By Tim McMahon

Updated April 9, 2024

Current Analysis:

Hold Signal!

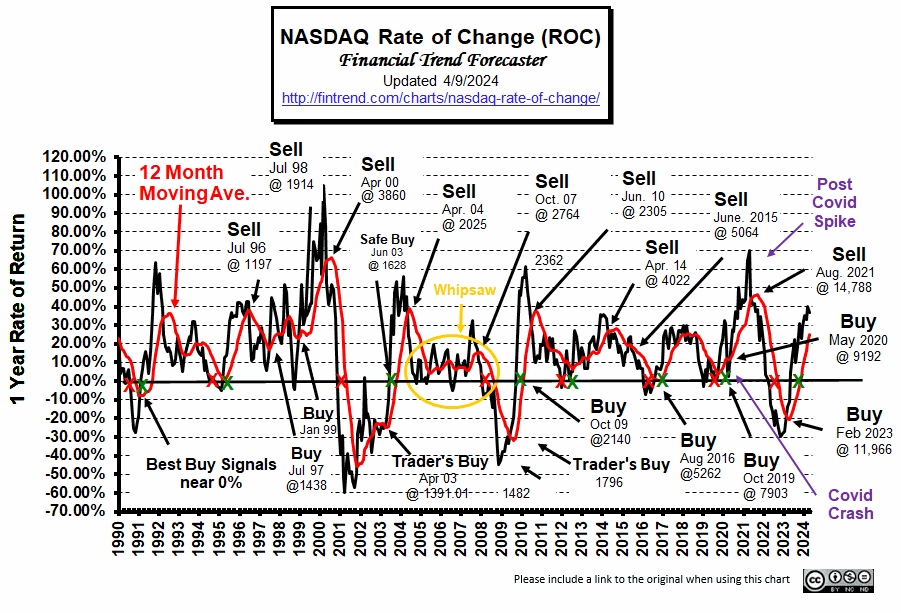

The NASDAQ peaked at 16,212 on November 22, 2021, three months after the NASDAQ ROC generated a “sell signal” in August of 2021. By October 13th,2022 it was down to a low of 10,088. Following our sell signal you would have avoided a 37.7% loss.

In February 2023, both the NASDAQ ROC chart and the NYSE ROC generated a BUY Signal. As of this writing, the NASDAQ ROC remains above the zero-line looking good. Typically, a move from well below the zero line to above is a very good sign. Of the three previous moves, 1990, 2001, and 2009 the only minor caveat was the unusual double bottom made in 2002.

The NASDAQ itself was up 1.8% this month, but the ROC is still up almost 37% above year-ago levels. Obviously, the NASDAQ can’t gain this much every year, so this level of annual gains is unsustainable. But annual gains have been significantly higher before falling, several times in the past. As of this writing the NASDAQ is 16306.74 but about 2 ½ years ago on November 22, 2021 the NASDAQ peaked at 16,212.23. So looked at that way the NASDAQ has gone exactly nowhere over the last two and a half years. That is why we recommend getting out near the top and back in near the bottom. That turns a break-even proposition into a 30% gain. But since the annual rate of return is lower than last month’s 39.9% we see a small drop in the ROC. But it is still well above its moving average so the hold is still in place.

NYSE ROC for more information about FED actions and what the ROC is currently telling us.

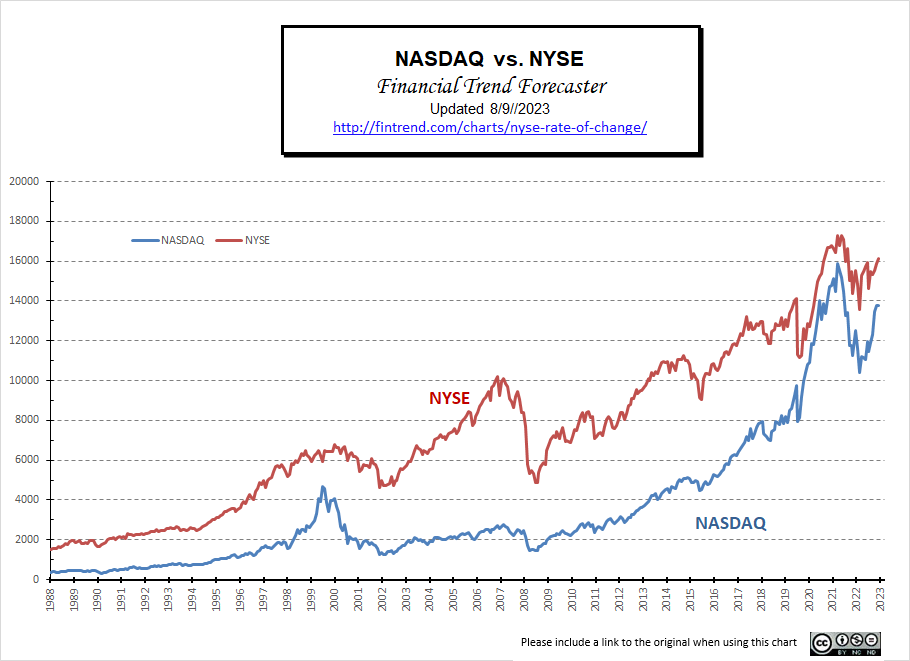

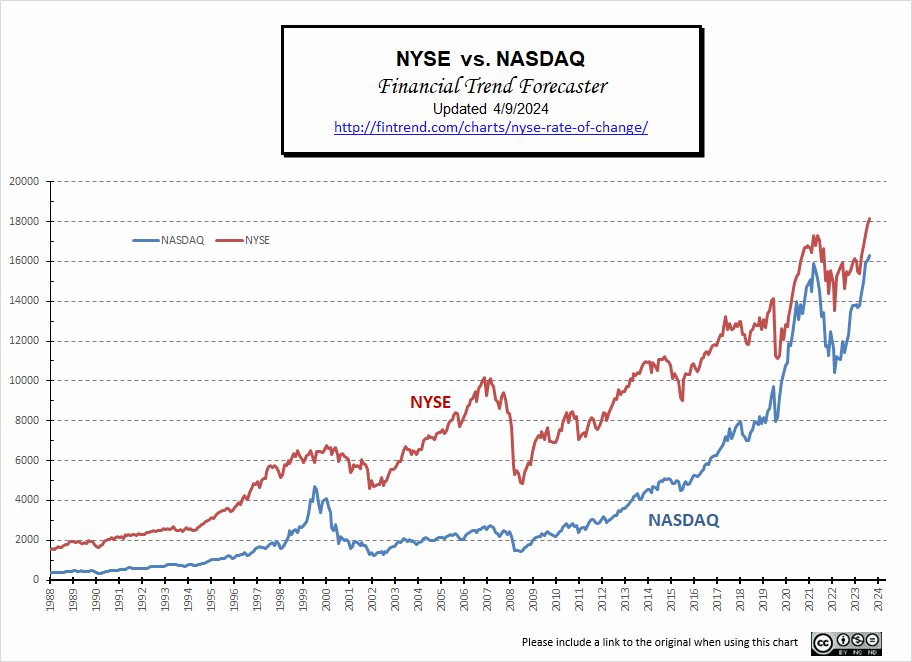

NASDAQ vs. NYSE Performance

Way back, in November of 2007, the NASDAQ was in the 2700s, and then 14 years later, the NASDAQ was above 16,000 in November 2021, resulting in a 492% gain. Since 2008, the NASDAQ has done a good job of beating the NYSE and the inflation rate. In the chart below, we can see the comparative performance of the NYSE and the NASDAQ. From 2000 – 2002 the NYSE lost about 30% of its value, but the NASDAQ lost over 70% of its value. The NYSE rebounded much better up through 2007, by which time it had more than doubled from its low, massively exceeding its previous high.

The NASDAQ, on the other hand, came nowhere near its previous high. But then along came the big crash. This time the NYSE lost roughly 52% of its value, and the NASDAQ lost 47%. By 2015 the NASDAQ had gained roughly 250%, and the NYSE had “only” gained 130%. Since then, the NASDAQ has continued to soar while the NYSE slowly plods along. So, the NYSE outperformed the NASDAQ in the first half of the chart, and the NASDAQ outperformed since 2008, primarily in the last few years. In late 2021, both were beginning to falter.

Then along came NVIDIA and the A.I. spike of 2023, and in a single month, the NASDAQ tacked on almost 10% to its value (prior to the release of the May inflation numbers). On the day of the release, taking the decline in inflation as a good sign, the NASDAQ was up another 0.83%.

For more information, see the NYSE ROC. Also, see the Inflation Adjusted NYSE Stock Index.

What is the NASDAQ ROC©?

The NASDAQ Rate of Change (ROC) chart, like the NYSE ROC, is helpful in determining the direction of the stock market quickly.

Once you understand it, you can easily see the direction of the NASDAQ stock market and easily decide whether you want to be in or out (long or short) of the market.

(See Above for Current NASDAQ Analysis)

The NASDAQ Rate of Change (ROC) chart shows the annual rate of return of the NASDAQ market along the left axis and the years since 1990 along the bottom.

Like our NYSE Rate of Change chart, it shows the rate of return, not the current price. The nice thing is that it makes it so much easier to see performance. It is just a matter of whether the index is above or below the zero line… the NASDAQ is up if we are above the zero line… and the NASDAQ is down if we are below.

Of course, you want to exit positions while we are in positive territory (with a gain above the line) rather than waiting until you have a loss. We exit, sit on the sidelines safely with our money intact, and reenter when we get a buy signal. Due to investor psychology, this isn’t easy to do. See: Why Investors Cling to Hope Amid Stock Market Turmoil and Improving Your Investments with Decision Theory for reasons why this is so.

About the Chart

The red line is the 12-month moving average. As with most moving averages, a buy signal is generated as the index crosses above the moving average. And a sell signal is generated as the index crosses below the moving average. (See Current Analysis Below)

Another helpful way to use this chart is to look at the slope of the red moving average line. If the slope is down, the market is trending down (annual gains are getting smaller). If the slope is up, the market is moving up (gains are increasing). And obviously, if the line is basically flat, the market is not trending at all. It is generating a steady return. If this steady return is positive, the market is performing well, and a nice flat, steady return is preferable to a volatile market that may cause you to panic and sell at a loss.

Just because this chart is not moving higher does not mean we should sell. In the period from June 2004 – June 2007, the red moving average line was basically flat, although it had a bit of wiggle, it was still flat at around 10% rate of return, so holding during that period would have produced returns very close to the long-term average.

If you are looking for big gains, the best buy signals come from a movement from below the 0% line. This allows you to capture the greatest up move.

The Chart issued a sell signal in October 2007 with the NASDAQ at 2764. Subsequently, the NASDAQ fell to around 1480. A buy signal was issued at 1796, almost 1000 points below where the sell signal was generated.

Note: While viewing this chart, we must remember that it represents the rate of return we would have earned if we held the entire NASDAQ for the previous 12 months. This can be achieved through the use of an index fund or ETF.

You might also be interested in the correlation between inflation and the stock market? How does decade inflation and stock market returns compare?

See Also:

- Oil Price Table (Inflation Adjusted)

- Oil Prices < $40/Barrel?

- Gold vs Oil Chart