED is now going to now realize that it cannot buy itself out of a “business cycle” and that an “old-fashioned” deflationary depression is upon us, now!

The International Monetary Fund, (IMF), released a report that is projecting a prolonged period of low interest rates and low growth that has gripped the global economy since the 2008 financial crisis. This would force major structural changes of pension funds, asset-management firms and insurance companies. Their products and business models, under lower growth and low interest rates, will have to be radically revamped! Pension funds, insurance companies and the future of investing all will likely have to change significantly: (https://www.bloomberg.com/view/articles/2017-03-24/pension-crisis-too-big-for-markets-to-ignore). Defined-benefit pension plans would have to start reducing benefits. Insurance companies will have to reinvest in maturing assets at lower yields while continuing to make high payouts on their policies. Today, they are acting more like hedge funds than their traditional roles. They will most likely require more capital to stay solvent.

The IMF Global Financial Stability Report stated, “The experience of Japan suggests that an imminent and permanent exit from a low-interest-rate environment need not be guaranteed. That would pose “a considerable challenge to financial institutions.” The Trump Rally Will continue? http://www.barrons.com/articles/are-you-ready-for-trump-rally-2-0-1492634005)

Live The American Dream!

Are you living hand-to-mouth or paycheck-to-paycheck? This all is too common a reality for U.S. workers. Three-quarters of the population are scrambling to cover their basic living costs. This next problem that Wall Street is about to experience can actually help you to make money, if you understand it and do exactly what we are doing.

Tune in every morning for my video analysis and market forecasts at TheGoldAndOilGuy.com on all ‘asset classes’ and new ETF trade opportunities.

Chris Vermeulen

www.TheGoldAndOilGuy.com