Is a Second OPEC Cut In The Cards?

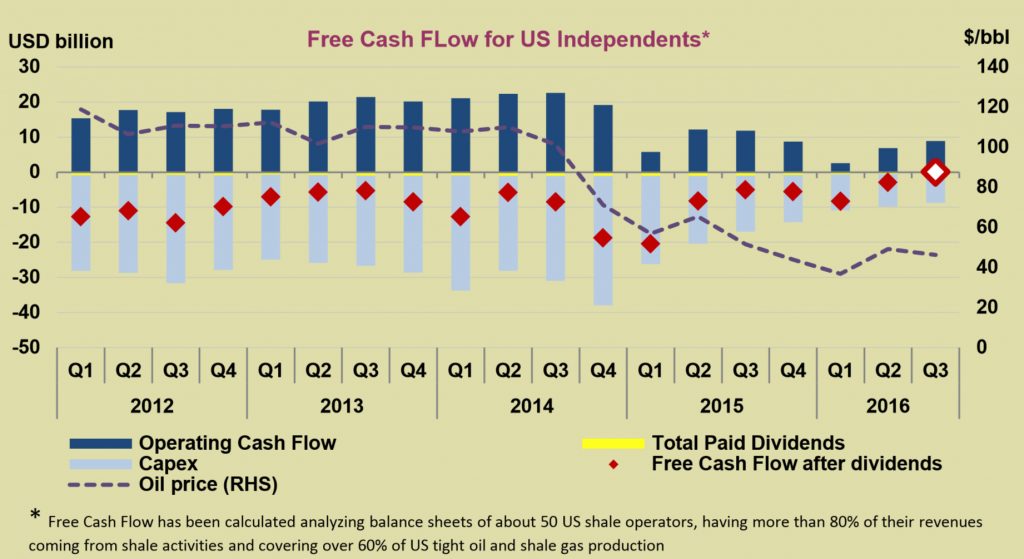

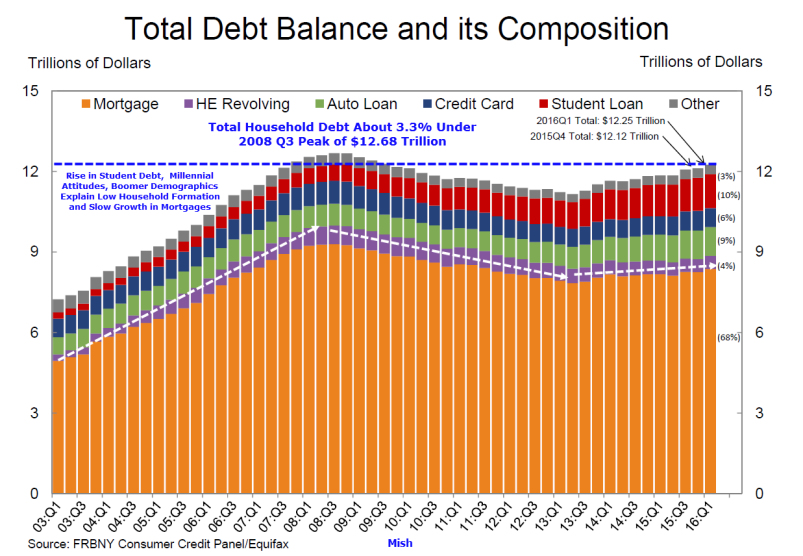

In November 2016 with great fanfare OPEC announced a cut in production in an effort to drive up prices in light of the massive global supply glut partially the result of U.S. shale oil flooding the market. This supply glut had put every Oil producing country in fiscal straits (since most of the governments derive a substantial portion of their revenues from oil). It also squeezed the private U.S. shale oil producers who had racked up significant debt prior to the oil price crash. In the months since we have published several articles pertaining to the price of oil. Initially OPEC’s production cut drove up oil prices but in Oil Prices High Enough to Spark Shale Rebound we showed that Shale production was capping the oil price gains.

Is a Second OPEC Cut In The Cards? Read More »