Unusual things move the market. Lately, FED announcements have been responsible for moving the market, but at its January 28-29 meeting, the FED didn’t have much to say, i.e., they kept rates steady, so the market was relatively stable. The one telling comment from FED Chairman Jerome Powell at this meeting was his shift in how he spoke about Crypto. He seemed to be opening the door for banks to custody Bitcoin.

This had the expected outcome of temporarily boosting the price of Bitcoin by a percent or two. But then along came the Trump tariffs on Mexico, Canada, and China. These were announced after the markets closed on Friday. In the “old days” announcements made after 5 PM on Friday gave the markets two whole days to digest the news before the markets reopened on Monday.

But now since the Crypto Market is open 24/7/365 and liquidity is lower on the weekends, so we can see some sharp moves over the weekend. In this case, Bitcoin took this news as a signal to dump. On Friday, January 31 Bitcoin peaked at just over $106,000 and just before midnight (Eastern) on Sunday February 2 it bottomed at $91,178. If any regular stock market saw a 14% drop over a weekend, it would be considered a major catastrophe, but in Crypto this is just an ordinary weekend. On Monday the tariff trade war with Canada and Mexico had been averted (at least temporarily) and Bitcoin was back up around $102,000 by 5 PM Eastern on Monday.

Those interested in “Dollar Cost Averaging” can use these wild swings to accumulate Bitcoin by placing limit orders with an exchange like Coinbase at 10-12% below the Friday price. You stand a good chance of getting your order filled over the weekend. This doesn’t work every weekend but quite often.

As we said in our updated Bitcoin ROC commentary, “BTC has been consolidating in the $90,000 to $110,000 level” … so logically whenever it nears the $90,000 level it is a good opportunity to accumulate more. Many experts are projecting a $250 – $270,000 BTC price by year-end. For instance, PlanBTC’s “Stock to Flow” model suggests that in the “post halving” year, (i.e. 2025) we can expect between three and five 40% monthly moves.

Note: 2013 had four +40% monthly moves. 2017 had five +40% monthly moves. 2021 had four +40% monthly moves.

Just three +40% moves in 2025 would result in a $270,000 Bitcoin price.

Raoul Pal says we can expect a peak at 3x the previous high of $68,000 i.e. $204,000.

On Monday the tariff trade war with Canada and Mexico had been averted (at least temporarily) and Bitcoin was back up around $102,000 by 5 PM Eastern on Monday.

An interesting side note is the lopsided trade situation between the U.S., Canada, and Mexico. A major portion of Canada’s and Mexico’s GDP results from selling to the U.S., while only a couple of percent of U.S. GDP results from selling to both of them combined. So, they have much more to lose from a trade war than the U.S. does.

[Note: Bitcoin and ETH are still in Buy territory. ROC Charts were updated on February 1, 2025.]

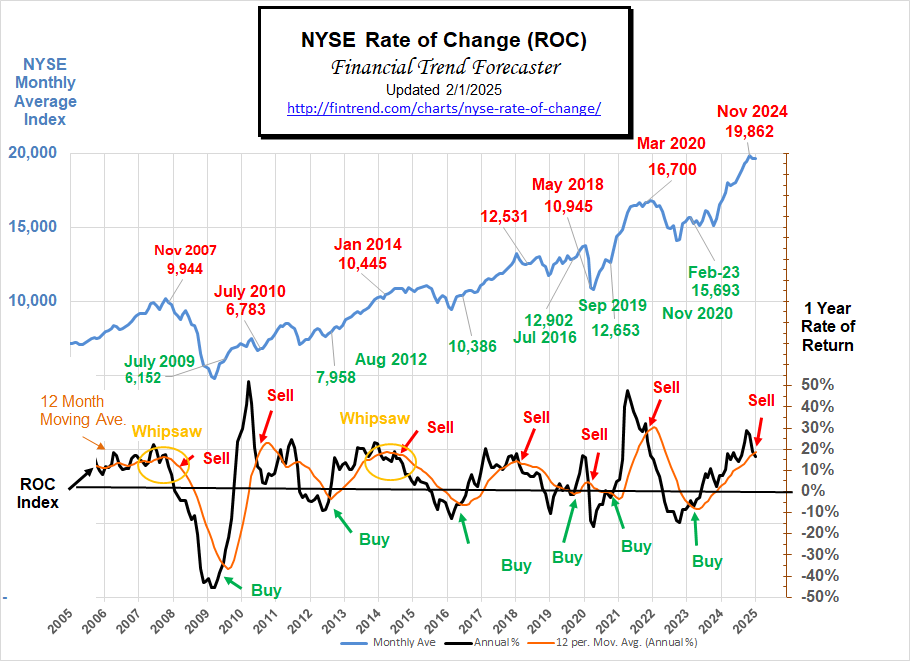

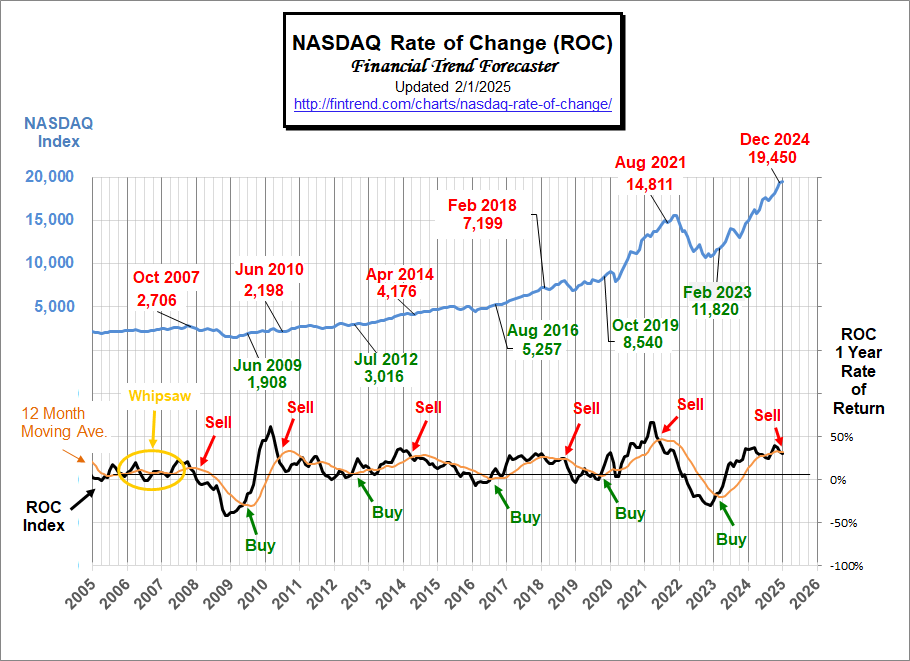

NYSE and NASDAQ

The ROC is not looking as favorably on the NYSE and NASDAQ market with “Sell Signals” for both of them. The current ROC commentary says, “In January the NYSE was down -0.13% after being down -1.03% in December. With the advance warning built into the ROC it is still possible that the ROC could reverse and negate the sell signal but caution is advised.”

See NYSE ROC for more.

Our NASDAQ ROC page discusses “DeepSeek” saying, “In December 2024, it [NASDAQ ROC] once again crossed below generating a sell signal. Since then the market fell into a panic with the revelation that the Chinese have developed “DeepSeek” an open-source AI computer that was significantly cheaper to build than American versions. “

See NASDAQ ROC for more information.