Stock Market Outlook – March 24, 2023

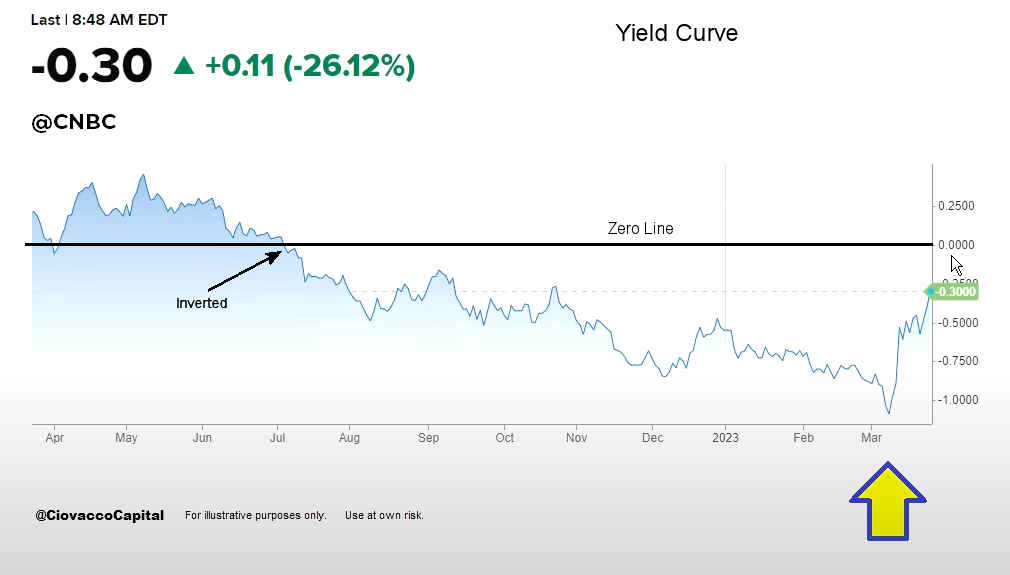

Today Chris Ciovacco of Ciovacco Capital Management looks at the market situation in light of the bank failures. First up is the Inverted Yield Curve. We can see that it originally inverted in July of last year, when short-term interest rates moved higher than long-term rates. From there it moved steadily lower before rebounding earlier this month. So although it is still inverted it is not anywhere near as bad as it was just a few weeks ago.

Stock Market Outlook – March 24, 2023 Read More »