By Tim McMahon, Editor

I recently was talking to a fellow investor at a conference and I mentioned that we carried quite a few articles from Elliott Wave International on this site. The gentleman I was speaking with commented that he had the impression that Bob Precter founder of Elliott Wave International was permanently bearish and so “eventually he would be right”.

And I guess quite a few people might have that impression. Bob has been quite vocal about his bearish predictions and the news media likes to target him when they have a bullish agenda. However, if we look at the last decade we see that taking a bearish stance might not have been so bad. Back in February of 2000 the NASDAQ index stood above 5000 and about six months later the the NYSE was around 7000.

Now about ten years later the NASDAQ is around 2200 (less than half what it was ten years ago) and the NYSE is around 7000. Taking inflation into account holding stocks for this entire decade would have been a major losing proposition. So perhaps being a bear was the right thing to do after all. But of course no one wants to be bearish when the market is going up.

But if we look at Bob Prechter’s track record in a bit more detail we won’t see a “PermaBear” at all. Bob Prechter has always said that successful forecasting should look to the current wave count (and various other technical measures) for direction. He is not married to the idea of being a bear, as a good umpire would say, “he just calls them as he sees them”.

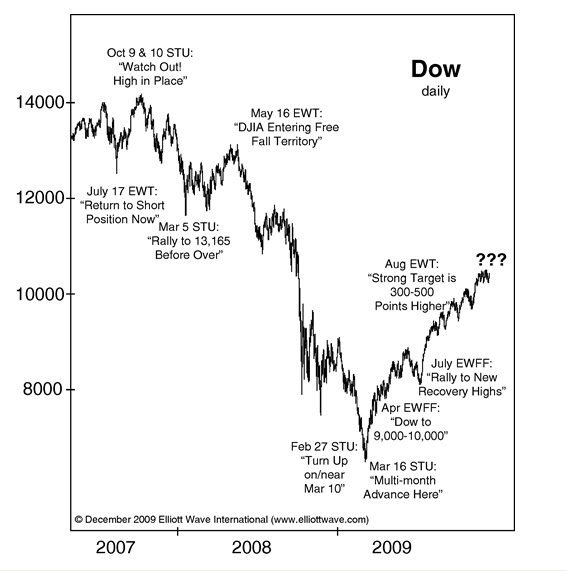

Lets take a look at some of Bob Prechter’s recent calls:

In July of 2007 the Elliott Wave Theorist began warning that the high was near and in October 2007 the Short Term Update said the top was in place. The Short Term Update even got the March intermediate rally right and then after a four month rally EWT called “Free Fall Territory” ahead. Which was certainly a good time to be bearish. Then in February just before the March bottom they called a “Turn Up on/near March 10”. Perfect timing to turn bullish! Confirming on March 16th “Multi Month Advance here” followed by three more bullish calls in the following months.

This certainly doesn’t sound like a “PermaBear” to me. Follow these links, if you’d like to find out more about what Bob Prechter is forecasting now .