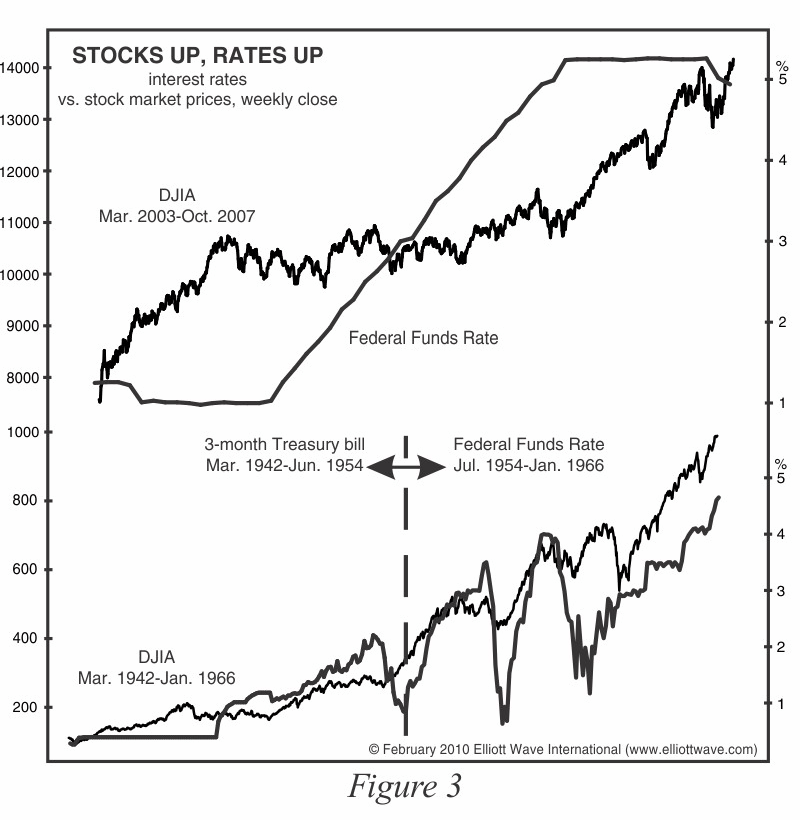

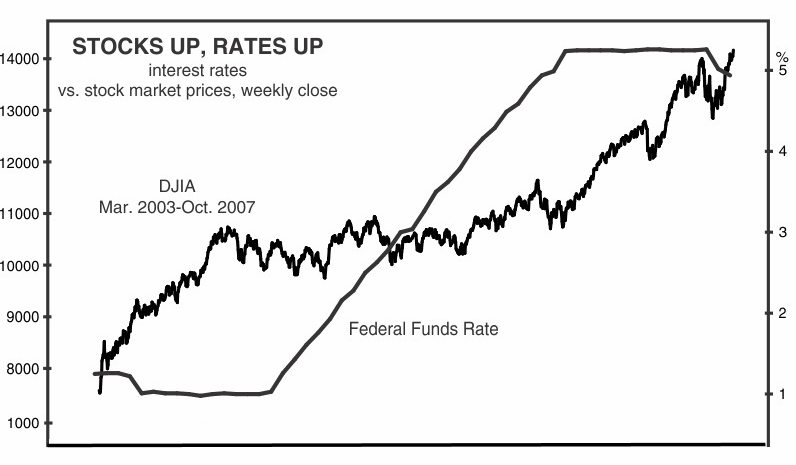

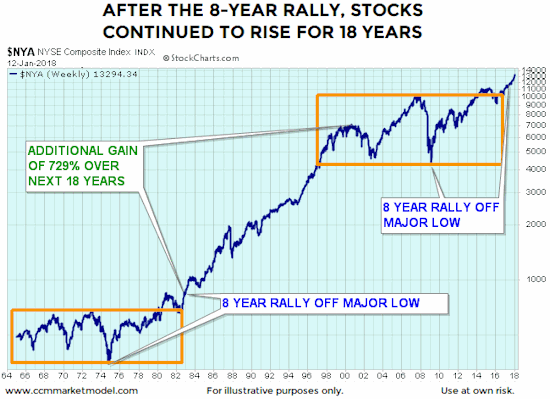

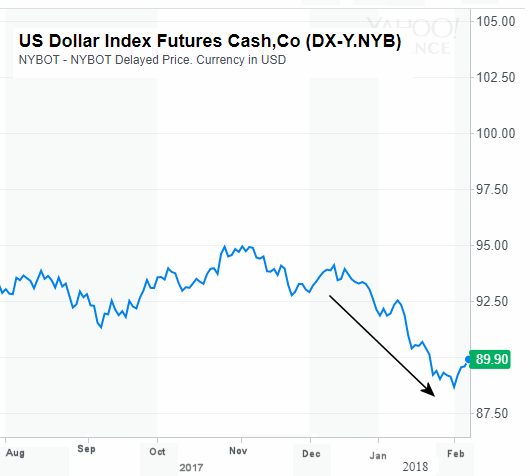

In anticipation of the September 25-26 Fed meeting, CNBC ran this headline (Sept. 21): “Record High Stocks Face Fed Rate Hike.” implying that the Fed’s interest rate decisions actually affect the stock market. Common wisdom says that “falling interest rates means higher stock prices, while rising interest rates means lower stock prices.” At first blush this might sound logical because rising interest rates makes fixed income investments more attractive because they pay more and have less risk than stocks. So some of the available capital will flow into bonds, etc. thus starving the stock market and putting downward pressure on prices. In this article, Elliott Wave International contends that there is actually no consistent relationship between interest rates and the stock market and they present examples of how the exact opposite of what you would expect has happened.