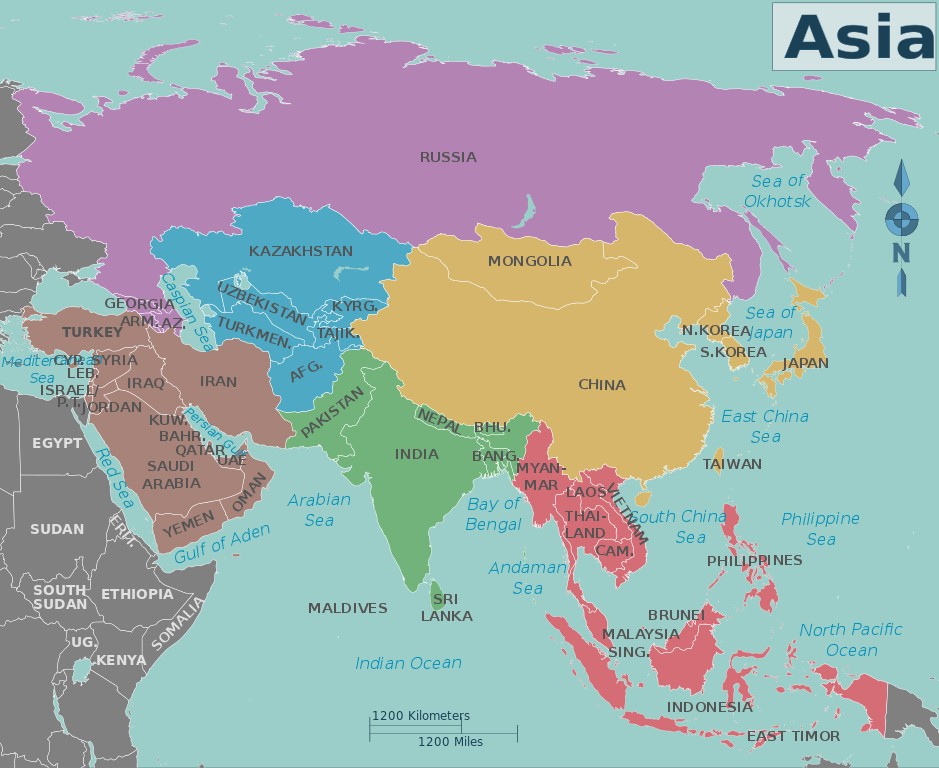

Russia Looks to China as Relations with Europe Deteriorate

Russia and China could develop stronger economic ties as Europe pulls away in light of the annexation of Crimea. After all, Russia needs an outlet for its energy production and China’s energy needs continue to grow, so there could be a good fit there.

Russia Looks to China as Relations with Europe Deteriorate Read More »