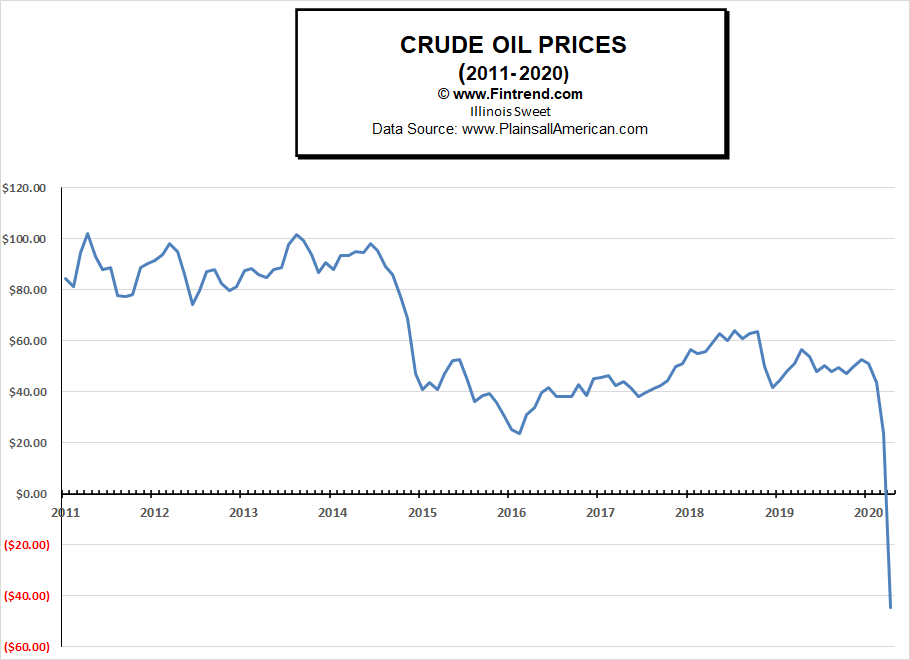

April 20th, 2020, is a day that will go down in history. Not because of wars or even because of the Coronavirus but simply because it was the first day ever where oil prices were negative. Yes, they were actually paying to try to give it away. Last month we said, that Saudi Arabia’s Oil Price War Is Backfiring. They picked a very bad time to boost production in order to drive prices down just as the Coronavirus stalled the world economy and drove demand to historic lows. It appears that Monday’s price fall is the culmination of that disastrous decision.

How Did the Oil Price Get So Low?

It doesn’t seem logical that a valuable commodity like oil could be worth less than zero. How could that happen? Well, according to AAA stations certainly aren’t paying you to take their gasoline although the national average price is down to $1.80/gallon.

The crude oil price is based on a complex system supported primarily by futures traders. In normal times these traders keep the market liquid by trading contracts for future delivery. Crude oil producers sell contracts for future delivery to the traders in order to be assured of a certain price for their oil and perhaps to promote cash flow. Traders buy futures at a discount in the hopes that prices will go up and they can sell the contract for more than they paid for it. Refineries buy contracts from the traders in order to ensure a steady supply of oil. If a trader believes that prices will fall they might “sell short” which means that they are selling without actually having the product with the expectation that they will buy it in time to close out their contract before having to deliver it.

A “short squeeze” happens when prices rise rapidly and those traders who sold short are forced to buy at much higher prices because they have nothing to deliver and the contract end is coming. The classic example is in Eddie Murphy’s movie “Trading Places” where they made a fortune as everyone panicked as the day came to an end and everyone’s contract had to be closed.

Since the majority of traders are not planning on delivering or taking delivery of the oil they must close out their options before the close of the contract which was on April 21st anyone with an open contract at the end of the day must deliver or take delivery of the oil in May. Once the traders have closed out all their spurious contracts, the actual oil drillers will deliver their oil to the actual oil refineries based on the remaining contracts.

This time instead of a “short squeeze” we had a “long squeeze”. Since there is very little demand for oil right now due to the Coronavirus and the supply is increasing because of Saudi Arabia and Russia flooding the market, the reserves have been increasing to the point where there is very little storage space left. So those traders holding contracts for delivery in May needed to unload them. But nobody wanted them since they already had plenty of oil and didn’t have anywhere to store more. This made the “long” traders desperate. They don’t want the oil and can’t put it in their desk drawer so they have to close out the contract at any price. So who is left to buy? Only those traders who were “short”, they also need to close out their contracts but now they have traders clamoring to do business with them so what happens?

Short trader: How much will you give me to take this contract off your hands?

Long trader: Give you? You’re supposed to pay me… this is valuable oil.

Short trader: The clock’s ticking.

Long trader: Ok, I’ll give you a dollar a barrel just to take it off my hands.

Long trader#2: I’ll give you two dollars a barrel.

Long trader#3: I’ll give you three dollars a barrel.

And so it goes.

What Caused It?

As we said, it began with a price war between Saudi Arabia and Russia. In an effort to force small U.S. producers out of business Saudi Arabia and Russia opened the oil spigots wide and began flooding the market with oil. This drove the price down and squeezed profit margins. Not only for U.S. companies but for Saudi Arabia and Russia as well. But they figured they could weather the storm better than the small U.S. shale producers. Once the Shale producers were bankrupt Saudi Arabia and Russia would be free to reduce production and make much bigger profits.

As we said, it began with a price war between Saudi Arabia and Russia. In an effort to force small U.S. producers out of business Saudi Arabia and Russia opened the oil spigots wide and began flooding the market with oil. This drove the price down and squeezed profit margins. Not only for U.S. companies but for Saudi Arabia and Russia as well. But they figured they could weather the storm better than the small U.S. shale producers. Once the Shale producers were bankrupt Saudi Arabia and Russia would be free to reduce production and make much bigger profits.

But while they were driving the price of oil down, along came the Coronavirus scare and everything shut down. Worldwide demand for oil fell drastically and supplies started building up. Storage facilities can only hold so much oil. One of the key storage facilities is in Cushing Oklahoma where a variety of pipelines meet. Back in February, Cushing storage was at about 50% of their 80 million barrel capacity and it is expected to be at 100% in May.

Reuters reported back on March 13th that President Trump wanted the U.S. Strategic Petroleum Reserve (SPR) to begin buying up the excess oil. The reserve currently has about 635 million barrels but it can only hold about 75 million more. And of course, Democrats and Environmentalists opposed the idea.

The SPR is stored at four separate sites containing a number of artificial caverns created in salt domes below the surface. Each is located near major petrochemical refining and processing plants on the Gulf of Mexico for easy distribution in times of emergency.

The last president to order filling the SPR to capacity was George W. Bush, in the wake of the Sept 11, 2001 attacks. During times of emergency, like hurricane Lili in 2002, hurricane Ivan in 2004, hurricane Katrina in 2005, etc. the Department of Energy has made deals with oil companies to release oil in exchange for a greater quantity in return once the emergency is over.

Democrats, however, have generally been more in favor of reducing the SPR than increasing it. In 2011, Obama ordered the sale of 30 million barrels of oil from the SPR. And in 2014 they conducted a “test sale” of another 18.5 million barrels. Then in 2015, Congress decided to tap the SPR again rather than budget money to pay for SPR “modernization”, sort of like a snake eating its tail because it is hungry.

According to the New York Times, “Congressional Democrats recently balked when the administration proposed spending $3 billion to fill the reserve as part of the stimulus package lawmakers passed last month. But on Monday Representative Lizzie Fletcher, a Houston Democrat, said she would introduce legislation appropriating funds for a reserve purchase.”

Interestingly, if there was a way to do it logistically, rather than costing $3 billion, they could actually have made a profit by taking all that excess oil, unfortunately, the SPR can only process about 500,000 barrels a day so even though Trump wants to buy up to 75 million barrels of oil he can’t do it all at once. However, had the Democrats been on board on March 13th in the following 37 days the SPR could have already received about 18 million barrels.

Unfortunately, there isn’t a quick fix for the oil industry’s problem. It takes time to reduce production once it has started you can’t just turn off the spigot. Wells often don’t return to previous production levels once restarted and stopping and restarting requires expensive manpower and equipment. And small companies often must continue producing no matter how low the price, in order to meet their interest payments. Most small drillers need at least $30/barrel in order to stay in business, and at $20/barrel as many as 80% of the small oil companies will be forced into bankruptcy. These bankruptcies would cause as many as 250,000 oil workers to lose their jobs in Texas alone.

You might also like: