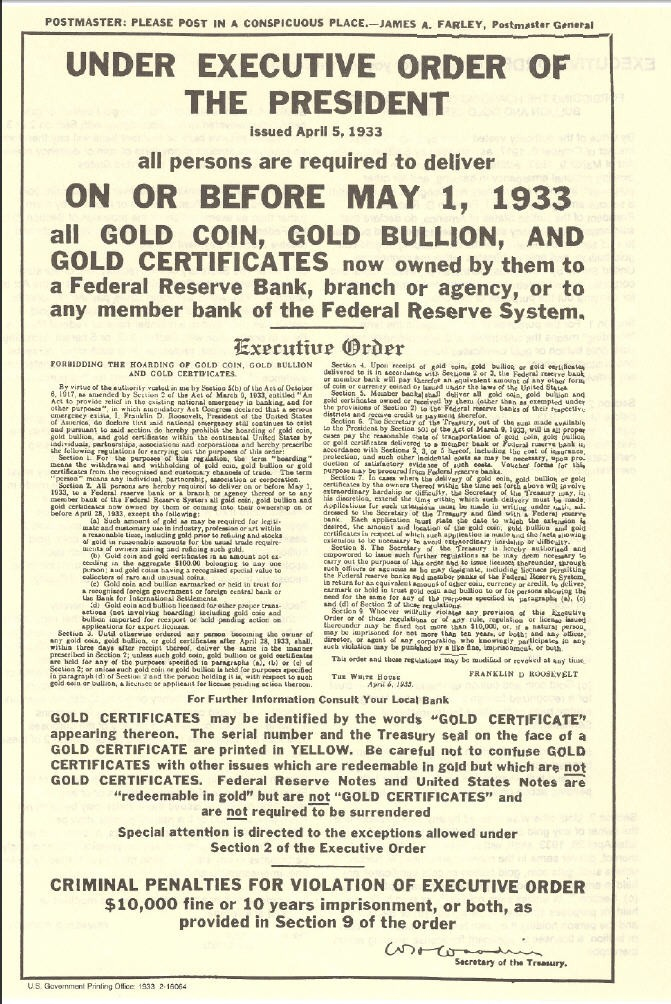

Tether and Gold Holdings by Country

“If Tether were a country, its gold reserves would rank 34th in the world, surpassing many nations. With central banks and gold-backed ETFs also buying heavily, demand for gold is rising, putting upward pressure on prices. This surge shows how digital finance and traditional markets are increasingly intertwined.”

Tether and Gold Holdings by Country Read More »