This month we’ve decided to use our ROC (Rate of Change) system to look at the two biggest cryptocurrencies, i.e., Bitcoin and Ethereum. While doing this we changed the look of how we do ROC, so we will be adapting the regular ROC charts to the new style as well. The advantage of this new look is that you can see the underlying index at the same time, so you can see exactly where the various signals kicked in and how it evolved from there. Also, I think the new look is much cleaner and less cluttered.

This month we’ve decided to use our ROC (Rate of Change) system to look at the two biggest cryptocurrencies, i.e., Bitcoin and Ethereum. While doing this we changed the look of how we do ROC, so we will be adapting the regular ROC charts to the new style as well. The advantage of this new look is that you can see the underlying index at the same time, so you can see exactly where the various signals kicked in and how it evolved from there. Also, I think the new look is much cleaner and less cluttered.

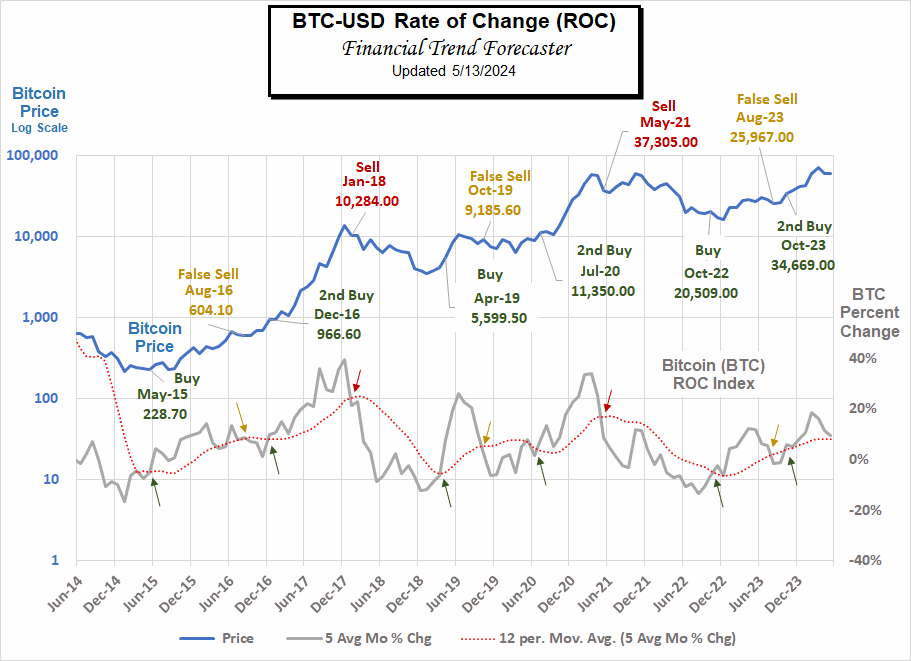

So, let’s look at Bitcoin first. Bitcoin is EXTREMELY volatile, so the first thing we had to do to adapt it to the ROC analysis was to smooth out some of the volatility. We did this in a few different ways. The first way was to take the average monthly price. So, on the index, we won’t see all the absolute highs and lows. The other thing was to plot it on a “Logrithmic” scale. That means that the distance between every horizontal line is 10x bigger than the previous one. If we didn’t do this the early line would look flat in the beginning and the last part of the chart would shoot straight up. By using the logarithmic scale we can see much more detail in the early chart.

We also averaged the ROC index to smooth out the bumps so it wasn’t crossing its red moving average lines 100 times. What we came up with was nice distinct crossings and a nice cyclical pattern. BTC is known for its cyclical nature due to the intrinsic code that created it. It is also to a great extent outside the influence of government manipulations and this results in a much cleaner pattern. Basically, Bitcoin has a 4-year cycle, with three years up and one year down.

Unfortunately, our ROC also generates one “false sell” that we are unable to smooth out. But it occurs regularly enough that it is easily recognized. The key thing we want to do when investing in crypto is to avoid the massive drop at the end of the cycle. And the ROC helps spot that very well.

The Final Blow-off Top of the Cycle

As we can see, in May of 2015 BTC was selling for $228.70 and by January 2018 it was selling for $10,284. That is a massive move… but a little over a year later, it lost almost half of its value. The same type of drop happened from 2021 to 2022. So, if we can avoid that drawdown we can keep those massive gains, rather than giving half of it back each cycle. Although the ROC doesn’t capture the absolute high and low it comes very close.

Where are We Now?

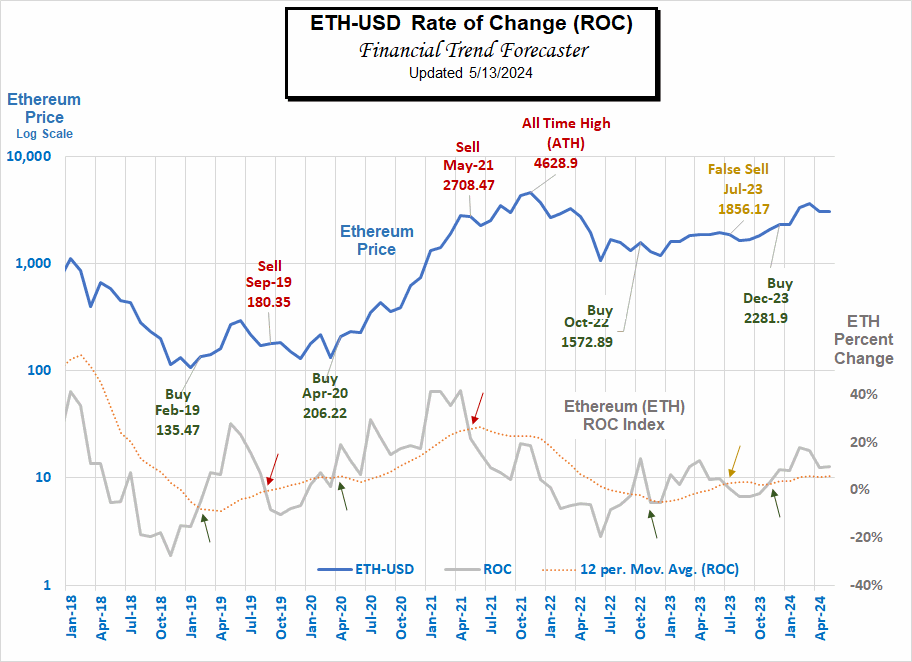

The ROC generated a Buy signal in October 2023 signaling the beginning of the final parabolic up-wave of this cycle. This wave should last until roughly August of 2025. At the moment, we are in a base-building phase of that wave. It is theoretically possible that we will get another false sell signal in the next month or so. But once this wave takes off it should be meteoric. However, BTC is no longer in its infancy. So, we can’t expect percentage moves on the order of what happened from 2015 to 2018. We can still expect great things but not of that magnitude, simply because BTC is now so much bigger. But its little buddy ETH should tag along and perform even better percentage-wise.

Ethereum (ETH)

Bitcoin itself opened the floodgates for Crypto and decentralized finance (defi) but BTC is almost entirely an alt-currency. Ethereum has built on that foundation and is much more functional. Rather than only being a currency it allows applications to be built upon its code to enable almost anything you can imagine to be done in a decentralized fashion. This makes ETH even more useful than BTC. That being said, we can expect ETH to eventually rival BTC giving it much more upside from current levels. The one difference is that there is a limited supply of BTC built into the algorithm but the same limitation is not built into ETH. So, ETH is useful and BTC is scarce, much like Silver vs. Gold or perhaps Copper vs. Gold.

Smaller Cryptos

There are literally thousands of cryptocurrencies. Some good, some not-so-good, and some totally worthless. Ethereum’s nearest competitor is Solana (SOL) which serves a similar function as a “Layer 1” protocol. These are followed by “Layer 2” protocols that add functionality on top of ETH or SOL. They will be even more volatile yet. And finally, there are “MemeCoins” that serve primarily an entertainment function and are the most volatile of all. The interesting thing is that the vast majority of these coins follow roughly the same cycle as BTC and ETH but because they are smaller their percentage changes can be much greater. A 1-cent coin can go to a dollar much easier than Bitcoin can go from $63,000 to $6,300,000.

Crypto Stocks

There are several ways to invest in various Cryptos via the stock market. Recently there have been Exchange Traded Funds (ETFs) created for Bitcoin. And there is an effort to create Ethereum ETFs but so far the SEC hasn’t approved them. Prior to that, a company called Grayscale created “Trusts” that owned a fixed amount of various cryptos and then sold shares of the Trust. Unfortunately, those shares often cost more than the underlying value of the assets the Trust held, often many multiples of the cost. As of this writing, for instance, Grayscale Solana Trust (GSOL) has a Net Asset Value (NAV) of $55.89/share. But it is selling for a whopping $363.99/share. That is absolutely insane. That would be like me walking up to a guy on the street and saying I have this beautiful $50 bill and I will let you have it for only $350. No thanks!!!

But occasionally it works the other way around when market sentiment turns negative. As of 5/14/2024, there are currently three Grayscale funds that are selling at a discount. They are Grayscale Ethereum Trust (ETHE), Grayscale Ethereum Classic Trust (ETCG), and Grayscale Digital Large Cap Trust (GDLC). You can view all the current Grayscale NAVs and current prices here.

| Fund | NAV | Price/Share | Discount |

| Grayscale Ethereum Trust (ETHE) | $24.96 | $21.31 | 24% |

| Grayscale Ethereum Classic Trust (ETCG) | $21.63 | $12.21 | 44% |

| Grayscale Digital Large Cap Trust (GDLC) | $32.74 | $19.04 | 42% |

Now buying these are like offering someone a $50 bill for $30!!! Sounds good to me! (I have invested in these Trusts). ETHE holds Ethereum, and ETCG holds Ethereum classic which resulted from a split and isn’t as popular as ETH.

The interesting one of these three is GDLC which holds the 5 largest cryptos. 72.9% of the Trust is in Bitcoin, 20.85% is in Ethereum, 3.88% is in Solana, 1.64% is in Ripple (XRP), and 0.73% is in Avalanche. So basically instead of paying $63,000 for Bitcoin, you can buy it at a 42% discount from Grayscale. So even if Bitcoin (and the others) went nowhere but the discount just went away, you could almost double your money. Plus you get a bit of diversification among the top 5 cryptos as well. Or you could look at it as “buy the Bitcoin and Grayscale will throw in the others for free”. This is NOT typical. Usually, these trusts sell at a premium, not a discount.

Warning: Remember, these are volatile… don’t invest anything you can’t afford to lose, and I do own (a very small stake) in these funds. Only Trusts containing some ETH are selling at a discount, so perhaps the market is telling us something bad about ETH??? Or, on the other hand, perhaps it is just a rare anomaly that we should take advantage of??? Many Crypto experts believe that Ethereum and these trusts especially, are lower than they should be, because the market is waiting for the SEC to approve an ETF for Ethereum. Unfortunately, that may not happen until sometime in 2025, and by then, this bull market will be half over.

You might also like:

- The Modern Day Wild West: Crypto Scams And Opportunities

- Blockchain Goes to Ethiopia

- Ripple the Cryptocurrency of Banks

- 4 Investments Making Waves in the Technology Sector

- How High Inflation Drives Countries Towards Crypto

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- Cryptocurrencies and Inflation

- Cryptocurrency: Is Bitcoin the Future of Money?