By David Galland, Managing Director, Casey Research Casey Research

Following a recent group email exchange with Louis James, the truly tireless editor of Casey’s International Speculator currently kicking rocks in Colombia, one of the non-Casey Research participants in the exchange commented, “You guys are doing it right. How many research shops have emails that start out with ‘Greetings from Medellin’?”

This is not Louis’s first trip to Colombia but just one of many. This time he is there to update his notes on what’s going on down there, now that some semblance of political stability has reignited interest on the part of large and small exploration/mining companies alike in Colombia’s rich mineral endowment.

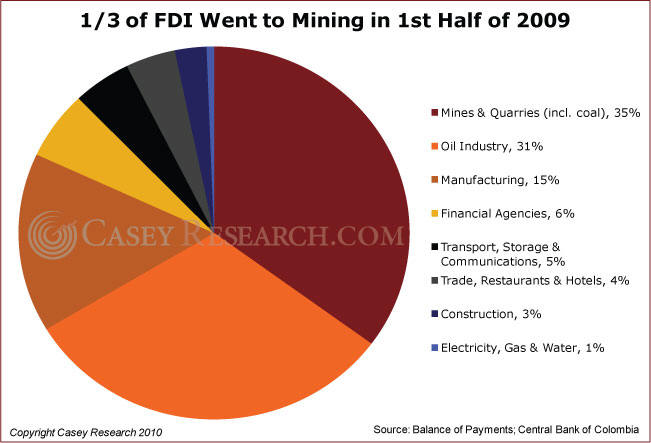

The Colombian economy, with its free-market approach, has fared better than its Latin American neighbors, and foreign investment is starting to flow in. In 2009, President Uribe attracted US$8.6 billion gross foreign direct investment (FDI).

As you can see in the chart below, more than 30% of total 2009 FDI in Colombia was in the mining and nearly as much in the oil sector.

I asked Louis to share his impressions on how the security situation has changed in the country over the past four years or so that he has been traveling there. During the early trips, he had military escorts and private bodyguards accompanying him into the bush for his explorations. So, how do things stand now?

Here’s his report…

Hola,

Oddly enough, where the mountains were once the guerillas’ strongholds, now they are relatively safe. Basically, where there’s good infrastructure, the army can deploy easily and the rebels don’t stand a chance. Up by Ventana and Greystar, I’m told, some 300 guerillas were cornered and wiped out to the last man. No prisoners in this war. So, they have been pushed out into the most remote regions, which are out on the jungle plains where there are no roads. One project I wanted to see is on the edge of those plains to the west, and the company politely said it was not yet safe… but that there’s a new army base nearby, so in time, the violence will move away.

Medellin is a much nicer and more modern city than most expect. There’s a modern urban rail system, linked by gondolas, like big ski lifts. Lots of new high-tech architecture, and the city is relatively clean and well-kept for a large (4M) Latin American city. But all the nice buildings have gates and security, of course.

I don’t think I took any undue risks on this trip. I did have a military escort one day, but it might have been more for show. (I’m more concerned about my trip to the Philippines next week – a friend of mine with a Filipina wife tells me his family won’t let him go where I’m going.) The Colombians I speak with are much more relaxed and so happy La Violencia is over for them.

Every time I come here, I like the place more and more for investment. I was told today that Colombia has never nationalized any private enterprise, and you know, for all its troubles, I can’t remember a time when it did. I was also told Colombia has never defaulted on debt payments, etc., and I can’t recall an instance of that, either. I’ve asked a new friend who works for a Colombian brokerage house for confirmation of these facts, which seem very significant to me, as they suggest that the current boom isn’t just because of Uribe’s personal values, but because his values are echoed by many Colombians.

I just came back from a dinner at which several key Colombian players were present. They were commenting on all the Johnny-come-latelies flocking to the area, and how many were picking up projects in parts of Colombia that are still dangerous.

It occurs to me that if one of these fools goes into an area where there’s still guerrilla activity and gets himself or one of his geologists kidnapped or killed, it could scare investors away from all Colombia plays.

I’m not sure that there’s anything that can be done about that, and the longer nothing happens, the better, as the guerrilla activity continues melting away. But for a while, all Colombia plays could face a sudden and serious drop in share price if some Vancouverite wins a Darwin Award down here.

I’m going to the Philippines to see a new low-cost, high-grade producer I’ve been looking at for some time, and another development story, but mostly to get a feel for the current realities of mining and exploration in the Philippines. It’s just me, not a big tour bus full of hotshots, making the trip, so I shouldn’t attract undue attention.

I’ll keep my eyes open and, of course, have more to say in our publications soon…

The opportunities in the junior resource sector can be truly stunning, with overnight triple-digit gains not unusual. But any sector that can go up that much can fall back just as sharply – so thorough due diligence is essential.

The good news is that if you do the homework, you can eliminate much of the risks, giving yourself a much better shot at the upside. But there is nothing easy or simple about the process – which is why Louis and other researchers on the team are on the road more or less constantly.

Fortunately, you don’t need to travel to the jungles of Colombia or the Philippines to profit from the best resource plays in the world. Read more here…