Since 1776, many things have changed dramatically in America. One of the most drastic series of changes has been in the way we conduct transactions using money. Believe it or not, the monetary system that is in place today would be almost completely unrecognizable to the founding fathers. Here are some cool facts about the history of our monetary system.

In Early America

There were three general types of money in the colonies: specie (i.e coins made of precious metals), paper money and commodity money. Commodity money was used when cash (coins and paper money) was scarce. Commodities such as tobacco, beaver skins, and wampum served as money at various times and places. Wampum (made of shells) was used by the northeastern Americans Indians as a form of gift exchange, and the colonists adopted it as currency in trading with them. Eventually, the colonists developed more efficient methods of producing wampum, which caused inflation and ultimately the obsolescence of it as currency.

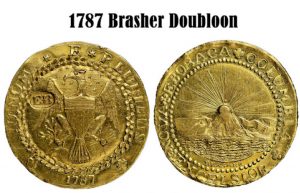

The first coinage act was not passed until April 2, 1792, (almost 16 years after the Declaration of Independence), prior to that the Colonies did not mint their own coins and thus relied on coinage of other countries with British Pounds circulating side-by-side with Spanish “Pieces of Eight” (Silver Dollars) and Gold Doubloons (known to all Pirates of the Caribbean fans). The Spanish dollar was widely used by many countries as the first international currency because of its uniformity in standard and milling characteristics (i.e. they all contained the same amount of silver so they were honest money). The honesty of the Spanish dollar was the reason the U.S. has Dollars now and not pounds. It was the coin upon which the original United States dollar was based, and it remained legal tender in the United States until the Coinage Act of 1857.

The first coinage act was not passed until April 2, 1792, (almost 16 years after the Declaration of Independence), prior to that the Colonies did not mint their own coins and thus relied on coinage of other countries with British Pounds circulating side-by-side with Spanish “Pieces of Eight” (Silver Dollars) and Gold Doubloons (known to all Pirates of the Caribbean fans). The Spanish dollar was widely used by many countries as the first international currency because of its uniformity in standard and milling characteristics (i.e. they all contained the same amount of silver so they were honest money). The honesty of the Spanish dollar was the reason the U.S. has Dollars now and not pounds. It was the coin upon which the original United States dollar was based, and it remained legal tender in the United States until the Coinage Act of 1857.

States Once Issued Their Own Currencies

The paper bills issued by the separate colonies were known as “bills of credit.” Bills of credit could not be exchanged for a fixed amount of gold or silver thus they were “fiat” money (i.e. created simply because the government said they were money). Bills of credit were usually issued by colonial governments to pay government debts. In other words, the local government would buy things by issuing I.O.U’s and then you could trade them with other people until someone eventually used them to pay their taxes. At that point, the governments would retire the currency (i.e. take it out of circulation).

When colonial governments issued too many bills of credit or failed to tax them out of circulation, inflation resulted. Pennsylvania was unique in that it did not issue more currency than it could redeem and it remains one of the few examples in history of a successful government-managed monetary system. Pennsylvania’s paper currency, secured by land, was said to have generally maintained its value against gold from 1723 until the Revolution broke out in 1775.

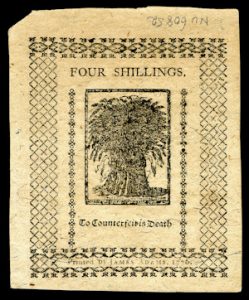

In order to finance the American Revolution Congress adopted the use of paper money called “continentals” but because of the expenses of the war and the massive printing (in addition to the counterfeiting of Continentals by the British the Continental experienced massive loss of value (inflation) and gave rise to the saying “not worth a Continental”. Note the “motto” on the Delaware Currency “To Counterfeit is Death”.

Coins Once Had Many More Denominations

Even though there are only a few coins in circulation today, coined money was once by far the most common form of currency. Denominations including half pennies, two and three-cent pieces, $5, $10, $20 and even an extremely rare 20-cent coin were once used in America. Today, these rare coins are considered extremely collectible.

The Truth about Nixon Ending Gold Exchange for Dollars

In 1933, President Franklin Roosevelt perpetrated one of the greatest frauds ever on the American public. He knew that the government had inflated the currency and the U.S. could no longer maintain the pretense that Gold was still worth only $20.67 per ounce. So he hatched a scheme to nationalize all the gold in the country, by forcing the citizens to turn in their gold at the official price and then promptly raised the “official” price of gold to $35/oz. instantly making the government richer.

Dollars could still be exchanged directly for gold at the new higher price, for several decades after that (but only by foreign governments). But the U.S. continued to debase the Dollar while maintaining the charade that it was worth only $35/oz. and eventually France decided to call the U.S.’s bluff and buy as much of this discount gold as it could get. This forced Richard Nixon to order a stop to all direct gold conversions for the US dollar in 1971. Since then, the Dollar is only worth whatever the market believes it is worth and the value has eroded year by year. See The Fall of Gold and Rise of the Dollar for more info.

The Federal Reserve Had Two Predecessors

As unusual as it may sound, the Federal Reserve hasn’t always been our central bank. In the first half of the 19th century, the First and Second Banks of the United States filled that role, each chartered for a 20-year period. While the first bank served out its full charter, the second was closed by President Andrew Jackson, who realized the danger of investing power over the money supply in the hands of a few individuals. All federal deposits were withdrawn in 1833, reducing the bank effectively back to a private banking institution only. The Federal Reserve was created on December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law. Not coincidentally this was almost simultaneous with the institution of an income tax and the tracking of Historical Inflation by the Bureau of Labor Statistics.

The history of America’s monetary system is a long and interesting one with many surprising twists. These are just a few of the fascinating facts that can be found studying the development of the currency and financial system we use today.

For More Info See:

- Oil, Petrodollars and Gold

- Gold and Inflation

- Inflation and the Civil War

- Keynesian vs Austrian Economics

- The History of Gold as Money in the U.S.