High Yield Bonds

Many investors who are tired of the fluctuations and whims of the stock market find their way over to the bond market. A bond is a type of debt security issued by a company or Government agency. The nice thing about Investing in bonds is that you know exactly how much money you will have made at maturity and so they typically provide lower risk than what you can find in the stock market. With bonds, you are loaning money to the company and therefore you are a creditor, so you will be paid before shareholders if something goes wrong. You earn interest based on market interest rates and how much you invested.

While all bonds pay some kind of interest, some pay more than others. For investors who want to maximize their returns, high yield bonds can be enticing because of the higher rates they pay. While the rates appear attractive, you may want to exercise caution before jumping headfirst into the high yield bond market.

Why do High Yield Bonds Pay More?

This means that if you want to earn more reward through high yield bonds, you’re going to have to take on more risk too. The highest yields on bonds come from the companies or organizations that are considered to be riskier investments. For instance, if a company is having difficulty paying its debts its bonds will sell at a discount which could be significant enough to give you a 50% or even 100% annual return (if you get paid at all). The higher the yield you want to earn, the greater the possibility of losing your money. Of course, there are all levels of risk available. And you may be able to find bonds that are rated as risky but still are very likely to pay their bondholders.

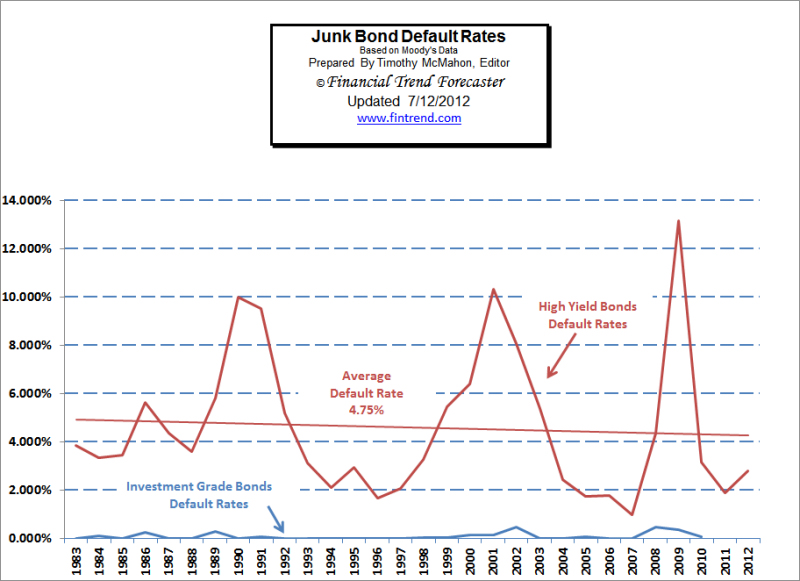

As you can see from the chart above investment grade bonds have a very low default rate often zero percent in a given year occasionally 1/2 of 1%. High yield bonds aka. Junk bonds have had default rates over 13% in the occasional bad year and averaged a default rate of 4.75% during the period from 1983 through the present.

Who Decides Which High Yield Bonds Are Risky?

Although you may understand the basics of high risk/high reward in the bond market, it can be a little confusing when it comes time to understand the specifics. How do investors determine which companies or organizations are risky and which ones are safe? After all, you can’t audit the company’s books and see what’s really going on. This is where ratings agencies come in.

Rating agencies like Standard & Poor’s, Moody’s, and Fitch are the go-to resources when it comes to figuring out which companies are safe bets and which ones are a gamble. Big companies allow ratings agencies to come in and check out their financial situation. Every year, the ratings agencies will perform some due diligence on publically traded companies to see what investors should expect. Then they will release their ratings.

In many cases, the ratings offered by the agencies will coincide with one another. Sometimes, they will differ slightly in their ratings from one agency to another.

How Do the Bond Ratings Work?

The ratings for each agency work a little bit differently, but they all work under the same basic premise. The higher ratings start with “AAA” and go down from there. The next highest ratings for most agencies are “AA”, “A”, “BBB” and so on.

The companies that have these ratings can typically pay very low interest rates. Once companies get down into the “C” and “D” ratings, they have to pay a lot higher interest rates to be able to get investors on board.

Investing in High Yield Bonds

If you are an investor, and you are looking for a way to make higher returns on your investment dollars, high yield bonds are an interesting option to consider. When you are investing, it pays to look at the ratings regularly. A change in ratings can significantly change the value of a bond.

As we saw in the chart, percentage wise, only a few companies that issue bonds actually go bankrupt in good years. For instance in 2005 only 1.745% of companies with poor ratings went bankrupt. But the bankruptcy rate is still much higher for high yield bonds than for AAA rated bonds. But that amount can vary wildly from year to year. After the recent market crash the default rate spiked up above 13% in 2009 but in 2012 the consensus projects a default rate well below average at about 2.8%. One way to limit your risk is with a high yield bond fund. Since the fund holds a diverse selection of bonds if 4% of them default the yield on the remainder after accounting for the losses could still be significantly higher than you could otherwise earn.

Can You Trust Ratings?

When investing in high yield bonds, you have to consider whether you can actually trust the ratings agencies or not. There have been numerous instances where the ratings agencies were completely wrong. They have stressed that their ratings are nothing more than opinions. For example, Lehman Brothers had a perfect “AAA” rating the day that it filed for bankruptcy and sent shock waves through the financial markets.

Overall, the high yield bond market can provide you with an intriguing opportunity to invest. Just make sure you understand the risks that you’re getting into along the way.

See Also:

- A Student’s Guide To Investing in Bonds

- Buying Stocks and Bonds?

- What are Company Bonds?

- Invest in Structured Bonds?

- How to Invest for Safety

- Moving into Bonds: From Frying Pan to Fire

- Are “High Yield Bonds” the Next to Go Up in Flames?

- Major Disaster Developing For Bond Holders

- What are Treasury Inflation Protected Securities (TIPS)?

- What are I bonds?

- Impact of Inflation on Bonds Part 1

- Impact of Inflation on Bonds Part 2

- Inflation Adjusted Gold vs Stocks vs Bonds