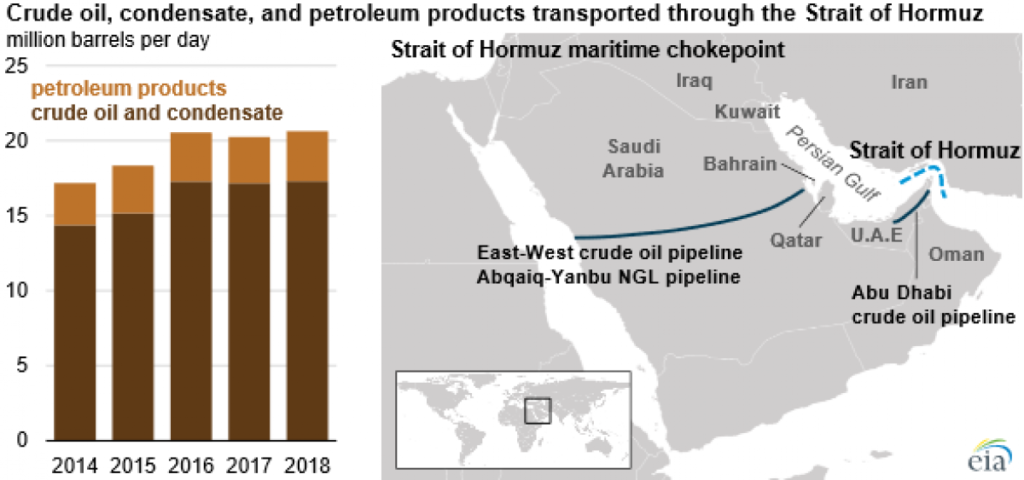

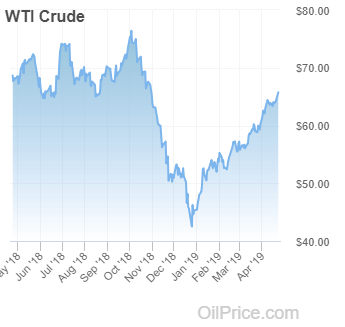

Quelling fears in the market is the right thing to do, but reality also needs to be addressed. Nasr’s message is that of an oil company CEO, taking all precautions to deal with a calamity. ADNOC’s Sultan will be doing the same. Still, the oil market is at present a victim of geopolitical power projections of emotional leaders superseding rationality. This confrontation is one of a possibly unprecedented order, not for oil (as skeptics again will state) but with oil as a weapon for defeat or survival. The continuing reference to the Iran-Iraq tanker war during 1980-1988 is out of touch with reality. At this time, it is not going to be Iran denying support or trade with Iraq, but a possible Arab-Iranian confrontation, led by the USA if no countermeasures are being implemented.