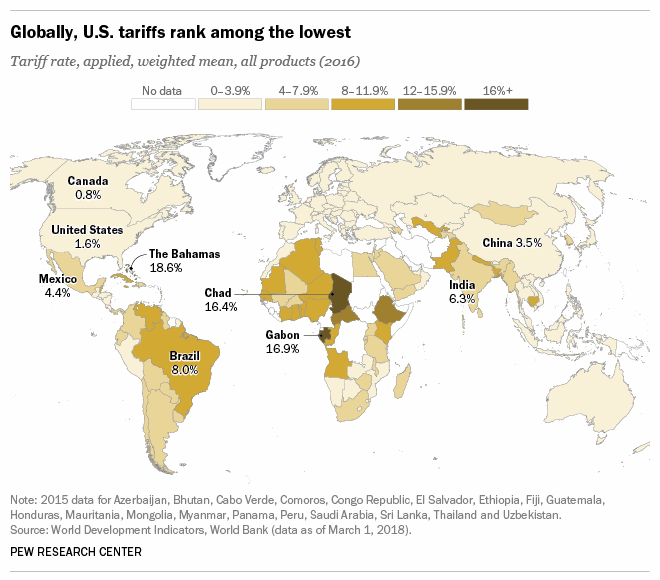

One of Trump’s big talking points in this election cycle was tariffs. So, what are tariffs and are they a good thing?

Tariffs or “import duties” have existed since the country began in the 1700s. Initially, they were imposed by Britain on imports to the Colonies. One memorable instance is the 1767 Townshend Revenue Act, which eventually resulted in the Boston Tea Party. (But not for the reasons you might think.)…

For many years economists believed, as Janet Yellen says, “if a company wants to export to the United States at below-market prices, we should buy the goods and send a thank-you note” but recently economists have begun rethinking that idea. What if those cheap imports last long enough to destroy all domestic production? Then you are at the mercy of foreign producers and all those domestic jobs moved overseas…

“When considering trade policy, it is important to recognize the difference between using tariffs to tilt the international playing field in favor of American businesses and using them as a negotiating tool…

Tariffs can help level the playing field when currency exchange rates aren’t doing the job they should be. Interestingly, back in 2005, it was none other than Democrat Chuck Schumer who led the charge to impose a 35% tariff on China…