When you think of banking in the Middle East the Emirates and Dubai are generally the first to come to mind. However, away from the main stage, the kingdom of Bahrain holds much of the hidden potential which could bring the whole region to new levels of worldwide financial excellence.

Bahrain’s Economy – An Introduction

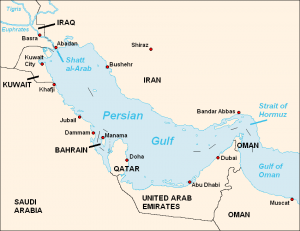

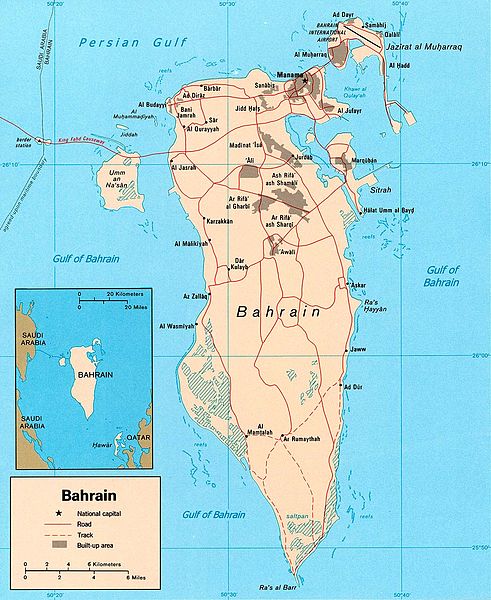

There are many reasons why the Bahrain economy has been attracting increasingly more foreign investors. First and foremost, the country has the region’s lowest taxes, and it still allows businessmen to travel effortlessly within the region, as it takes less than one hour by flight to reach Saudi Arabia, the Emirates and Qatar.

With 100% foreign ownership allowed, business in Bahrain is all about ease of access, and the overall economy has been benefiting from the country’s open market despite the recent global down-turn. Picking up from a short period of slow growth, the country’s GDP is expected to go up by an outstanding 6.2% this year and 3.4% next year.

Playing by Bahrain’s Rules

As the strong regional stability attracts many US businessmen to the region, it is still paramount to know what the local rules for banking are right

from the planning stage of your Bahrain-based business.

For what concerns Bahrain specifically, the Islamic culture comes into play also for what concerns opening hours: banks are open between 7:30 AM and 2.30 P.M. with Friday and Saturday being the days of rest.

Available in the country are three main kinds of accounts: current accounts, coming with no monthly fee, credit cards with little or no interest, savings accounts, which pay more interest than current accounts but have limited access to funds, and fixed-deposit accounts for long-term saving.

In order to open a bank account in Bahrain, you’ll need a residence permit, a ‘letter of no objection’ from your employer stating the monthly salary and expected monthly deposits, your tenancy agreement, and a copy of your passport.

It is possible to open an account before actually moving to the country, something which can be done online or over the phone through international banks operating in Bahrain.

It shouldn’t also be forgotten that local ATMs will charge you a service fee, and as elsewhere in the region, only American Express cards are accepted for withdrawals. As a means of payment, however, your American credit card operating on another system will be accepted, but it will be charged extra fees.

Last but not least, if you’re venturing outside the main urban areas always remember to have some cash on you as ATM services may not be available.

See Also:

- Forgotten Treasure: Unconventional Oil in the Middle East

- The Endless War: Saudi Arabia Goes on the Offensive Against Iran

- Oil Prices < $40/Barrel?

- Bank Runs Can’t Happen- Right?

- How the Golden Reset Button Could Drive the Price of Gold to $20,000.

Recommended by Amazon: