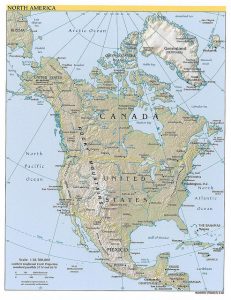

Mexico and Canada-

The University of Texas, El Paso (UTEP) has good news for Mexico. The Mexican economy has been growing, and it is expected to continue in an upward direction into the future. The Gross Domestic Product (GDP) increased by 3.5 percent, and the University’s experts expect prices to rise by 3.9 percent throughout the rest of the year. Both public and private sectors are expected to be a part of this expansion in economic activity.

The Presidential Election and the Economy

Like in the United States, during a year that the country decides who it will elect for its next president is a time when the economy becomes a subject at the forefront of the news. The year 2012 is also a presidential election year in Mexico, and economists have been looking into how the economy is doing. Past elections have resulted in a disruption in Mexico’s economic activity, but no such occurrences are expected this year.

The Peso against the Dollar

Mexico has experienced some negative economic news in the recent past. The peso has depreciated against the dollar, but experts do not believe that this trend is likely to continue. Even though the peso has dropped the most in the past three weeks due to the weakness in the United States’ economy, the experts believe that the peso will make a turnaround during the second part of this year. They expect the peso to be more stable against the dollar next year. Many countries actually want their Currencies to decline because it will make their exports cheaper on the global market. (Although conversely it will make imports more expensive) although it makes the individual poorer in the long run it may also encourage individuals to “buy locally” rather than sending the income abroad.

Mexico as an Alternative to China

Furthermore, Mexico seems to be the place where U.S. companies are turning as an alternative to China. Thanks to the fact that Mexico is going to be a major exporter of goods and services to the United States, its economy will remain ahead of Brazil for the second year in a row. As long as Mexico can be a place where U.S. companies can set up their operations, the working relationship between the two countries will continue into the future.

Canada: What about Our Neighbor to the North?

Mexico has a largely positive economic forecast, but the same cannot be said of the United States’ other neighbor. Canada is losing jobs and it is exporting fewer goods. Its housing starts have also slowed down in recent times.

Indications of how things are going economically for Canada are the unemployment rate and the trade deficit. The unemployment rate remained unchanged last month at 7.3 percent and falling exports caused there to be a trade deficit in April. Another negative indicator is the fact that construction companies are building new homes at a rate 13 percent lower this year than last year. Everything is leading economists to believe that the Canadian economy is set to be stagnant for the time being.

The Low Interest Rate May Be about to Increase

Currently, the country is enjoying extremely low interest rates. This week, the Bank of Canada announced that it is considering raising rates. The lower interest rates in place right now are the reason that consumers have been able to increase their household spending. As a net Energy exporter of primarily Oil from shale, Canada’s economy has also benefited from the recent higher prices of fuel, but they are aware that they cannot expect high fuel prices to drive the economy forever.

The rate hike will have the effect of reducing the numbers of people who seek to borrow money at the low interest rates. The reason they would want to do this is to keep from needing to raise the interest rates to a much higher level than where they are now. This is meant to keep the economy stable. Canadians may see an increase in interest rates by the beginning of next year.

Canada Is Watching the U.S. and Europe

Canada is a country that is closely watching what is going on in Europe because their economy will be affected by the happenings there. They are also watching how the United States and others handle their own economies and appear to be following their lead.

See Also: