In my recent NASDAQ ROC stock commentary I said,

Caution: Watch for the next sell signal. From the sell signal in July of 1996 to the final Sell signal in April of 2000 was roughly 3 ½ years. The time from the sell signal in April 2004 until the final Sell signal in October 2007 was roughly 3 ½ years. Our first sell signal in June 2010 was 3 years and 2 months ago, meaning that based on time alone there is only 4 months left in this whipsaw period. And the next crossing below the red moving average should be our exit point!

Today Chris Ciovacco points to some other indicators that are beginning to turn negative. Of course, we are coming to the end of the summer doldrums and so we could see a reversal of fortunes as we enter the fourth quarter but we still have to make it through the notorious months of September and October. Remember the ROC has not issued a sell signal yet but just a preliminary warning. ~Tim McMahon, editor

Stock Bulls Concerned

With the primary focus on the Fed, many market participants may have missed President Obama’s repeated calls for avoiding another round of asset bubbles. When the President’s remarks are paired with the Fed’s tapering script, it paints a potentially concerning picture for the stock market. From Bloomberg:

With the primary focus on the Fed, many market participants may have missed President Obama’s repeated calls for avoiding another round of asset bubbles. When the President’s remarks are paired with the Fed’s tapering script, it paints a potentially concerning picture for the stock market. From Bloomberg:

President Barack Obama, who took office amid the collapse of the last financial bubble, wants to make sure his economic recovery doesn’t generate the next one. Obama this month spoke four times in five days of the need to avoid what he called “artificial bubbles,” even in an economy that’s growing at just a 1.7 percent rate and where employment and factory usage remain below pre-recession highs. “We have to turn the page on the bubble-and-bust mentality that created this mess,” he said in his Aug. 10 weekly radio address.

Market’s Profile Is Deteriorating

Chart reading or technical analysis helps us monitor the market’s reaction to fundamental news. For example, this week’s video outlines significant deterioration in the market’s technical health, which tells us the “bubble avoidance” and “tapering” campaigns are not being offset by confidence in the global economy.

After you click play on the video below, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Will Obama Reshape The Fed?

When the President speaks about “artificial bubbles” four times in five days, it is noteworthy. If you asked an experienced Fed-watcher who has a higher probability of creating asset bubbles, Janet Yellen or Larry Summers, the response would most likely be Janet Yellen. According to Reuters, Larry Summers could shake the stock market with a more aggressive campaign to increase interest rates:

When the President speaks about “artificial bubbles” four times in five days, it is noteworthy. If you asked an experienced Fed-watcher who has a higher probability of creating asset bubbles, Janet Yellen or Larry Summers, the response would most likely be Janet Yellen. According to Reuters, Larry Summers could shake the stock market with a more aggressive campaign to increase interest rates:

Barring another financial crisis or slide back into recession, the next head of the Federal Reserve is likely to oversee a gradual normalization of monetary policy. But that pace, including the first interest rate hike, might be somewhat quicker under former Treasury Secretary Lawrence Summers than under current Fed Vice Chair Janet Yellen, the two top contenders for the job, if their own comments are any guide.

Broader Market Wants More Stimulus

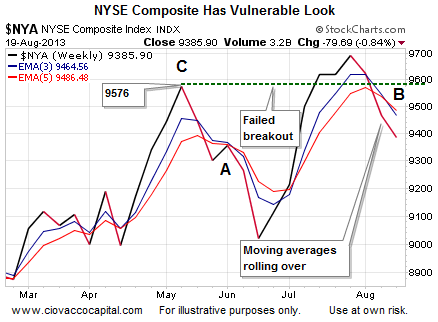

It is common knowledge the Fed is considering tapering their money printing and bond purchase program. If the stock market was unconcerned about the Fed’s desire to begin stepping away, we would expect to see a healthy weekly trend. That is not what we have. As shown in the weekly chart of the NYSE Composite below, the bullish breakout that occurred in early July (see point C) can now be classified as a failed breakout. The current weekly trend (point B) has a similar look to point A, where weakness in stocks continued.

Fed’s Script Has Been Consistent

Since their comments can move global financial markets, members of the Federal Reserve think long and hard before making public remarks. Since late May, Fed governors have consistently talked about the possibility of tapering. The odds of the Fed continuing unabated in the coming months are not good. As we have noted in the past, like President Obama, Fed governors are concerned about QE-induced asset bubbles. Statements over the weekend continued to carry the tapering torch.

Since their comments can move global financial markets, members of the Federal Reserve think long and hard before making public remarks. Since late May, Fed governors have consistently talked about the possibility of tapering. The odds of the Fed continuing unabated in the coming months are not good. As we have noted in the past, like President Obama, Fed governors are concerned about QE-induced asset bubbles. Statements over the weekend continued to carry the tapering torch.

From MarketWatch:

Richmond Federal Reserve Bank President Jeffrey Lacker made a case Sunday for ending QE3: the costs of asset purchases are rising and any future benefits are likely to be small. “The data in the first half of the year in my view is confirming my sense that the asset purchases were unlikely to have a noticeable effect on growth, ” Lacker said in an interview with the Richmond Times Dispatch on Sunday. And the larger the Fed’s balance sheet grows, “ the greater the risks of us getting it wrong, and getting the timing wrong, and getting the exit process wrong and letting inflation overheat and rise too much,” Lacker said.

Bond Market Takes Note

Rising interest rates can be a sign of confidence in future economic growth. However, when interest rates rise rapidly, it sends up “be careful” flares for stock investors. From Reuters:

U.S. benchmark bond yields hit a two-year high near 3 percent on Monday and emerging market currencies from India to Indonesia tumbled as markets braced for the Federal Reserve to start withdrawing support for the U.S. economy.

Investment Implications

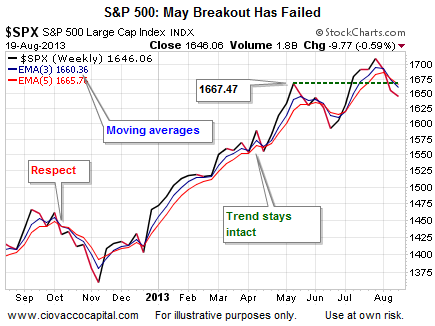

Our thoroughly backtested market model has called for three bouts of risk reduction in recent days. We remain long but with a much larger cash position. Like the NYSE Composite, the more widely followed S&P 500 has given back ground covered since early July. The weekly chart below has a profile similar to last October’s market correction.

If the markets can regain their footing and/or the Fed backs off their tapering-is-imminent stance, we are happy to increase our exposure to the broad market (SPY), small caps (IWM), and technology (QQQ). Should the bears maintain their momentum, we will continue to move away from pain in an incremental fashion.