An NFT or non-fungible token is similar to Bitcoin but entirely different. It is similar in that it is based on similar Crypto technology but it is different in that it is not a currency. The one major factor that makes money useful is that it is “fungible” i.e. one dollar is just as valuable as another. So you can freely trade them and not care whether you got last week’s dollar back or a different one.

NFT’s are exactly the opposite, each NFT is unique with its own “serial number” stored in its crypto-algorithm. This makes NFTs perfect for marking items that are unique. In a society that is obsessed with collectibles, NFTs could come in handy to ensure that you are getting the “real thing” and not just a copy.

And that has opened up a whole new field. Unlike the “Mona Lisa”, today’s digital art is often freely available all over the internet… you can freely download a copy of most anything… even the Mona Lisa. But when it comes down to it, there is a BIG difference between the original Mona Lisa and the copy you just downloaded. Even if you blew it up to full size and printed it on canvas and put it in a nice frame it still wouldn’t be THE MONA LISA. But there may not be any difference between a digital image created by a modern artist and one you’d find on the internet. So along comes NFTs which enable the original to be “marked” with a traceable token signifying that it is the real thing and not just a copy. You can see how artists and art collectors might find this useful.

But that is where the current market has gone a little crazy. Not only are digital artworks being marked but certain video clips as well. You want to own the last 30 seconds of Superbowl LIV? Sure, no problem that will be $10 million, please. Recent NFT sales include LeBron James “Cosmic” Dunk #29 (20 second video) which sold for $200,000. The first Tweet of Twitter CEO Jack Dorsey sold for $2.9 million. And the first piece of purely NFT artwork to be offered by a major auction house (Christie’s).Everydays: the First 5000 Days by artist Beeple which sold for an astounding $69.3 million.

According to Wikipedia:

Everydays: the First 5000 Days is a digital work of art created by Mike Winkelmann, known professionally as Beeple. The work is a collage of 5000 digital images created by Winkelmann for his Everydays series. Its associated non-fungible token (NFT) was sold for $69.3 million at Christie’s in 2021, the most expensive NFT and among the most expensive works by a living artist.

“Everydays” was purchased by Vignesh Sundaresan, a programmer based in Singapore and the owner of Metapurse, known by his pseudonym MetaKovan. MetaKovan paid for the artwork using 42,329 Ether (i.e. Etherium cryptocurrency). MetaKovan receives rights to display the artwork but does not receive copyright. He has displayed the full-resolution artwork in a digital museum within Metaverse.

The following image is one of the 5000 images contained in the Everydays series.

“Everydays”

Winkelmann started “Everydays,” which involved creating a piece of art every day, on May 1, 2007. This project is ongoing, and has spanned more than 5,000 consecutive days of digital art creation. Winkelmann has discussed completing a piece of art even on days when it was inconvenient, like on his wedding day and the day of his children’s births. The project was inspired by Tom Judd, who did a drawing every day for a year. Winkelmann thought it was a beneficial way to sharpen his drawing skills. In the following years, he focused on one skill or medium per year, including Adobe Illustrator in 2012 and Cinema 4D in 2015. Winklemann’s works often depict dystopian futures. Frequently, he uses recognizable figures from popular culture or politics to satirize current events.

Some of Winkelmann’s works were incorporated into Louis Vuitton’s Spring/Summer 2019 ready-to-wear collection.

Editor’s note: So, not only is “Everydays- the First 5000 Days” a digital artwork made up of other digital artwork, tokenized by an NFT, which sold for the highest price ever, but it was paid for via Cryptocurrency. The following article by Elliott Wave International might shed some more light on this bizarre NFT trend. ~Tim McMahon, editor.

Cryptos: What the “Bizarre” World of Non-Fungible Tokens May Be Signaling

By Elliott Wave International

The world of cryptos includes something known as non-fungible tokens, which go by the acronym NFTs.

If you’re unfamiliar with them, they’re a bit bizarre but quite simple. Here’s what the April Global Market Perspective, a monthly Elliott Wave International publication that covers 50+ worldwide financial markets, noted:

Investors’ manic behavior has expanded to include non-fungible tokens, paying large sums of money for essentially a picture of something.

Getting more detailed, “a non-fungible token is a unique identification code that is affixed to a [digital] asset using blockchain to distinguish it from all other [digital] assets.”

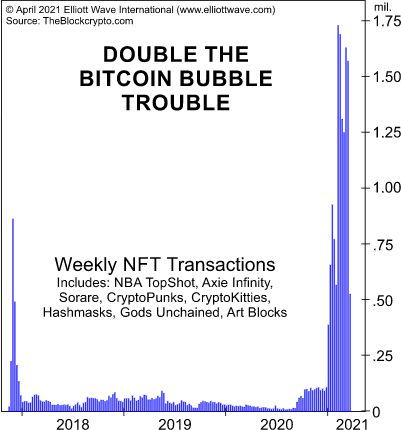

The April Global Market Perspective provided more insight with this chart and commentary:

The chart shows the performance of one of the most unseasoned of all collectibles, the non-fungible token (NFT), which first hit the market in December 2017. … In addition to rocketing prices, NFTs surged into the culture at large with tokens tied to everything from basketball and football players to Passover and a Saturday Night Live skit. Capping the rage is a “digital collage” of bizarre, post-apocalyptic images called Everyday, which sold for $69.3 million through Christie’s on March 10.

Well, the NFT craziness has persisted, as the May Global Market Perspective followed up by showing this NFT and saying:

Apparently, NFTs are still a thing. Paris Hilton, who is famous for being famous, garnered a bid of $1,111,211.00 for this Iconic Crypto Queen token on [April 25]. The absurdity of it all is not lost on everyone. “Each market frenzy seems crazier than the last,” says MarketWatch.

As for one of the latest developments, on June 10, Barron’s showed this image under the headline:

‘Covid Alien’ CryptoPunk Sells for $11.75 million in Sotheby’s Sale

The reason for pointing out investors’ interest in non-fungible tokens is to emphasize the level of financial mania that has been reached.

The monthly Global Market Perspective employs Elliott wave analysis to forecast what’s next for cryptos, global stock markets, rates, metals, energy, forex and much more.

If you’d like to learn how the Wave Principle can help you analyze financial markets, you are encouraged to read Frost & Prechter’s Wall Street classic book, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or “waves,” that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Good news! You can read the entirety of the online version of the book for free!

All that’s required for free access to Elliott Wave Principle: Key to Market Behavior is a free Club EWI membership. Club EWI members enjoy free access to a wealth of Elliott wave resources on investing and trading.

Just follow this link and you can have the online version of this Wall Street classic on your computer screen in moments: Elliott Wave Principle: Key to Market Behavior — free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline Cryptos: What the “Bizarre” World of Non-Fungible Tokens May Be Signaling. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.