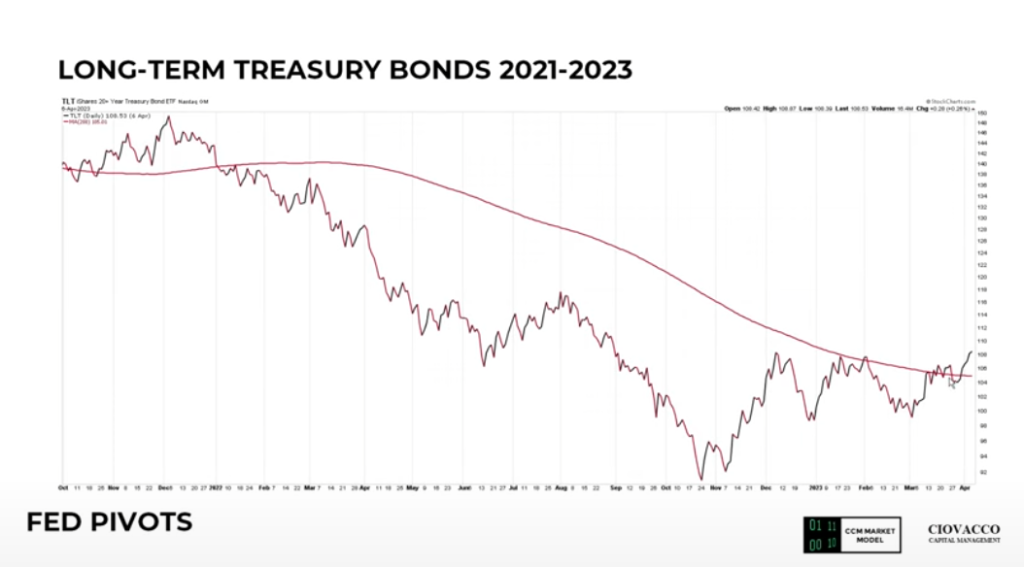

Is this the End of Fractional Reserve Banking?

In the following article Douglas French looks at the shaky Fractional Reserve Banking system that has been around since it was created by the Banking Act of 1933 (aka. the Glass-Steagall Act), which also created the Federal Deposit Insurance Corporation (FDIC). Will Fractional Reserve Banking survive to celebrate its Centennial anniversary? Recent trends in Idaho (of all places) could spell the end of fractional reserve banking (but not the FED).

Is this the End of Fractional Reserve Banking? Read More »