Over the years, I’ve written numerous articles about Crypto. A decade ago, the Crypto 1.0 premise was that Bitcoin could replace fiat currencies due to the built-in mining and halving functions limiting supply. It was also promoted that it could replace gold as a storage of wealth. Since Crypto was the “new kid on the block”, I was skeptical… there were some immense hurdles to overcome before the new kid could assume the role of a currency, let alone a storage of value. But Bitcoin had some of the components necessary.

Over the years, I’ve written numerous articles about Crypto. A decade ago, the Crypto 1.0 premise was that Bitcoin could replace fiat currencies due to the built-in mining and halving functions limiting supply. It was also promoted that it could replace gold as a storage of wealth. Since Crypto was the “new kid on the block”, I was skeptical… there were some immense hurdles to overcome before the new kid could assume the role of a currency, let alone a storage of value. But Bitcoin had some of the components necessary.

A currency must be / Bitcoin has:

![]() Limited supply- Sand could never be a currency because there is just too much of it. Bitcoin has a limited supply.

Limited supply- Sand could never be a currency because there is just too much of it. Bitcoin has a limited supply.

![]() Divisible- Diamonds don’t make a good currency because although they have a limited supply, how do you make change? Bitcoin is divisible. Each bitcoin is divisible into 100,000,000 satoshis. So, even if one bitcoin appreciated to $1 Million, one Satoshi would still only be equal to a penny.

Divisible- Diamonds don’t make a good currency because although they have a limited supply, how do you make change? Bitcoin is divisible. Each bitcoin is divisible into 100,000,000 satoshis. So, even if one bitcoin appreciated to $1 Million, one Satoshi would still only be equal to a penny.

![]() Fungible- i.e., each one is the same as another. This is another reason diamonds don’t make a good currency. The value of a diamond is based on various characteristics such as Cut, Color, Clarity, etc. of that particular diamond. One Bitcoin is exactly the same as any other Bitcoin.

Fungible- i.e., each one is the same as another. This is another reason diamonds don’t make a good currency. The value of a diamond is based on various characteristics such as Cut, Color, Clarity, etc. of that particular diamond. One Bitcoin is exactly the same as any other Bitcoin.

![]() Transferable- As a medium of exchange you must be able to transfer ownership easily to another person. You can electronically transfer Bitcoin to anyone with a Bitcoin wallet, almost instantaneously, for almost free.

Transferable- As a medium of exchange you must be able to transfer ownership easily to another person. You can electronically transfer Bitcoin to anyone with a Bitcoin wallet, almost instantaneously, for almost free.

![]() Dense- In order to purchase large items, a currency must have significant value in a relatively small space. We’ve all heard stories of an irate person who drops a truckload of pennies on someone’s lawn to pay a debt. That is not the optimal way a currency should operate. At about $70,000 each it doesn’t take too many bitcoins to buy a house.

Dense- In order to purchase large items, a currency must have significant value in a relatively small space. We’ve all heard stories of an irate person who drops a truckload of pennies on someone’s lawn to pay a debt. That is not the optimal way a currency should operate. At about $70,000 each it doesn’t take too many bitcoins to buy a house.

![]() Identifiable- In order for a currency to work well, the buyer and seller have to be able to be sure that it is actually currency quickly and easily. That is why early coinage had the stamp of the King or Emperor on it. The government was certifying that yes this coin was gold or silver and so it became easily identifiable as currency. Bitcoins are electronically identifiable as authentic.

Identifiable- In order for a currency to work well, the buyer and seller have to be able to be sure that it is actually currency quickly and easily. That is why early coinage had the stamp of the King or Emperor on it. The government was certifying that yes this coin was gold or silver and so it became easily identifiable as currency. Bitcoins are electronically identifiable as authentic.

![]() Durable- Although ice in the desert could be valuable, divisible, fungible, identifiable, and transferable, but it isn’t durable, i.e., it melts way too fast to be anything other than of very short-term value. Bitcoin durability is still a question. In the early days, people lost or were locked out of their Bitcoin wallets. And if everyone decided they were worthless, they would be. Gold on the other hand has thousands of years of history testifying to its long-term value.

Durable- Although ice in the desert could be valuable, divisible, fungible, identifiable, and transferable, but it isn’t durable, i.e., it melts way too fast to be anything other than of very short-term value. Bitcoin durability is still a question. In the early days, people lost or were locked out of their Bitcoin wallets. And if everyone decided they were worthless, they would be. Gold on the other hand has thousands of years of history testifying to its long-term value.

![]() “Universally” Accepted- In order for something to be a currency it has to be widely accepted as currency. Something could be rare and meet all the other criteria but if no one is willing to accept it, it still isn’t a good currency. The jury is still out on whether Bitcoin will become universally accepted.

“Universally” Accepted- In order for something to be a currency it has to be widely accepted as currency. Something could be rare and meet all the other criteria but if no one is willing to accept it, it still isn’t a good currency. The jury is still out on whether Bitcoin will become universally accepted.

Bitcoin Hurdles

In the early days, Bitcoin’s anonymity gave it a bit of a shady reputation as it was the primary currency of the “DarkWeb”. Since then it has become more mainstream.

Early on, I realized that in order to be an effective currency, bitcoin would have to become readily accepted by a vast majority of merchants, and people would have to become accustomed to a new electronic method of exchange. You no longer would carry coins and bills in your pocket, but instead, you would have to have some sort of electronic wallet. At the time, that looked like it could possibly involve carrying a “thumb drive” aka. flash drive, USB drive, etc.

In the decade since then, smartphones have become ubiquitous and people have become much more comfortable with electronic payment systems, i.e. PayPal, ApplePay, Venmo, etc. But after a decade, Bitcoin still has other hurdles.

First of all, it still has not reached the tipping point where all merchants accept it. And still, only a very small portion of the population own any bitcoins at all. I would venture to say that the vast majority of people don’t even know how to obtain or transfer bitcoins for a purchase. So as more people need Bitcoins to transact business their value would be driven up geometrically.

FYI: To transfer Bitcoin- you can copy either a long unique string of characters or a QR Code and once a transfer is made, it is not reversible. This is both good and bad. If you make a purchase with a credit card, you have some recourse, if you feel you have been cheated. You can contact the credit card company and receive some arbitration. On the other hand, if you transfer Bitcoin, there is no higher authority to complain to. But this also means that if someone pays you, they can’t snatch the money back because they changed their mind (or because they are just crooks).

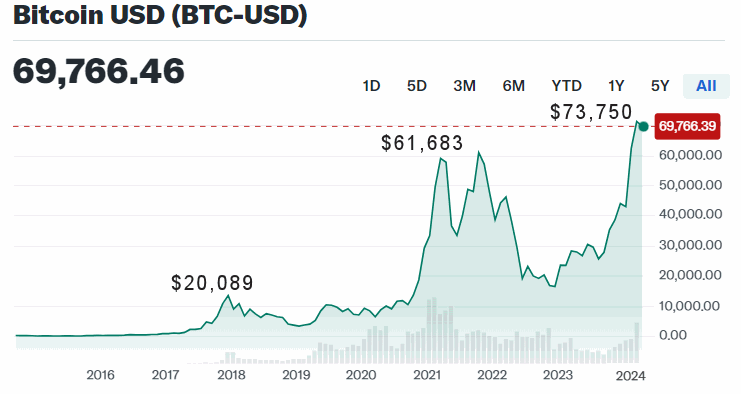

The biggest problem with Bitcoin as a currency is that it isn’t stable. Although Bitcoin supply is limited, Bitcoin price is the opposite of stable, it is one of the most volatile investments available. So although gold is considered volatile, its volatility is dwarfed by bitcoin. Currently, this makes Bitcoin a good speculation… but a bad currency, but this could change with mass adoption.

Crypto 2.0

Fortunately, it turns out that Crypto is much more than just Bitcoin. In October 2008, when a person (or anonymous group) named Satoshi Nakamoto created the code for Bitcoin it opened the door to more than just a currency. It introduced the concept of a “Blockchain” to the world. Since then there have been literally thousands of Cryptos created, most of which ended up totally worthless. Some were simply jumping on the Blockchain bandwagon, just as during the Dot com mania of the 1990s, companies added “.com” to their name, and during the “Tech Boom”, everyone wanted to be considered a Tech Company. And so, just like previous booms this resulted in the creation of a lot of mostly worthless cryptos in the 2010s. But not all the cryptos were worthless. Some were alternative currencies, but others were new and innovative ways to use blockchain.

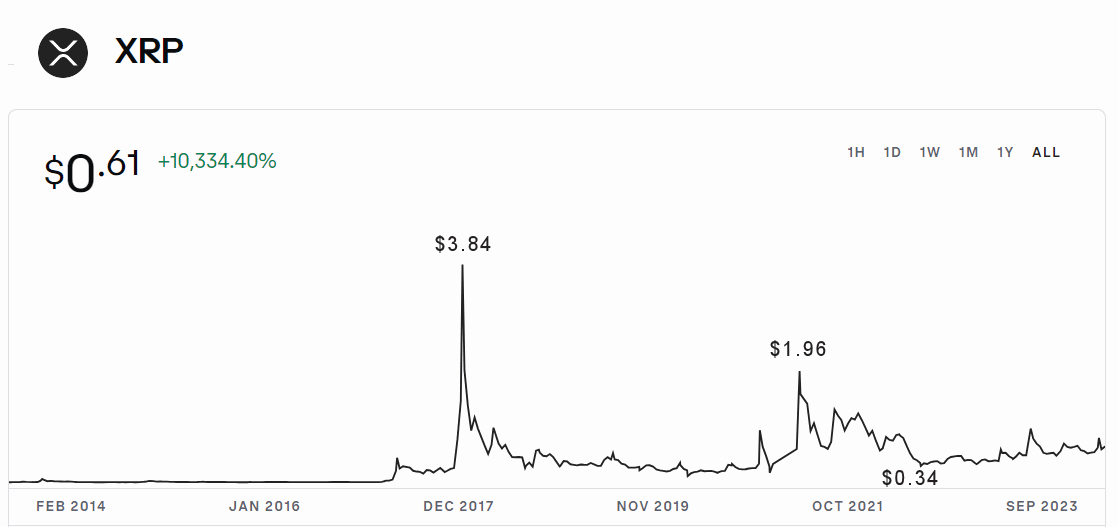

Back in 2021, we wrote about one of these “Alt Coins” i.e., Ripple (XRP) which was designed to provide blockchain features to large banking institutions. Since then XRP has hit a few snags, including running into interference by the SEC. While Ripple won summary judgment on a portion of its case with the SEC, the litigation is ongoing and may be subject to appeal. So, temporarily at least , XRP is trading below $1.00. IF, it can resolve its SEC issues and gain widespread institutional use it could become a powerhouse, but that is still a VERY BIG IF.

Ethereum (ETH)

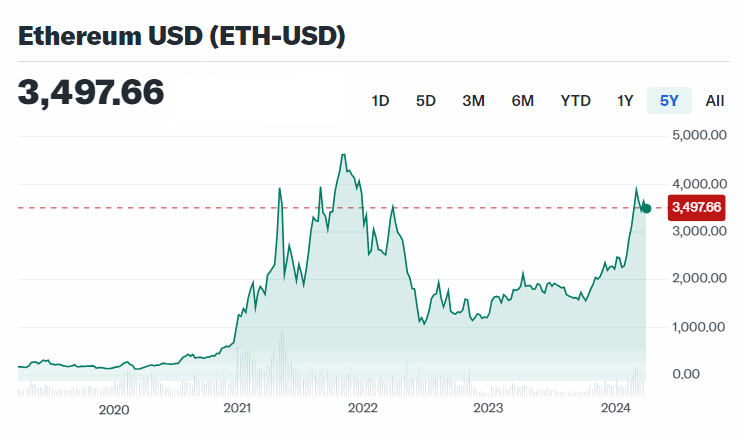

A major Crypto that has done much better than XRP is Ethereum (ETH) which has evolved to be a platform for other Crypto applications to build upon. Ethereum’s programming language is much more functional than Bitcoin. ETH did for crypto what “Open Source Programs” did for programming. Now anyone can build Crypto apps using the ETH platform. The major problem with ETH has been its limited number of transactions that could occur at any particular time. ETH could only process 17 transactions per second, which seems relatively fast until you realize that Visa’s network is capable of handling more than 24,000 transactions per second. So, ETH had a long way to go. But in March of 2024, that issue was addressed by a major upgrade in ETH that allows the breaking down of transactions into smaller components, which will ultimately allow up to 100,000 transactions per second.

Ethereum has created the opportunity for Crypto 2.0.

Institutions have started investing in not only Ethereum but also in the Apps that can run on ETH. A whole new genre of investing has been created called Decentralized Finance (DeFi). DeFi allows financial transactions virtually instantaneously anywhere in the world at extremely low costs and much more privacy and security. Just a few years ago, it you wanted to send money to another country you had to go to the bank (in person) sign some papers to get a wire transfer, and pay a hefty fee. The money would then be wired to the recipients bank and be available a week or two later. In the last few years, peer-to-peer, exchange networks have sprung up that allowed pairing someone who wanted to exchange one currency for another, with another person who wanted to do the opposite exchange. This drastically lowered the cost of the transaction and drastically reduced the amount of time necessary. As recently as 2020, DeFi was estimated to be worth under $10 Billion. Currently, it is worth almost $40 Billion.

The Effects of ETF Creation

They have also created investment vehicles like Exchange Traded Funds (ETFs) that open the world of Crypto investing to traditional brokerage accounts. Just as the first Gold ETF in 2004, opened up gold investing to stock investors there are now ETFs being created to invest in Bitcoin (there are at least 19 available as of this writing). There are also Etherium ETFs and other Crypto ETFs will be coming along over the next few years. Recently U.S. News published an article about the 7 Best Cryptocurrency ETFs to Buy.

One of the major effects of the creation of Crypto ETFs is the massive injection of liquidity into the Crypto space. It makes it easier for ordinary investors, and hedge funds to invest in cryptos and this increases demand for these cryptos and drives up the price. DeFi demand for cryptos like ETH will also increase the price, although the vast increase in the number of transactions possible will initially drive down the cost per transaction, in the long run, however, lower costs will further increase demand, driving up the value of ETH.

The Effects of “Halving”

As we said earlier, Bitcoin production is limited by its basic code. In addition to the massive amounts of computing power necessary to “mine” a bitcoin, there are other limits built into the code. At certain waypoints, the amount of processing power needed to create the next bitcoin jumps up. Just as a goldmine gets “tapped out” and finding the next ounce of gold gets harder, at a “halving” point it gets more difficult to produce another bitcoin and eventually there will be a finite limit. The effects of these limitations mean Bitcoin values can’t be diluted. What that means is that Bitcoin can only become more valuable as demand increases because supply is limited. And after a halving event, prices tend to jump up, because the steady flow of new Bitcoins is now reduced. So, if demand stays the same, prices will be bid up because new investors/users have to buy some from previous holders rather than buying new supply.

The interesting thing is that, based on current mining levels another “halving” will occur sometime in April 2024. So, the supply of new Bitcoins is set to be reduced very shortly.

With the sentencing to 25 years in prison of FTX co-founder Sam Bankman-Fried, Crypto may be nearing the end of its “Wild West Era” and entering a more mainstream period. But, the new Crypto phase will still be exciting and will almost certainly mint thousands (if not hundreds of thousands) of new Crypto Millionaires. I am extremely optimistic about the next few years and the changes that will occur due to the implementation of blockchain in almost all areas of our life.

You might also like:

- Ripple the Cryptocurrency of Banks

- How to Invest in Cryptocurrency

- Meet The World’s Most Powerful Bitcoin Backers

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- How has Venezuela’s Bitcoin experiment Fared?

- Cryptocurrencies and Inflation

- Cryptocurrency: Is Bitcoin the Future of Money?

- What is FinTech

- Can Ruthless Governments Make Crypto Worthless

- Will Russian Sanctions Open a Can of Worms?

- How Blockchain’s Unique Innovations Can Prevent Money Remittance Scams

- 5 Revolutionary Developments in the Financial Industry

- How Is Technology Affecting Global Trading Markets

- Fintech: The New Financial Management Disruptive Technology

- What are NFTs and Why are They Going Crazy?

- Blockchain Goes to Ethiopia

- eCommerce Trends: What’s in Your eWallet?

- Argentina Mulls Dollarization- What is it?