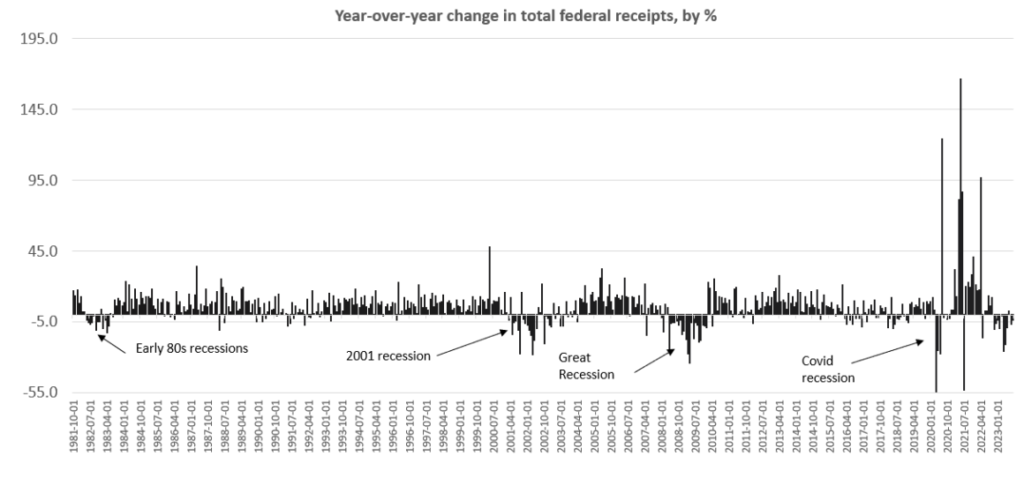

If the Economy Is So Great, Why Are Tax Revenues So Weak?

It seems pretty obvious that when the economy is weak individual’s earnings go down, and unemployment goes up, consequently tax revenues go down. After all, if people aren’t making any money they can’t give it to the government. So, it seems logical to ask about falling tax revenues and rising deficits. In today’s article, Ryan McMaken looks at the current situation.

If the Economy Is So Great, Why Are Tax Revenues So Weak? Read More »