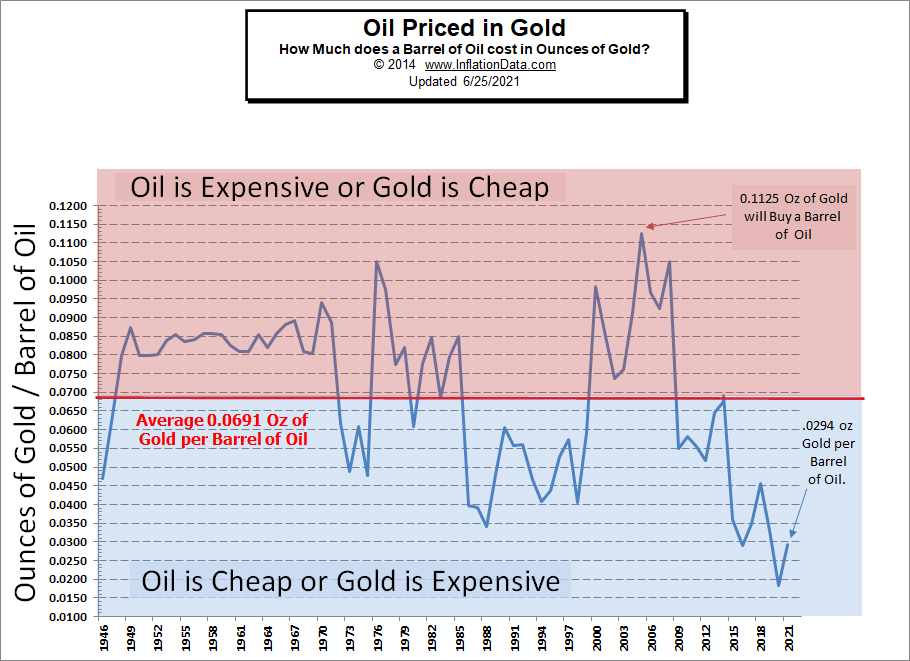

Which is Over Priced? Oil or Gold?

Was gold in a Bubble? Does the recent correction mean anything? With the value of the dollar constantly changing it is hard to tell what it all means. After all, can you imagine trying to build a house if every day when the workers arrived you gave them a different size ruler?

With everything from lumber to bitcoins skyrocketing in price (or the dollar devaluing), is there any way to tell the real value of something? How much is anything really worth? Is Oil overpriced? How about Gold? Is it overpriced? Is it cheap now that the price has come down? Looking at these commodities in the standard way, it’s often difficult to tell.

Which is Over Priced? Oil or Gold? Read More »