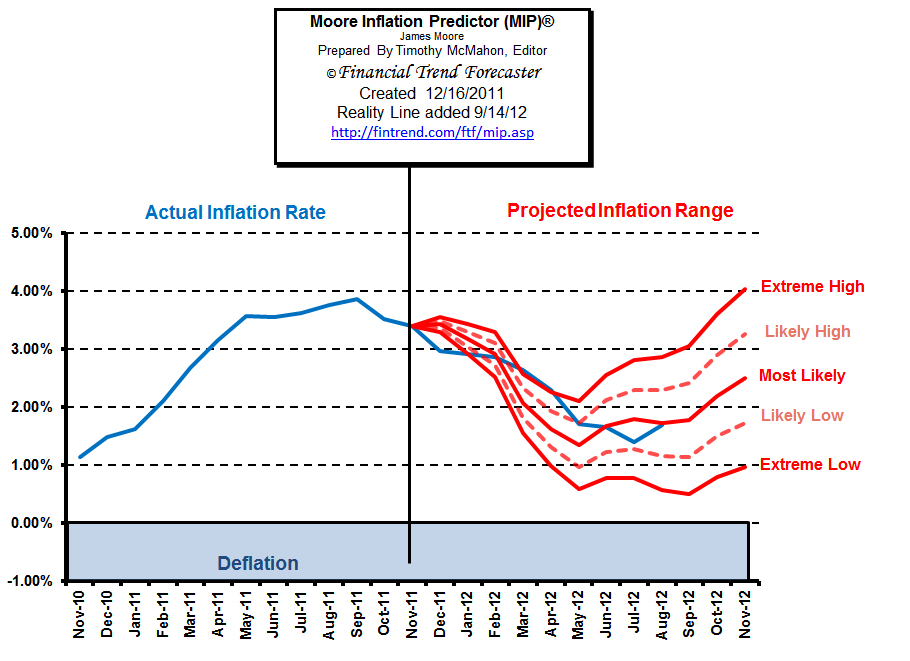

The MIP (Moore Inflation Predictor) is our proprietary index that projects future inflation rates one year into the future.

It uses a “fan” style with varying level of likelihood that certain rates will be attained. If you are considering refinancing (see When is it Right to Refinance? ) naturally you want the best rate. In order to determine the timing just look at the MIP chart.

From it you can determine when the next bottom will be occurring. Even though the MIP tracks and predicts the “Inflation” rate, interest rates tend to track fairly well with Inflation. So when the inflation rate is bottoming the interest rate should be bottoming as well. And this makes sense because as inflation increases banks have to charge larger and larger interest rates in order to make a profit over and above inflation. In the above chart you can the the “blue reality line” how the actual inflation rate compared to the MIP inflation forecast.

From it you can determine when the next bottom will be occurring. Even though the MIP tracks and predicts the “Inflation” rate, interest rates tend to track fairly well with Inflation. So when the inflation rate is bottoming the interest rate should be bottoming as well. And this makes sense because as inflation increases banks have to charge larger and larger interest rates in order to make a profit over and above inflation. In the above chart you can the the “blue reality line” how the actual inflation rate compared to the MIP inflation forecast.

See the Current MIP projection to see the current outlook for inflation and interest rates.

Tim McMahon, Editor

Financial Trend Forecaster

P.S. Even with the recent doom-and-gloom of the housing market, the right lender can still save you lots of money and refinance your home at a great interest rate.