Is This Really the End of the Bitcoin Bull Market?

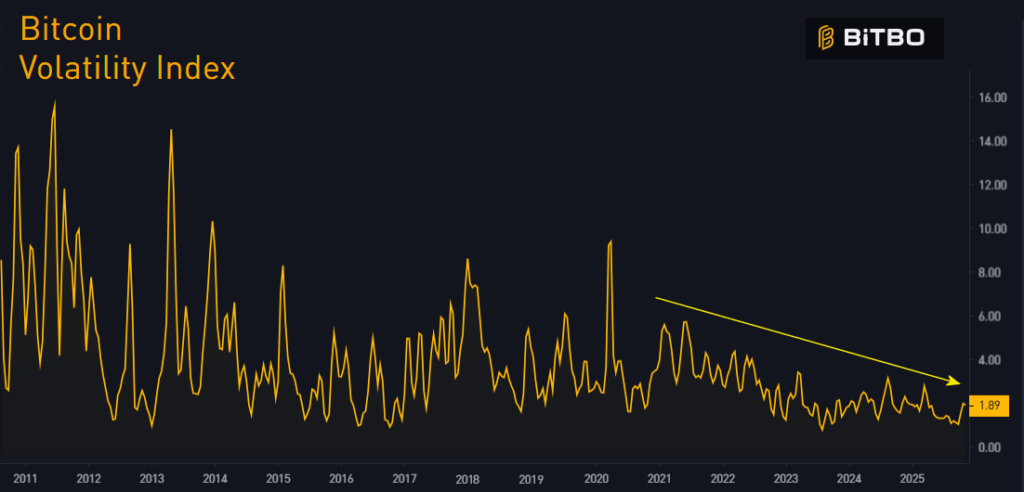

Many traders believe Bitcoin’s four-year cycle already peaked — but this wasn’t a blow-off top — it was a liquidity timeout. Fear is elevated, long-term holders are rotating, and fresh capital is building on-chain as stablecoin inflows hit record highs. Markets rarely end in fear. Instead of euphoria, we’re seeing uncertainty, liquidity constraints, and profit-taking from long-term holders. With billions in stablecoins waiting on the sidelines, the next major move may surprise the majority the cycle may have one more explosive leg.

Is This Really the End of the Bitcoin Bull Market? Read More »