By: Artis Shepherd

Mainstream financial news today is replete with stories about “distress” in the commercial real estate market. But what is the precise nature of this distress, and what implications does it have for those outside of the respective industry or asset class? More importantly, what set of factors contributed to the distress, and what does that say about its potential alleviation?

Mainstream financial news today is replete with stories about “distress” in the commercial real estate market. But what is the precise nature of this distress, and what implications does it have for those outside of the respective industry or asset class? More importantly, what set of factors contributed to the distress, and what does that say about its potential alleviation?

Broadly, “distress” in the commercial real estate context refers to the inability of a property, or portfolio of properties, to make required payments on the underlying loan (to “service debt,” in industry terms). There is also physical distress—lack of physical upkeep, accumulation of deferred maintenance, etc.—but the inability to service debt is what’s generally referred to as distress in the financial media. I’ll refer to this as financial distress and focus on it as the more relevant driver of immediate and material negative implications for owners and investors.

In the following discussion, I’ll draw on my previous experience in the hospitality and core commercial real estate industry—specifically, my involvement in restructuring, recapitalization, and various other forms of dealing with financially distressed assets in the wake of the 2008–9 crash. I’ll also use my current role as the founder of a private equity real estate company focused on apartments to expound on the current issues in that specific industry. Throughout, I will highlight connections between financial distress and economic management by government at the expense of the free market.

Background

Murray Rothbard states in What Has Government Done to Our Money?, “Embedded in the demand for money is knowledge of the money prices of the immediate past.” If I want to buy a thing, I am keenly aware of that thing’s price (in money terms), which subsequently influences my demand for money. In a free market, in order to acquire that money, I must provide a service or good in exchange. Hence, the individual productive drive.

What the Federal Reserve and the United States government have done over the last fifteen years, and to a slightly less obscene degree for the last century, is to distort this relationship by creating money from nothing. Rather than demand for money and productive drive arising from a desire to acquire goods, the Fed sought to increase the desire to acquire goods (i.e., aggregate demand) by increasing the supply of money. As the money supply increases in this manner, only the first recipients of new money receive the primary benefit—the ability to acquire goods at status quo prices before they inevitably rise. This shifts the incentive from productive drive to rent seeking—the gaining of access and proximity to whoever controls the money supply.

After money is created, large banks and other financial institutions control its dissemination. The process of quantitative easing, for example, is facilitated by the primary dealers—a group of banks and hedge funds that are authorized to trade securities with the US government. Total money supply is also influenced by all banks through the fractional reserve banking system.

Since banks are in the business of investing and lending, the primary and immediate recipients of this new money are the capital markets—stocks, bonds, real estate, and others.

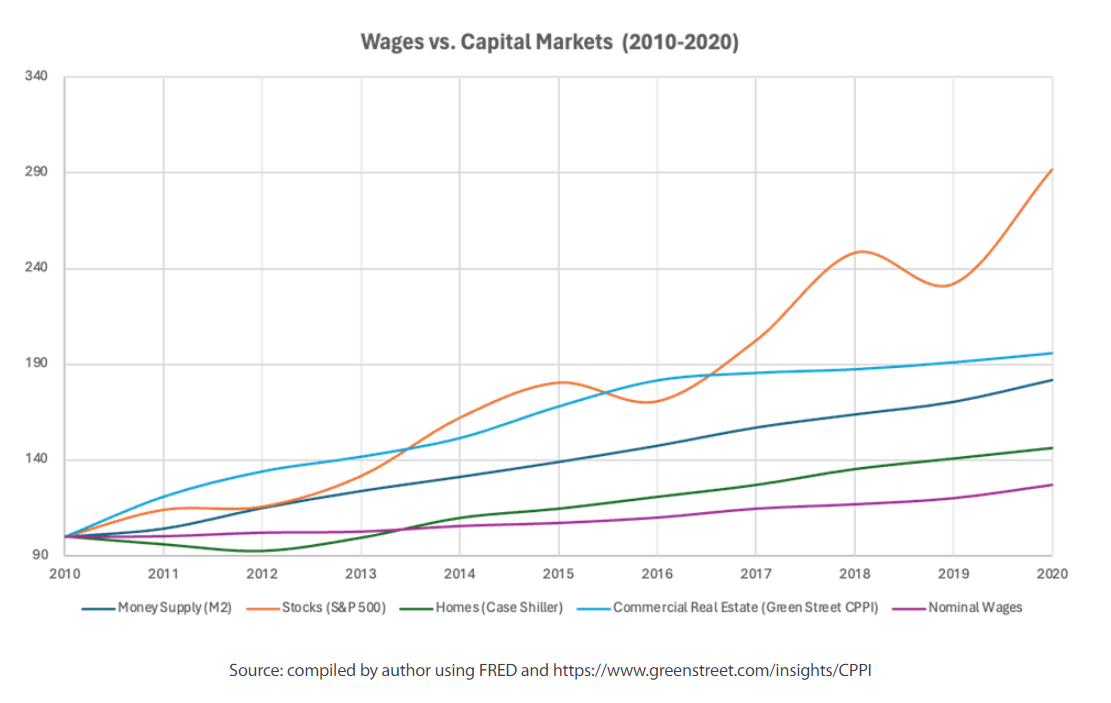

To illustrate, from 2010–20, the money supply doubled, which led to a corresponding tripling of the stock market during that time, as measured by the Standard and Poor’s 500. This happened despite real wages growing by only 6.5 percent during this time—a complete disconnection of capital markets from the main street economy.

The Apartment Bubble

Lending to the commercial real estate market during this period of money creation was one of the ways for banks and other institutions to disseminate the increased money supply. This was already apparent in higher asset prices during the 2010–20 period, but the process was given rocket fuel in early 2020 when the Federal Reserve and the Trump administration created trillions of dollars ex nihilo in their panicked response to covid.

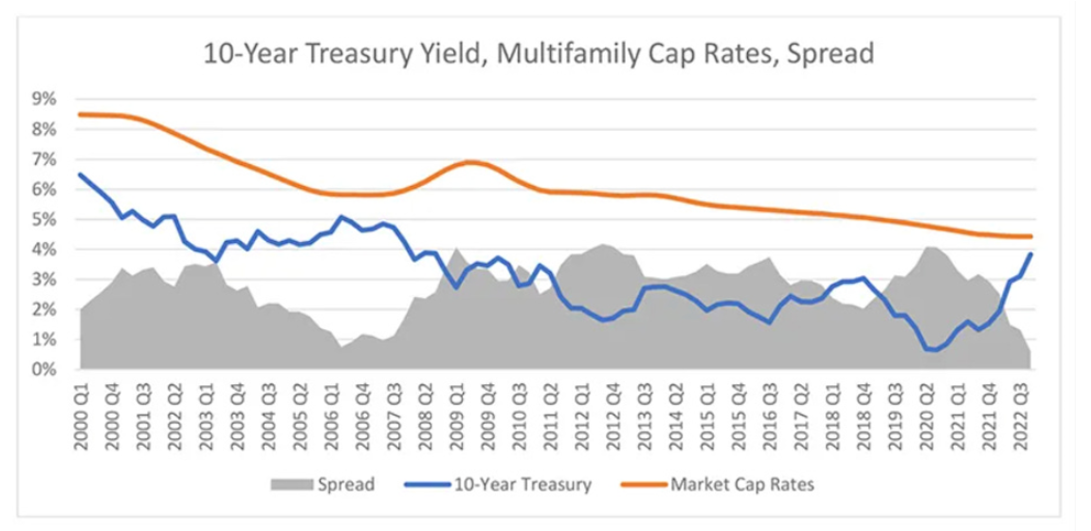

To disseminate a large amount of money in a short amount of time, a political imperative at this point, lenders abandoned credit standards, leading to the ubiquity of apartment bridge loans in the 2020–22 period. These were high leverage, floating rate loans that were easy to obtain, leading to a shocking run-up in apartment prices. Shunning the resulting low returns and high prices, experienced operators and investors generally stood down, leaving less experienced speculators—syndicators—to fill the void. As prices were bid up, cap rates (a proxy for the initial, unlevered yield a property generates) on apartment properties, historically above 6 percent for assets of reasonable quality, dropped below 3 percent in several markets.

Source: https://www.multihousingnews.com/the-cap-rate-spreads-underlying-message/

A typical apartment acquisition using a bridge loan from 2020 to early 2022 relied on the concurrence of two improbable projections to make the deals work on paper: First, no increase in benchmark interest rates—a remarkable assumption in the midst of the zero-interest rate environment at the time, when rates had nowhere to go but up. Second, huge increases in net operating income were based on renovation plans. While the numbers looked nice in a spreadsheet, operators and lenders were ignorant of the flesh and blood individuals at the end of these projections who had to sign up to more expensive leases when real wages were going nowhere.

Naturally, these projections did not pan out. The Fed was forced to increase benchmark rates in 2022 as consumer price inflation increased to untenable levels. As debt service consumed ever more cash at the property level, financial distress set in, kicking off a series of actions including foreclosure and various debt restructuring negotiations.

Foreclosure involves the owner losing the property completely as the lender seizes it in a legal process. Debt restructuring often entails new money coming in at terms that are extremely dilutive to existing investors. In both cases, the initial passive investors—moms and pops from whom the syndicators took money to complete these acquisitions—lose all or most of their invested capital.

So far, the losses are massive. The total size of the apartment bridge loan market is approximately $80 billion, while a conservative estimate of the proportion of financially distressed loans within it is one-third, or roughly $27 billion. Investors tied to these apartment loans have seen their capital decimated.

Other areas of the apartment market aside from bridge loans are also feeling the squeeze. Commercial mortgage-backed securities, loans securitized in a similar fashion to bridge loans but that are typically longer term and fixed rate, have seen their rate of financial distress double in the last month.

Real estate investment trusts, corporations in the business of owning and operating commercial real estate, are also financially distressed. Two of the largest—Blackstone’s BREIT and Starwood’s SREIT—have both suffered from massive investor redemptions and cash shortfalls jeopardizing their operations.

Office, Retail, and Hospitality

Other sectors of commercial real estate have likewise suffered, though the direct connection to monetary policy is obscured by other factors. Office properties have been made obsolete through the measures passed down during the covid panic—specifically the regime’s instructions for everyone to work from home. While some office property distress would have been likely regardless, the covid-era measures undoubtedly played the biggest part. Since “work from home” is now ubiquitous, meaningful recovery is unlikely.

In major metros, distressed office properties have been selling for pennies on the dollar (relative to assessed value or most recent purchase price) and in some cases below twenty-five dollars per square foot—roughly the cost to install a cheap laminate countertop.

Retail establishments and hotels likewise incurred significant losses from covid lockdowns but don’t suffer from the fundamental issues seen in office space. Nevertheless, most of the damage in those markets was done to smaller owners who didn’t have the wherewithal to survive a complete shutdown of commerce at their properties.

The Impending Bank Crisis

Over $2 trillion in commercial real estate debt is held by regional banks. This is distinct from loans, like the aforementioned bridge loans, that are securitized and sold to investors after origination. Banks, on the other hand, typically hold loans on balance sheet, meaning that they directly incur any related losses. Due to bank regulations, loan losses must be offset with otherwise useful capital held by the bank. As losses accumulate, capital subsequently declines, and banks are susceptible to failure or regulatory seizure precipitated by the anticipation of such failure. A banking crisis of this variety is likely in the near term, barring another series of bailouts.

Let Them Fail

Government intervention and Fed policy create cycles of asset bubbles and bursts. The commercial real estate bubble that is now bursting is only the latest example.

Lurking near the current distress is a loud, politically active group of rent seekers within the banking and investment industries begging for a bailout in the form of lower interest rates. This will ostensibly alleviate the pressure of lower asset prices, remove regulatory threats to banks, and provide political cover for politicians and their cronies who wish to extend the pseudoprosperity offered by asset bubbles. In other words, lower rates offer a way to avoid the negative consequences of their imprudent actions.

But more loose money is not a solution to problems caused by loose money in the first place, and government interference in the economy only rewards those who didn’t earn it, at the expense of others. As long as the free market is impeded by the state and the Fed, these crises will continue.

You Might Also Like:

- Crypto Goes Mainstream

- Economic Education Has Become Economic Disinformation

- Global Debt Levels Are a Ticking Time Bomb

- Argentina Sees First Monthly Budget Surplus in 12 Years

- Free Market Capitalism Improves Lives

About the Author:

Artis Shepherd is the Founder and Managing Partner of a private equity firm based in the Dallas-Fort Worth area, and previously worked for a sovereign wealth fund in the Middle East overseeing their hospitality investments in Europe, Africa, and Asia. He has a BS in Computer/Electrical Engineering from Purdue University and an MBA from the University of Chicago (Booth) Graduate School of Business. He publishes content at MTSObserver.substack.com.

This article originally appeared here and has been reprinted under the Creative Commons License.