The Modern Day Wild West: Crypto Scams And Opportunities

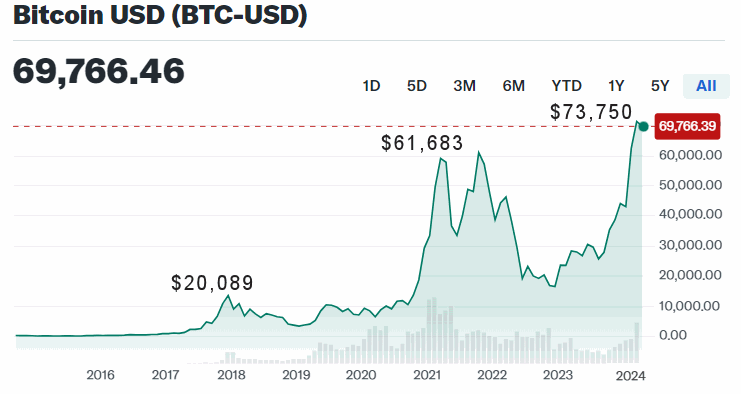

We’ve all heard that the Crypto landscape is much like the “Wild West” with very little regulation. But along with risk comes opportunity. One of the reasons the “Wild West” was so wild was because “Boom towns” would spring up in the middle of nowhere due to the discovery of gold nearby. The gold would attract not only hard-working prospectors and pioneers, but also promoters, grifters, and outright crooks. Sometimes a “Lawman” such as Wyatt Earp would show up and try to enact some sort of system of Law and Order.

The Modern Day Wild West: Crypto Scams And Opportunities Read More »