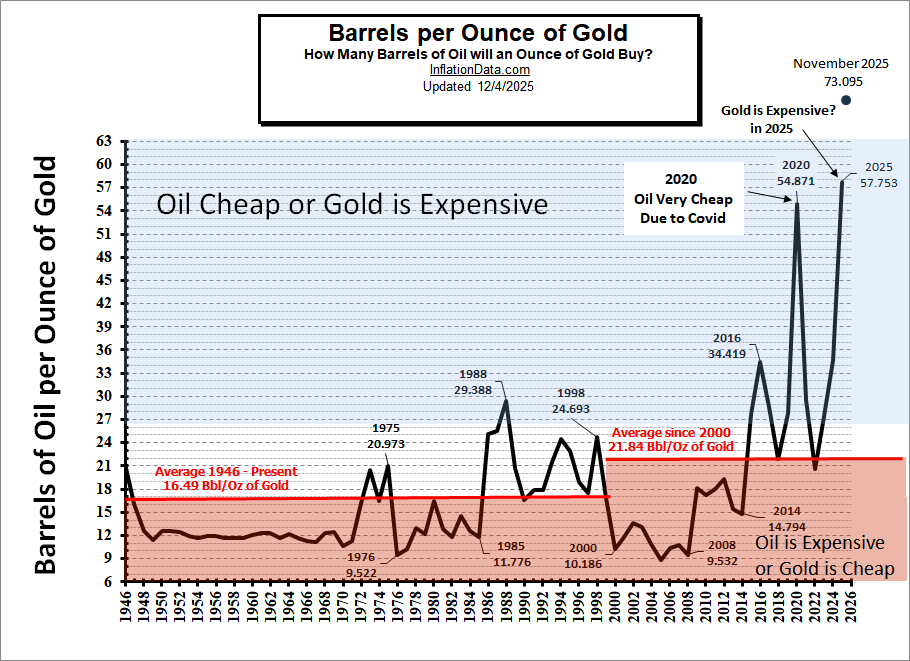

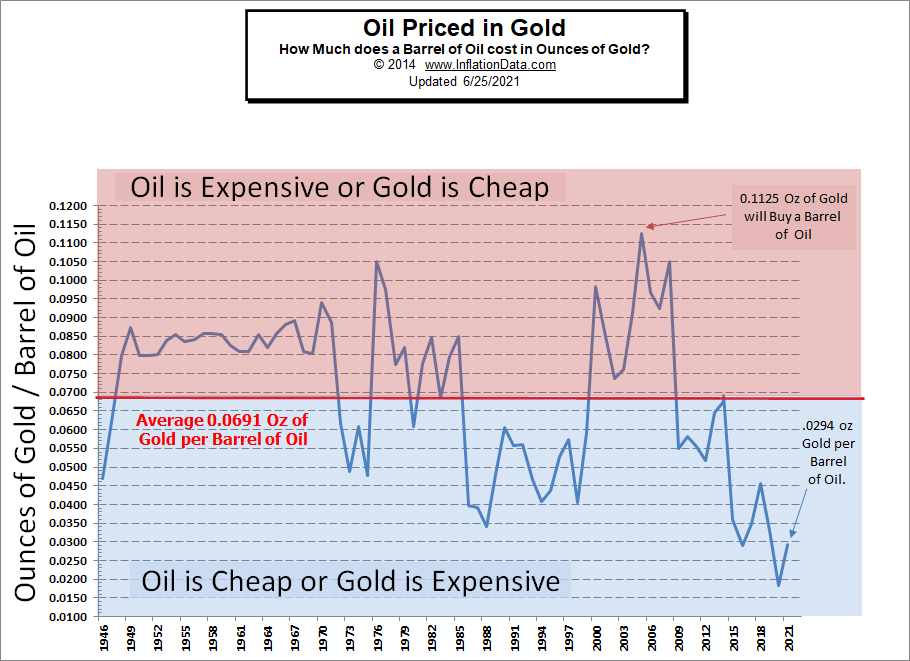

Everyone knows that Gasoline and Crude oil are currently expensive right? I recently updated several of our charts and when I got to the Crude Oil vs Gold chart I was in for a shock. According to that chart either Gold is expensive or Crude oil is cheap. Not as cheap as it was in 2020 but still historically cheap but it is actually simply approaching the long-term average ratio.

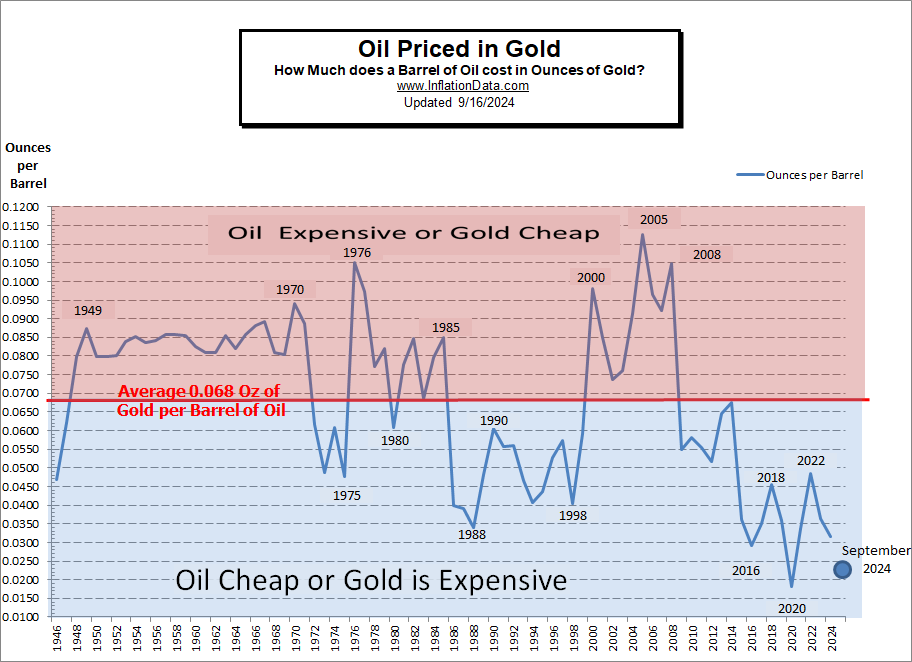

The thinking of the ratio is this… if the value of dollars is constantly changing the best way to tell if a commodity is expensive is to compare it to other commodities. Historically, gold has been money so what better commodity to compare to?

Looking at the chart of Gold vs. Oil we see that oil is still relatively cheaper than gold. Now as we have said many times Gold is a Crisis hedge so in times of crisis, gold appreciates. Therefore, we would expect gold to currently be expensive and it is, but it is not currently at all-time highs. Read the Full updated Gold vs. Oil Article here.