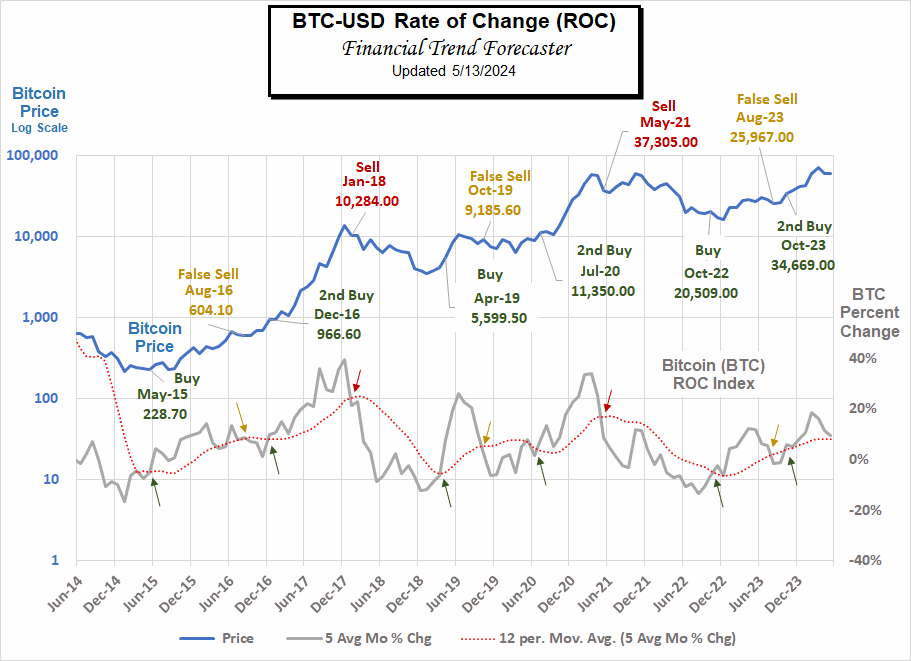

Applying the ROC to Crypto

Our ROC system is very good at spotting major turning points in the market. So this month we adapted it to look at Bitcoin and Ethereum. While doing this we changed the look of how we do ROC, so we will be adapting the regular ROC charts to the new style as well. The advantage of this new look is that you can see the underlying index at the same time, so you can see exactly where the various signals kicked in and how it evolved from there. Also, I think the new look is much cleaner and less cluttered.

Applying the ROC to Crypto Read More »