Not all insurance companies are equal. Let’s take a closer look at each of the most popular life insurance rating companies and how they actually rank the insurance companies in finer detail.

Moody’s:

The Moody’s website is set up to rank insurance companies based on a variety of different criteria. You may have to create a free account to search their system. They rate a variety of different institutions including Financial Institutions (Banks) and even Governments. Their insurance company rating system is as follows:

Aaa (Exceptional) – The financial security of this life insurance company has been deemed to be nearly perfect. Some inevitable events may happen, but the overall financial strength of the life insurance company is predicted to remain strong and fortuitous. This includes Insurance companies like New York Life and Northwestern Mutual, and Teachers Ins. and Annuity … and very few others.

Aa (Excellent) – The long term risks associated with a AA rated life insurance company is all that sets it apart from the AAA rated companies. Somewhere in the future, a AA rated life insurance company may experience temporary setbacks, but the overall outlook of the financial strength is very good. This includes Guardian Life, Principle Life, Massachusetts Mutual and Metropolitan Life among others.

A (Good) – Although the overall financial security of an A-rated company is good, there may be certain financial setbacks that may hold them back in the future. This includes John Hancock, American General, Transamerica Life, Hartford, Liberty Mutual, Mutual of Omaha, Nationwide, Allstate, ING Life Insurance and Prudential. Note that many of the most advertised companies are on this list.

BAA (Adequate) – The financial strength of a BAA rated insurance company is currently adequate, but there may be certain financial protections lacking that may make them unreliable for future endeavors. Many divisions that specialize in Mortgages may be on this list even thought the Life insurance portion of the same company is A or Aa. Fortunately, the divisions are usually separate so that the impaired health of one division will not affect the other divisions.

Ba (Questionable) – The financial abilities of a life insurance company rated this low may be questionable at best, and also the long term outlook may be in serious jeopardy. Genworth Mortgage Insurance (USA) is on this list while Genworth Life insurance is rated A as is Genworth Financial Mortgage Indemnity Ltd. (Australia).

B (Poor) – The ability of a life insurance company to make the policyholder payments with a rating this low is very slim.

CAA (Very Poor) – A company rated as CAA may default on their policy payments on a regular basis and have other major problems as well.

CA (Extremely Poor) – A CA rated life insurance company should be avoided at all costs, as the chances of actually receiving lump-sum payments according to a policy is slim to none.

C (Lowest Rated Class) – Companies rated as C are in serious financial trouble, and may be in danger of closing up business for good. This is the lowest Moody’s rating there is.

Standard & Poor’s:

The S & P insurance rating system is somewhat different than Moody’s although the upper levels appear much the same . They have different rating criteria and a different rating system. Let’s take a closer look.

AAA (Superior) – The ability of an AAA-rated life insurance company to meet policyholder obligations is nearly unmatched in the competitive genre of life insurance. An AAA-rated life insurance company stands as a “top of the line” example for all other companies to follow.

AA (Excellent) – A AA rated life insurance company is able to meet policyholder expectations under a variety of challenging economic conditions. A AA rating is another good example of a great life insurance company to do business with.

A (Good) – The overall outlook of a A-rated life insurance company is good, but a company rated as A may be susceptible to adverse conditions in the future.

BBB (Adequate) – The overall impression of a BBB rated life insurance company is favorable, and they can meet policyholder expectations, but the future of the said company may be somewhat shaky.

BB (Adequate) – The ability of a BB-rated company to meet long term customer expectations for policy payments is questionable at best. A company like this is also vulnerable to adverse economic conditions in the market.

B (Vulnerable) – Although able to meet current customer expectations, the probability of a B rated life insurance company to experience financial fallout in the future is high. Everyone should be especially wary of B rated companies in order to stay safe.

CCC (Extremely Vulnerable) – The ability of a CCC rated company to meet customer expectations and make required payments is highly questionable. People are advised to stay away from these companies.

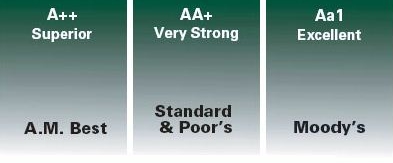

AM Best

Unlike fellow rating agencies Standard & Poor’s, and Moody’s which issue ratings for a broad range of business sectors—A.M. Best historically has focused exclusively on rating insurance companies.

The AM Best ratings scale includes six “Secure” ratings:

- A++, A+ (Superior)

- A, A- (Excellent)

- B++, B+ (Good)

The scale also includes ten ratings for companies deemed “Vulnerable”:

- B, B- (Fair)

- C++, C+ (Marginal)

- C, C- (Weak)

- D (Poor)

- E (Under Regulatory Supervision)

- F (In Liquidation)

- S (Rating Suspended)

Listed at the AM Best website is a variety of insurance articles, all designed to teach you about insurance, what it’s used for, and what it can do for you. And, if you want to find out more about the methodology of the AM Best insurance rating process, they detail their process schematic so you can see how they rank the insurance companies for yourself. It takes a lot of research on their part to find out the background history, track record, and overall quality of the insurance companies listed.

An Example Of The AM Best Ratings Service In Action

New York Life Insurance Company (March 2013)

Financial Strength Rating: A++ Superior

Outlook: Stable

Long Term Issuer Credit Rating: AAA Exceptional

Outlook: Stable

The best life insurance companies are out there waiting for you to find them. The life insurance rating systems are in place so you can see who stacks up and who doesn’t.

See Also:

- Trends: Estate Planning Changing

- Insurance Tips for Small Businesses

- Portfolio Insurance: A Concern for Industry Regulators?

- Financial Calculators

Life Insurance Ratings are of the utmost importance.

Is there someplace I can look at this rating of any insurance company?

Adrian,

Great question! Yes A.M. Best has been rating insurance companies for decades. you can look up your company here:

https://ratings.ambest.com/search.aspx