Which is Over Priced? Oil or Gold?

Updated 3/14/2022

With Oil surging is it now overpriced? What about Gold? With the value of the dollar constantly changing it is hard to tell what it all means. After all, can you imagine trying to build a house if every day when the workers arrived you gave them a different size ruler?

With everything from lumber to bitcoins skyrocketing in price (or the dollar devaluing) is there any way to tell what the real value of something is? How much is anything really worth? Is Oil overpriced? How about Gold? Is it overpriced? Is it cheap now that the price has come down? Looking at these commodities in the standard way it is often difficult to tell.

We could look at the inflation-adjusted price of Gold but that requires that we rely on (and believe) the government-stated inflation index. But that is just one way to look at the price by comparing it to U.S. dollars. We could also look at its price in Euros or at what the price looks like to the people in China or India. And each of those is based on the values of their currency and how much they are inflating.

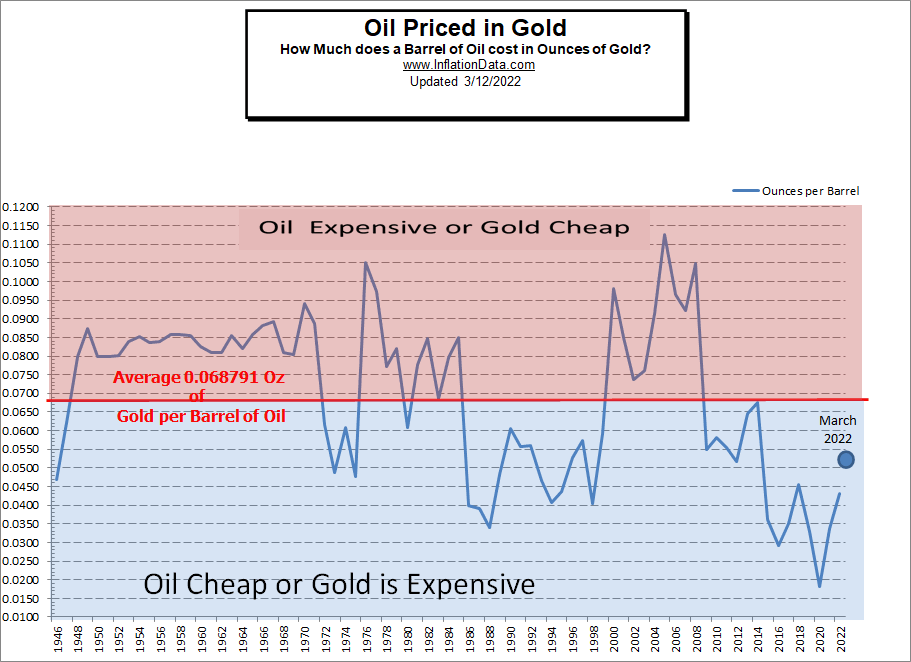

Oil Priced in Ounces of Gold:

But in the real world that isn’t true. There are inequalities partially because money doesn’t flow equally initially. Eventually, it will even out as traders arbitrage high-priced commodities against lower-priced ones.

But how do you know which commodities are overpriced and which are underpriced?

Very simply, you just divide one price by the other to get a ratio. If we look at the ratio of Gold to Oil we will see how they relate without bringing dollars into the equation.

Assume for a moment that an ounce of gold is exactly $1000 and a barrel of oil is $100. Let’s look at how many barrels of oil an ounce of gold would buy. So we are looking at barrels of oil per ounce of Gold. So if Gold is at $1000 /oz and Oil costs $100 per barrel it is obvious that one ounce of gold would buy 10 barrels of oil, right? 1000/100 = 10.

The mathematics works out like this:

($/oz) ÷ ($/barrel) = ($/oz) x (barrels/$) = ($ x barrels)/(oz x $)

the dollars cancel out and you are left with:

barrels / oz = barrels per ounce.

Note: Many economists measure it the other way around, but I prefer barrels per ounce because if you do it the other way around the numbers come out messier i.e. it takes a fraction of an ounce of gold to buy a barrel of oil.

The Ratio is What Matters

The Ratio is What Matters

If several years ago, gold was at $500 an ounce and oil was at $50, or if gold is $2000 an ounce and oil is $200 the ratio is still the same.

So, we need to look at the historical ratio and see what a reasonable number of barrels per ounce is.

We used the free market price of gold rather than the government fixed price of $35 / ounce. We also used the free market price of oil (called stripper price) rather than the government fixed price for the period when oil prices were fixed.

| Gold Prices source: http://www.kitco.com/charts/historicalgold.html

Oil Prices source: Plains-All-American |

From that we come up with the following table:

| Annual Average Gold and Crude Price 1946-Present |

# of bbl Oil 1 OZ Gold will buy | ||

|---|---|---|---|

| Year | Average $/bbl | Average $/oz | Ave bbl / oz |

| 1946 | $1.63 | $34.71 | 21.294 |

| 1947 | $2.16 | $34.71 | 16.069 |

| 1948 | $2.77 | $34.71 | 12.531 |

| 1949 | $2.77 | $31.69 | 11.440 |

| 1950 | $2.77 | $34.72 | 12.534 |

| 1951 | $2.77 | $34.72 | 12.534 |

| 1952 | $2.77 | $34.60 | 12.491 |

| 1953 | $2.92 | $34.84 | 11.932 |

| 1954 | $2.99 | $35.04 | 11.719 |

| 1955 | $2.93 | $35.03 | 11.956 |

| 1956 | $2.94 | $34.99 | 11.901 |

| 1957 | $3.00 | $34.95 | 11.650 |

| 1958 | $3.01 | $35.10 | 11.661 |

| 1959 | $3.00 | $35.10 | 11.700 |

| 1960 | $2.91 | $35.27 | 12.120 |

| 1961 | $2.85 | $35.25 | 12.368 |

| 1962 | $2.85 | $35.23 | 12.361 |

| 1963 | $3.00 | $35.09 | 11.697 |

| 1964 | $2.88 | $35.10 | 12.188 |

| 1965 | $3.01 | $35.12 | 11.668 |

| 1966 | $3.10 | $35.13 | 11.332 |

| 1967 | $3.12 | $34.95 | 11.202 |

| 1968 | $3.18 | $39.31 | 12.362 |

| 1969 | $3.32 | $41.28 | 12.434 |

| 1970 | $3.39 | $36.02 | 10.625 |

| 1971 | $3.60 | $40.62 | 11.283 |

| 1972 | $3.60 | $58.42 | 16.228 |

| 1973 | $4.75 | $97.39 | 20.503 |

| 1974 | $9.35 | $154.00 | 16.471 |

| 1975 | $7.67 | $160.86 | 20.973 |

| 1976 | $13.10 | $124.74 | 9.522 |

| 1977 | $14.40 | $147.84 | 10.267 |

| 1978 | $14.95 | $193.40 | 12.936 |

| 1979 | $25.10 | $306.00 | 12.191 |

| 1980 | $37.42 | $615.00 | 16.435 |

| 1981 | $35.75 | $460.00 | 12.867 |

| 1982 | $31.83 | $376.00 | 11.813 |

| 1983 | $29.08 | $424.00 | 14.580 |

| 1984 | $28.75 | $361.00 | 12.557 |

| 1985 | $26.92 | $317.00 | 11.776 |

| 1986 | $14.64 | $368.00 | 25.137 |

| 1987 | $17.50 | $447.00 | 25.543 |

| 1988 | $14.87 | $437.00 | 29.388 |

| 1989 | $18.33 | $381.00 | 20.786 |

| 1990 | $23.19 | $383.51 | 16.538 |

| 1991 | $20.19 | $362.11 | 17.935 |

| 1992 | $19.25 | $343.82 | 17.861 |

| 1993 | $16.74 | $359.77 | 21.492 |

| 1994 | $15.66 | $384.00 | 24.521 |

| 1995 | $16.75 | $383.79 | 22.913 |

| 1996 | $20.46 | $387.81 | 18.955 |

| 1997 | $18.97 | $331.02 | 17.450 |

| 1998 | $11.91 | $294.24 | 24.705 |

| 1999 | $16.55 | $278.98 | 16.857 |

| 2000 | $27.40 | $279.11 | 10.186 |

| 2001 | $23.00 | $271.04 | 11.784 |

| 2002 | $22.81 | $309.73 | 13.579 |

| 2003 | $27.69 | $363.38 | 13.123 |

| 2004 | $37.41 | $409.72 | 10.952 |

| 2005 | $50.04 | $444.74 | 8.888 |

| 2006 | $58.30 | $603.46 | 10.351 |

| 2007 | $64.20 | $695.39 | 10.832 |

| 2008 | $91.48 | $871.96 | 9.532 |

| 2009 | $53.48 | $972.35 | 18.180 |

| 2010 | $71.21 | $1,224.53 | 17.196 |

| 2011 | $87.04 | $1,571.52 | 18.055 |

| 2012 | $86.46 | $1,668.98 | 19.303 |

| 2013 | $91.17 | $1,411.23 | 15.479 |

| 2014 | $85.60 | $1,266.40 | 14.794 |

| 2015 | $41.85 | $1,160.06 | 27.719 |

| 2016 | $36.34 | $1,250.74 | 34.418 |

| 2017 | $43.97 | $1,257.12 | 28.590 |

| 2018 | $57.77 | $1,268.49 | 21.958 |

| 2019 | $50.01 | $1,514.75 | 30.289 |

| 2020 | $32.25 | $1,769.64 | 54.873 |

| 2021 | $60.84 | $1,798.61 | 39.563 |

| 2022 partial Year |

$80.18 | $1,860.63 | 19.340 |

| March 2021 | $102.31 | $1,978.70 | $19.34 |

| Average | $16.56 | ||

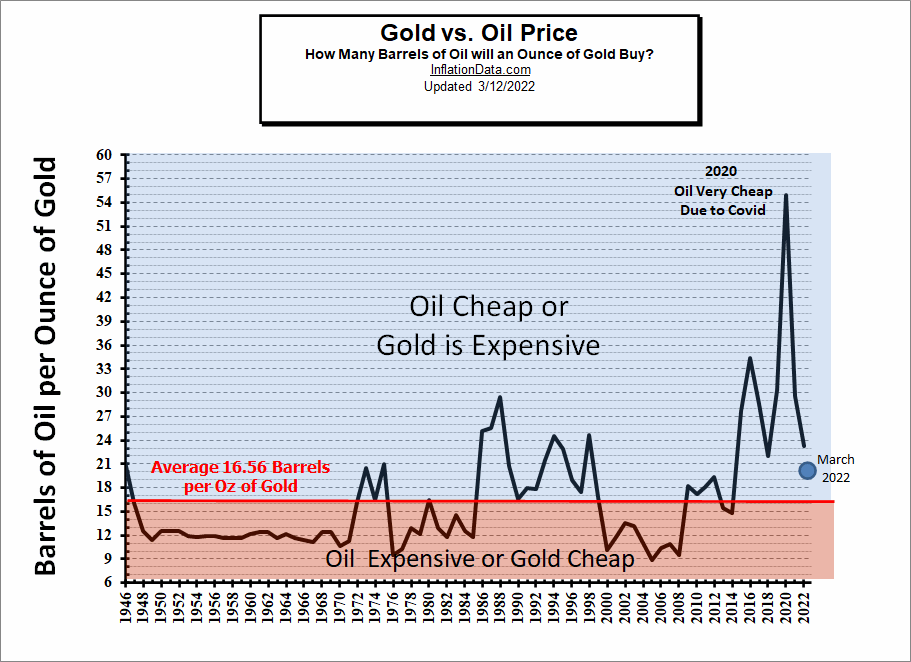

If we look at the ratio of Gold to Oil since 1946, the average turns out to be 16.56 barrels of oil per ounce of gold. Or 1 ounce of gold will buy about 16½ barrels of Oil on average.

If we look at the average ratio during 2020 one ounce of gold would buy 54.87 barrels of oil or more than 3 times normal. This tells us that either Gold was expensive or Oil was cheap (or both). In this case, probably both, due to COVID, there was an Oil glut, so oil was cheap. And since gold is a crisis hedge, due to extreme fear gold was in greater than normal demand.

So far in 2021, the ratio has fallen to “only” double normal. But even in 2019, the ratio was almost double normal.

Back in 2005 (before the big crash) greed was in fashion and no one was fearful, oil was expensive and/or gold cheap. So you would only get 8.88 barrels of oil for an ounce of gold.

But this is where arbitrage comes in… what we can do when oil is cheap, is buy oil and sell gold hoping the ratio would move toward normal. That way if oil rises in price and gold stays the same you make money. If gold falls in price and oil stays the same you make money. Even if both rise in price because of inflation, but oil rises more, so the ratio normalizes you make money, or if both fall in price but oil falls less, etc.

Quiz # 1

If you could go back to 1985 and be given a choice to invest in Oil or Gold which would you choose? The ratio is 11.776 bbl/oz. Assuming you have $1268 you could have bought 4 ounces of gold in 1985 at $317.00/ oz or you could have bought 47.10 barrels of oil.

If you bought Gold, three years later, in 1988, you could have exchanged your 4 oz of gold for $1748 and bought 117.55 Barrels of oil. So although your dollars increased by 37.8% your number of barrels of oil increased by 149.6%. Had you held your oil until 2000 when the ratio was back down to 10, your 117.55 barrels would now be worth $3220.87 while four ounces of gold would only be worth $1116.44 or about $150 less than you had paid for it!

In 1988 oil was extremely cheap at over 29 barrels per ounce. But if you had bought oil in 1986 at 25 (also very cheap) it would have appeared that you were losing money for two years until the ratio turned around.

Quiz # 2

In 1998 Gold is $294.24 an ounce and Oil is $11.91 a barrel you have $1200 to spend… Which do you buy?

Based on this chart at 24 barrels to an ounce of gold, Oil was cheaper. You could have bought 100 barrels for $11.91 x 100 = $1191 and sold them when oil was expensive in 2008 (once again less than 10 barrels per ounce. At that point, you could have exchanged your 100 barrels for $9148 and bought 10.49 ounces of gold.

On the other hand, had you bought gold in 1998 you could have used your $1191 and bought only 4.047 ounces.

If you are an economist I’ll include the chart based in standard terms as well.

Gold vs. Oil Chart

Warning: Don’t just go out and start buying oil and selling gold based on this chart. We are using Annual averages for easy comparison. These ratios change on a daily basis. So you need much more up-to-date information than what an annual chart will tell you.

For more information: