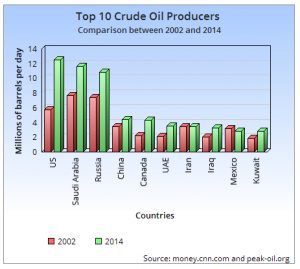

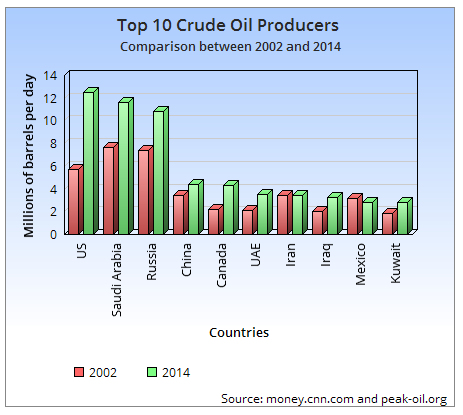

As the chart to the left shows, in the period from 2002 until 2014 the U.S. moved from 3rd place to 1st place in world crude oil production. This is primarily due to the improvement in “fracking” technology which has led to the massive increase in the production of shale oil. This does not sit well with the Saudis.

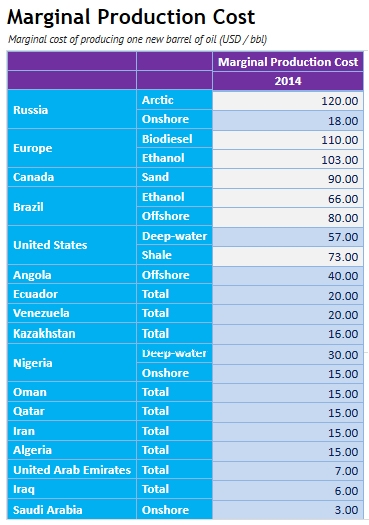

Extracting shale oil from the ground is an expensive process and it is not economically profitable with oil prices below $73 per barrel. So in an effort to drive the shale producers out of business Saudi Arabia (and against their collective will the rest of OPEC) has decided to drive the price of oil down to its currently unsustainable low level. Unfortunately, due to the high cost of restarting production and high levels of debt, shale oil producers can’t just shut down the wells and wait until prices improve… so shale producers have to continue to produce despite losing money. But low prices stop the creation of new wells since they are economically unfeasible and low prices may cause shale producers to shut down wells before they would if prices were higher.

A recent Business Insider article said that Saudi Arabia needs oil prices at $105 in order to balance their budget. But that is misleading. That is like a homeowner saying he needs to earn $100 an hour to pay all his bills. If his labor is worth $20/hr. it doesn’t matter what he “needs”.

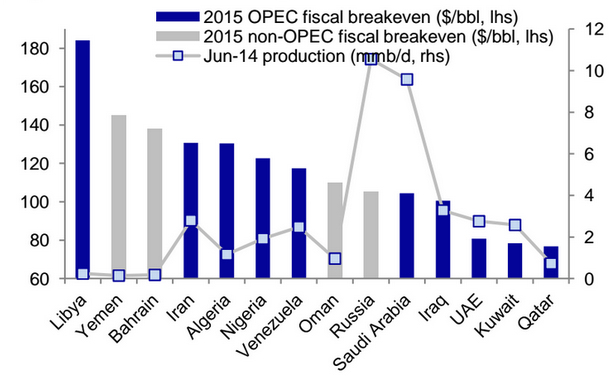

The article goes on to say that “Libya needs the highest price, above $180/barrel, to break even. Qatar can get by with oil below $80/barrel. Russia and Saudi Arabia’s break-even prices are both around $105/barrel, and Iran’s is nearly $130.”

Notice that these lists never say how much the United States needs to balance its budget. Why? Because the U.S. government does not own the oil… individual companies do. So the price of oil is irrelevant to whether the U.S. balances its budget or not. (Well not quite irrelevant since it does affect costs of production and tax revenues, etc.)

But the key factor Business Insider is not telling us is the cost of production. The following table from Knoema shows the “Marginal Cost of Production” (i.e. the cost of producing another barrel of oil.) This marginal cost varies based on how easy it is to extract and the existing infrastructure, etc. and we can see that it only costs Saudi Arabia $3 to produce another barrel of oil. So even at $20/barrel they are making a profit. Yes, the country is going deeper into debt but the wells are still producing a profit.

So Saudi Arabia is faced with a dilemma:

- Should it drive prices up to try to balance its budget and reduce unrest in its country by maintaining its massive welfare programs.

Or - Should it drive prices down and try to squash its competition, so it can maintain high prices and market share over the long term.

Currently it is following the second course but it is facing increasing unrest at home and among its OPEC partners. So the question the “Gold and Oil Guy” addresses below is the effect this decision is having on the rest of the world. ~ Tim McMahon, editor

Are Low Crude Oil Prices a “Boom Or A Curse” For The World Economy?

The energy markets are tanking and are at levels that have not been seen since “The Recession” of 2009. Opinions are divided on the effects of the fall. Some say it is good for consumers, whereas, others say it is bad for the global economy. This article will analyze the overall effects of low crude oil prices on the industry, the major oil-producing nations, consumers and the overall global economy. The severity of the fall can be seen in the chart below.

Top 10 crude oil producers which are being affected:

A glance at the charts of the top 10 crude oil producers shows the clear shift from Saudi Arabia to the US, as the largest energy producer in the world.

An analysis of the top producers of oil gives us a clear picture of the effects of this fall on the global economy. Does the drop in price have far-reaching effects, which may lead to geopolitical tensions in the world? Is the power to decide the pricing shifting from the hands of the OPEC nations, for the first time in decades? Are the low prices laying a base for a much larger uptrend in the future?

Effects of low crude oil prices on the US economy:

The US is both the largest producer, as well as the largest user of crude oil, in the world. Domestic supply caters to 50% of the daily needs, and the other 50% is imported, from around the world. The production from the US Shale wells have increased rapidly, in the last few years, and the industries associated with shale oil are being crushed.

Shale oil drilling is unprofitable at these levels:

The boom in oil prices, and an improvement in fracking technology, has led to a rapid growth in the number of shale oil wells. However, according to various reports, most of the shale oil wells are profitable only when priced above $60/barrel. Some of these companies have taken large loans, in order, to expand their production, and with prices remaining low, these loans are likely to become unserviceable. A failure of the companies with heavy loans is likely to strain US Banks, which have loaned the monies to said companies. Along with the crude oil producers, the associate industries ie: the equipment suppliers, the hotel industry, the truck companies, etc. are also struggling, due to a decline in prices.

With many drillers cutting costs, unemployment within this sector is on the rise, and wages are either stagnant or being reduced. New investments are being postponed. Associate companies, which supply to the oil producers, are slowly going “out of business”. As the US economy is very diverse, the overall impact is not alarming, however, US States that are dependent on the shale oil drilling, will almost certainly take a hit.

Advantage to the Consumers and the Auto Industry and the Airline Industry:

Auto and airline industries are welcoming the drop in prices. Consumers, also have more disposable income to spend for their holiday shopping this year, due to lower gas prices at the pumps. According to Goldman Sachs, US households have around $150 billion to spend this year, due to the fall in crude oil prices. If the price remains low, the domestic consumer will become the beneficiary!

Deflation:

The FED is struggling to increase the inflation figures to around 2%, but with low energy prices, fears of deflation are ever increasing.

Effects of low crude oil prices on the Russian economy:

Russia is another major exporter of crude oil in the global economy. The high price of crude oil during 2009-2014, assisted them in recovering from the crisis. However, with oil prices ‘tanking’, the Russian economy is now struggling. According to bbc.com, oil and gas contribute 70% of the export income for Russia. Every dollar drop in the price of crude oil impacts the Russian economy by $2 billion worth of losses.

With the Russian economy struggling, due to low crude oil prices and Western sanctions, it raised its interest rates to 17% this year, in order to stem the run on the Ruble. Refer to: chart of the Russian interest rate as shown. If the oil prices continue to stay low, Russia will struggle with its federal budget, since it mainly depends on the profits of crude oil. Some believe that President Putin is likely to resort to actions which will divert the attention from his struggling economy, and thus create geopolitical tensions in the world wide.

Source: Central Bank Of Russia and tradingeconomics.com

Effects of low crude oil prices on OPEC:

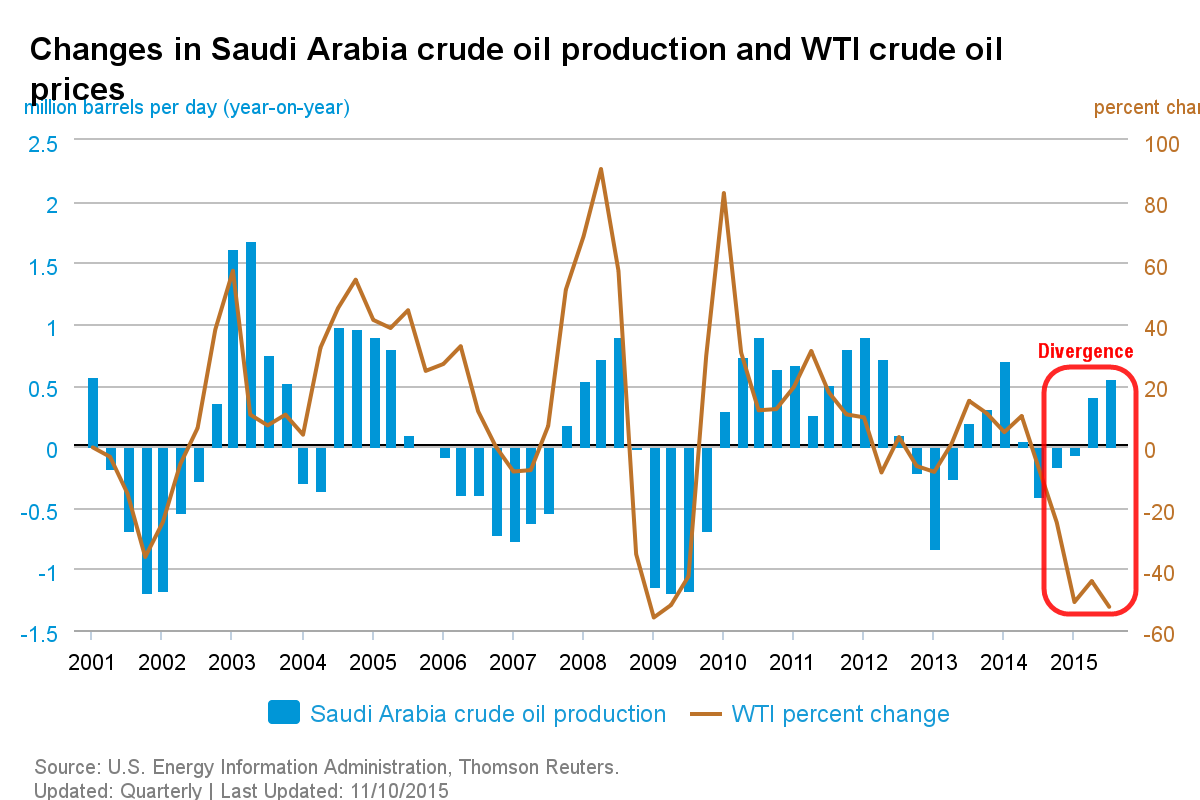

OPEC consists of twelve countries that produce 40% of the world’s crude oil demand. Saudi Arabia has been the leader of the OPEC nations and its change in production has significantly impacted the price of crude oil. For the first time in years, it looks like Saudi Arabia is losing its status as the decision maker of crude oil prices in the world. The divergence in price and the increase in production of crude oil, by Saudi Arabia in 2015 in the chart below is an indication of its declining power as price and their production have moved together in the past.

The recently concluded meeting of OPEC, on December 4th, 2015, showed the divide among the OPEC nations. The smaller nations like Algeria, Venezuela and Ecuador are all reeling under the effects of low crude oil prices, and their efforts to force a ceiling on the total production was rejected. Though Saudi Arabia has strong foreign reserves, which can support its economy and aid in pumping oil at these low price rates over a long time, it too has begun to feel the pain. The Saudi stock market is down 27% from its high of this year.

Editor’s Note: In the chart below we see that typically as prices rise Saudi production rises as well. This allows them to make more when prices rise. It also helps to maintain stable oil prices since the increased production tends to reduce prices. But beginning about a year ago the Saudis have continued to increase production despite falling prices.

Lower oil prices can lead to a crisis in the middle east region similar to 2010:

The international rating agency of Stand & Poor’s reduced the sovereign rating of Saudi Arabia by one notch in October 2015, with a negative outlook. Stand & Poor’s expects Saudi Arabia to have a budget deficit of 16% of its GDP, in 2015. There are unconfirmed reports of an internal power struggle of the throne, in the oil-rich nation. Any power struggle in the Kingdom of Saudi Arabia is likely to destabilize the entire Middle East region.

The Study of the price needed by various countries in order to balance budgets:

The chart below clearly shows that the current price of crude oil is not favorable to most of the nations. Many are bleeding heavily, due to the lower oil price and are struggling to fund their budgets. It won’t be long before the chinks in the armor of the weaker nations will begin indicating whether prices remain low, for a long time.

Low crude oil price is not a negative for all countries:

Oil importing countries like India, Japan, China, and some Western European countries have actually benefited from lower crude oil prices. China has been a major net importer of crude oil in recent years. With the Chinese economy slowing down, a fall in crude oil prices will help by increasing its foreign exchange reserves. However, only a fall in crude oil may not be sufficient enough to prop up the Chinese economy. For a few countries, like India, the fall in crude oil prices is good news, as it will help them control their current account deficit.

Another Crisis in the making:

However, the major ill effect of this fall has been the fears of deflation in Japan, Europe and the US. The ECB, the FED, and the BOJ are all struggling to bring inflation to around 2% so as to avoid deflation, but thus far they have failed. If prices remain low for a considerable period of time, it may lead to another crisis with deflation at the core.

Conclusion:

Saudi Arabia likely wants to keep the price down so the US Shale producers to go “out of business”. However, the US Shale production has been resilient so far. Russia is also at its highest output and Iran is expected to increase its output in the coming months and therefore, many oil-dependent countries are finding it difficult to handle their budgets. The strain among the countries taking opposing sides was evident during the recently completed OPEC meeting on December 4th, 2015.

If price remains low for too long, it is sure to cause geopolitical tension, lead the economies of Europe, the US and Japan towards deflation. Oil producers will have to cut production, in the future, as the low price is unsustainable in the long-term. When this starts to occur crude oil price will find a bottom. I will keep you updated regarding the time to enter oil, for long-term gains in the future. But until then follow my analysis and forecast.

HOLIDAY TRADE ALERT SPECIAL

GET 12 MONTHS OF TRADE ALERTS FOR PRICE OF 6!

www.TheGoldAndOilGuy.com

The article by the Gold and Oil Guy originally appeared here and was reprinted by permission.

You might also like: