Is Gold making another shot at becoming the star investment? I have included two articles by Chris Vermeulen, founder of TheGoldAndOilGuy.com and AlgoTrades Systems. Chris is an internationally recognized market technical analyst and trader. He has been involved in the markets since 1997.

Is Gold making another shot at becoming the star investment? I have included two articles by Chris Vermeulen, founder of TheGoldAndOilGuy.com and AlgoTrades Systems. Chris is an internationally recognized market technical analyst and trader. He has been involved in the markets since 1997.

Commodities Rally

In the following chart of the price of gold from Gold-Eagle.com we can see that over the last six months gold made a low of $1,046.8 in early December and had a stellar two months in January and February. Then it moved sideways consolidating its gains in March and April. But May saw a new high of $1303.4. ~ Tim McMahon, editor

Commodities Overtake Stocks and Bonds with Best Rally Since 2010!

Traders who follow the price of gold and silver, should keep an eye out on the U.S. dollar index. The dollar has been within a trading range for more than a year. During December of 2015, the dollar rose to test the highs at 100, however, since February of 2016, the dollar has been in a downtrend, as shown in the chart below.

The FED has reduced the expectations of a rate hike in 2016 from one full percentage point, in the beginning of the year, to a half percent and perhaps to none at all. However, my expectation is that the FED may have to start rolling back this increase before the end of 2016.

The bullishness in the dollar was sparked by expectations of a change in the monetary policy of the FED. Market participants believed that the Zero Interest Rate Policy, NIRP, would end and that the rates were on an upward trajectory. However, world economic conditions have deteriorated since the beginning of 2016 and the ECB and BOJ both responded with Negative Interest Rates, NIRP and more QE. Consequently, the FED was forced to delay their rate hikes.

Last week’s short term breakdown of the dollar, below the critical support of 93, was a bearish sign which can bring the dollar further down to the 86 levels. But the dollar posted a solid rally by the end of the week to regain that critical support level for the time being.

U.S. Dollar Index

Although gold is a commodity, it is used as a hedge against ‘uncertainties’ and ‘crisis points’ which gives it a different edge. Gold, also behaves differently because of its’ usage as money, as ‘a store of value’, for many centuries for both individuals and countries.

Due to the ‘meaningless’ monetary policies of the various global Central Banks, gold will follow its’ unique behavior. I have explained this earlier and my models have been very timely in forecasting the turning points.

Gold will have a one-way move higher with many corrective phases on its’ impulsive new uptrend, therefore, I always keep my subscribers immediately informed so as they know when to make the next profitable trades of both gold and silver. The next trade I feel is just around the corner.

The following information was originally published in April 2015 but bears repeating now.

Gold Price: Year 2000 All Over Again – How Will You Play It This Time?

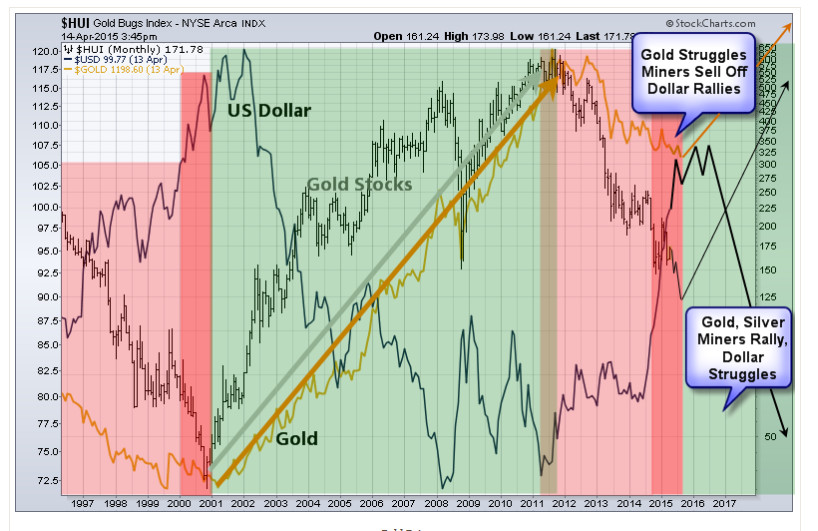

Recently business and financial guru Mark Cuban wrote an article about why this tech bubble is going to be worse than the tech bubble of 2000. This made me take another look at the long term charts again, but instead of looking up the NASDAQ or the tech sector I decided to check out gold mining stocks, gold price and the Dollar index.

From looking at the price action among the precious metals sector and the dollar it looks and feels like these markets are very close to repeating what happened in the year 2000.

The chart below is a monthly chart looking all the way back to 1996. I have color coded areas of the chart that represent weak and strong times for the price of gold.

Key Points:

- The US Dollar is trading roughly at the same level and trending higher as it was in 2000.

- Rising dollar is neutral/negative on commodity prices and resource stocks like gold miners.

- Gold price struggled as the dollar rose in value.

- Gold stocks fell sharply during the last year of their bear market.

- Gold stocks bottomed before physical gold by several months.

HOW YOU CAN PROFIT FROM GOLD PRICE THIS YEAR – BOOK/GUIDE

Concluding Thoughts on Dollar, Miners & Gold Price:

In short, I feel most of the downside damage has already been done to the price of gold. Gold stocks on the other hand could still get roughed up for a few more months before finding a bottom.

Money is likely to continue rolling into the dollar as a safe haven and this will keep gold and silver prices relatively flat. But once the dollar starts to show signs of increased volatility (top) similar to 2000 – 2001 money will find its way into other currencies and precious metals as the new trade and safe haven.

Get My Trades In Real-Time: www.TheGoldAndOilGuy.com

Chris Vermeulen

This article originally appeared here and here and has been reprinted by permission.