On Friday July 15th, the U.S. Bureau of Labor Statistics(BLS) announced that the Consumer Price Index (CPI-U) had increased from 238.638 in June 2015 to 241.038 in June of 2016 resulting in a 1% Annual inflation rate. InflationData calculated the rate to be exactly 1.01% down marginally from 1.02% the previous month. However, on a seasonally adjusted basis monthly prices rose 0.2% overall while food fell -0.1% and energy rose 1.3%

The BLS’ Commissioner’s Report stated “For the second consecutive month, increases in the indexes for energy and all items less food and energy more than offset a decline in the food index to result in the seasonally adjusted all items increase.” In other words, even though food fell in price, everything else (including energy) rose so the net effect was a 0.2% increase in the Consumer Price Index (on a monthly Seasonally Adjusted basis) and 0.3% on a non-adjusted basis.

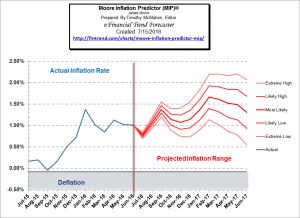

Unadjusted monthly inflation was 0.33%. The Moore Inflation Predictor (MIP)is forecasting a further decline during July followed by an increase during the months August through September.

Unadjusted monthly inflation was 0.33%. The Moore Inflation Predictor (MIP)is forecasting a further decline during July followed by an increase during the months August through September.

See full commentary on the MIP here.

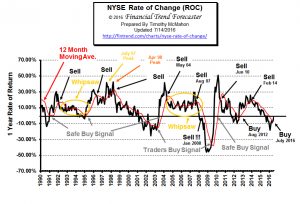

NYSE ROC

Although Brexit temporarily sent the market tumbling the NYSE has rebounded sharply. And now the NYSE Rate of Change (ROC) chart has crossed above its moving average line thus generating a buy signal for the first time in over two years. And although the annual rate of return is still marginally below zero the outlook for the NYSE doesn’t look nearly as bad as it did at the beginning of the year.

Although Brexit temporarily sent the market tumbling the NYSE has rebounded sharply. And now the NYSE Rate of Change (ROC) chart has crossed above its moving average line thus generating a buy signal for the first time in over two years. And although the annual rate of return is still marginally below zero the outlook for the NYSE doesn’t look nearly as bad as it did at the beginning of the year.

Read Full Commentary.

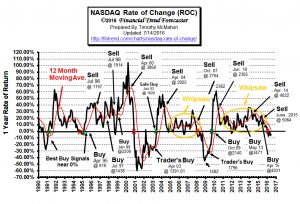

NASDAQ ROC

Even though the NASDAQ index increased 4.12% since last month, it remains below its moving average and below the zero line. So unlike the NYSE the NASDAQ is still in sell territory.

Even though the NASDAQ index increased 4.12% since last month, it remains below its moving average and below the zero line. So unlike the NYSE the NASDAQ is still in sell territory.