America & Money: Cool Facts About the History of Our Monetary System

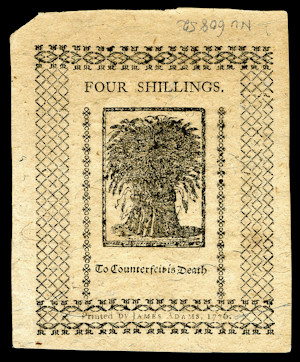

Since 1776, many things have changed dramatically in America. One of the most drastic series of changes has been in the way we conduct transactions using money. Believe it or not, the monetary system that is in place today would be almost completely unrecognizable to the founding fathers. Here are some cool facts about the history of our monetary system.

America & Money: Cool Facts About the History of Our Monetary System Read More »