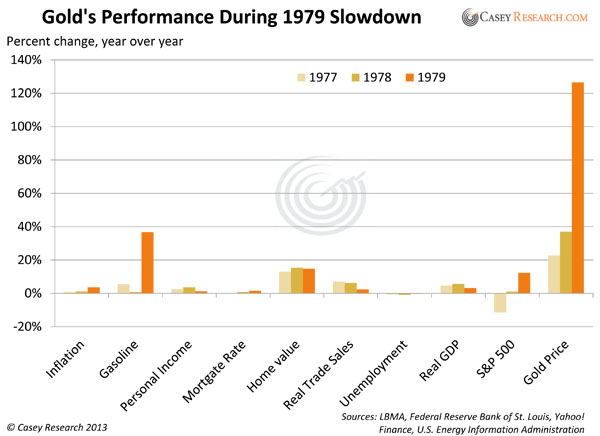

Doug Casey: “Gold Stocks Are About to Create a Whole New Class of Millionaires”

By Jeff Clark, Senior Precious Metals Analyst Bear markets always end. Has this one? Evidence is mounting that the bottom for gold may be in. While there’s still risk, there’s a new air of bullishness in the industry, something we haven’t seen in over two years. An ever-growing number of industry insiders and investment analysts […]

Doug Casey: “Gold Stocks Are About to Create a Whole New Class of Millionaires” Read More »