Investors have been told for years that diversification lowers risk. While that may be true in certain instances, it certainly isn’t true in the current world equity market.

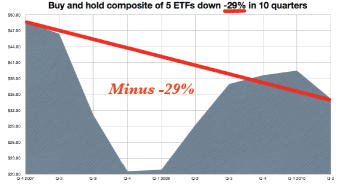

Let me give you an example: Using five ETF’s as a proxy for “BRICA” the five supposedly up and coming economies of Brazil, Russia, India, China and Australia we can see that if you had purchased them on January 2, 2008, you would have seen your equity diminish 29% in the space of 30 months with a “drawdown” much worse had you gotten out at the bottom of Q4- 2008. That means that after the miraculous rebound of 2009 and two quarters of 2010 you would still be down 29%. Not too good!

The big difference between the two is that you’re not in the market all the time. In fact, you are only in the market about 50% of the time based on MarketClub’s “Trade Triangle” technology which will tell you when that particular ETF is headed higher and when the market is headed down so you can be safely sitting on the sidelines in cash or an interest-bearing instrument and waiting for a signal to re-enter and catch the big up-moves. Adam Hewison, president of Ino.com has prepared a free 10-page report on the differences between these two strategies and how you can go from Buy and Hold losses to Trade Triangle Gains. We have made arrangements so you can get a free copy of this 10-page report from Adam. Simply click the link and he will e-mail you this 10-page report detailing the 5 ETF’s and what was involved in this study. Get your copy HERE.