Surprise Natural Gas Draw-down Signals Higher Prices Ahead

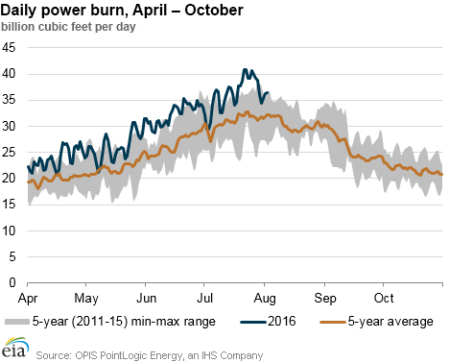

The U.S. electric power sector burned through a record amount of natural gas in recent weeks, a sign of the shifting power generation mix and also a signal that natural gas supplies could get tighter than many analysts had previously expected.

Surprise Natural Gas Draw-down Signals Higher Prices Ahead Read More »