One of Trump’s campaign platforms was that the U.S. wasn’t getting fair deals in international trade. His two biggest examples were NAFTA (trade with Canada and Mexico) and trade with China. And in 2018 the media panicked and drove the markets down anticipating that Trump would somehow destroy all trade and the U.S. would plunge the world into another depression. Then in November 2018 NAFTA (North American Free Trade) was replaced by USMCA (United States-Mexico-Canada-Agreement) which included new protections for U.S. intellectual property, Digital Trade, Anti-corruption, and Good Regulatory Practices. It also included provisions “Creating a more level playing field for American workers, including improved rules of origin for automobiles, trucks, other products, and disciplines on currency manipulation.”

One of Trump’s campaign platforms was that the U.S. wasn’t getting fair deals in international trade. His two biggest examples were NAFTA (trade with Canada and Mexico) and trade with China. And in 2018 the media panicked and drove the markets down anticipating that Trump would somehow destroy all trade and the U.S. would plunge the world into another depression. Then in November 2018 NAFTA (North American Free Trade) was replaced by USMCA (United States-Mexico-Canada-Agreement) which included new protections for U.S. intellectual property, Digital Trade, Anti-corruption, and Good Regulatory Practices. It also included provisions “Creating a more level playing field for American workers, including improved rules of origin for automobiles, trucks, other products, and disciplines on currency manipulation.”

And now six months later the Trump administration is taking on China. But China is not Mexico and it has a lot more clout so where does the U.S. stand in this fight?

How the U.S.-China Trade War Started

As the deadline for the negotiations approached Chinese representatives decided that the Trump administration would be just like the Clinton, Bush and Obama administrations and be more intent on striking a deal than actually worrying about what the deal contained. So at the last minute they backtracked and wanted to change the terms of the deal. But unlike previous administrations Trump refused. Trump is intent on eliminating unfair trade practices and theft of intellectual property and is willing to play “hardball” if necessary. So in response Trump raised the tariffs on $200 Billion worth of goods from 10% to 25%. In response, China announced tariff increases on over $60 billion worth of goods imported into China from the U.S.

The Balance of Trade

When it comes to trade the U.S. has the advantage since the U.S. buys much more from China than it sells so China will suffer more. In 2018, China shipped 18% of its exports to the U.S. while the U.S. shipped between 7% and 10% of its exports to China. Total U.S. exports was $1,671.8 billion and of that between $120.3 and $179.3 billion went to China (depending on whose data you use). So in terms of percentages of GDP China has a lot more to lose. So far the impact has been minimal on the U.S. but much more severe on China. A 25% tariff on $200 billion of goods could take 0.3–0.4% off Chinese growth. And if Trump carries through with 25% tariffs on an additional $300 billion of Chinese goods, it could subtract an additional 0.5% from Chinese growth. The Chinese economy is already struggling so it can hardly afford this additional stress.

The Nuclear Option

One of the biggest fears of previous administrations has been “the Chinese Nuclear Option” this does not mean the actual launch of nuclear weapons but instead the sale of U.S. Treasury notes that China holds. China exports more than it imports so goods go out and money comes in and for decades more money has come in than went out. So what are they going to do with all that excess money? If they put it into their economy it would cause massive inflation so instead the bank of China purchases U.S. Treasury obligations so the dollars flow back to the U.S.

Peter Schiff believes that China holds all the cards because it is never wise to fight with your banker. He says “We have been riding on a Chinese gravy train. We have been relying on China for capital and we have been relying on China for consumer goods. They supply us with the savings we don’t have and they allow us to import the products we consume.”

Nobel Laureate, economist and Yale Professor, Robert Shiller says everyone is overreacting. “Well, I think of it as theater. We have two strong politicians, Xi and Trump, and Trump has just (landed) a punch. He put these tariffs on to China … and he tweeted it on May 5. It wasn’t insulting — he hasn’t created any names for Xi yet — but it was a little bit on the edgy side and it kind of humiliates Xi. So this is a human interest story which bleeds over into the markets.”

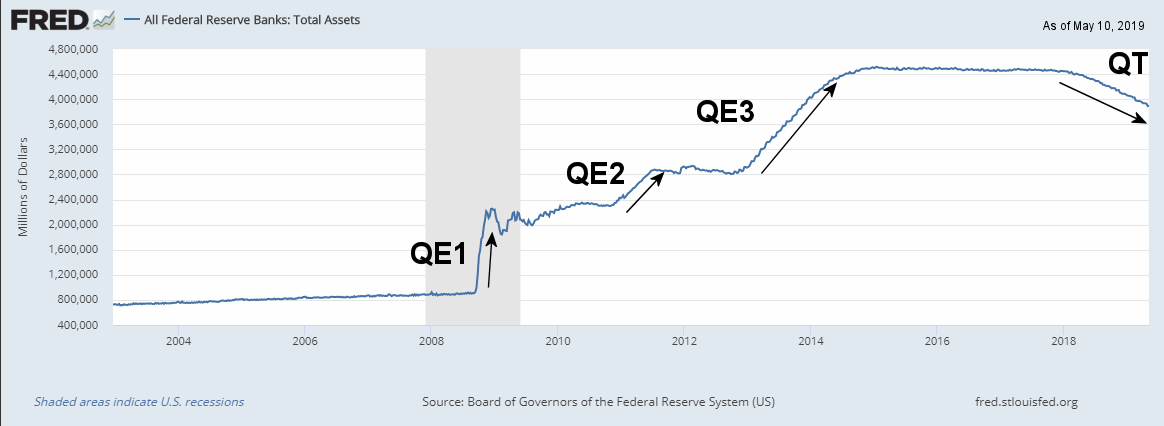

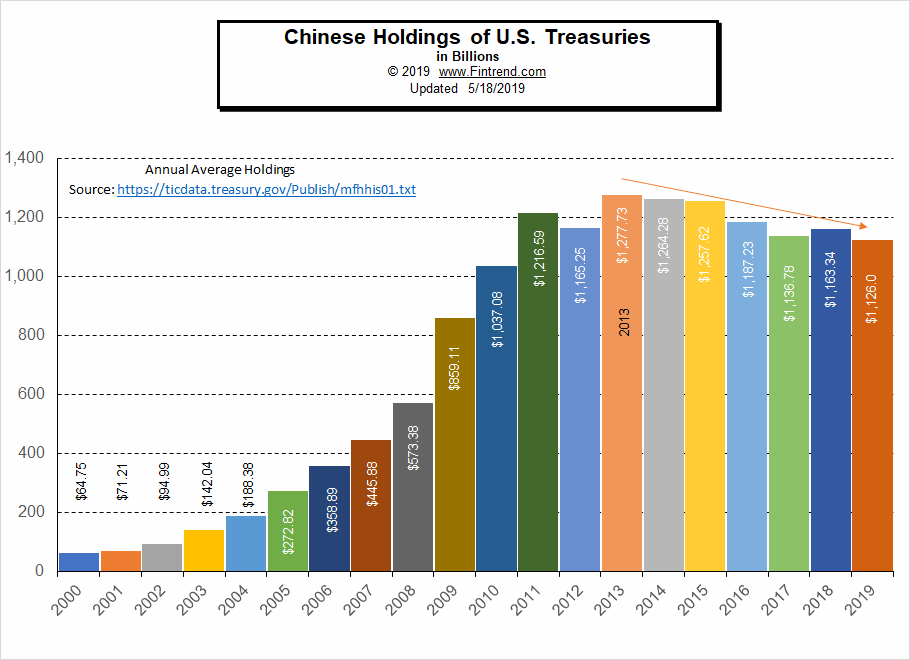

The fear has been that if they sell those massive Treasury holdings it would tank our economy. CNBC has been fear mongering saying “China has cut its holdings of U.S. debt to the lowest level in two years amid trade tensions… China reduced its holdings of U.S. debt in March by about $20.5 billion, bringing its overall ownership down to $1.12 trillion.” That is a 6.7% decrease. During that time our economy has boomed so obviously it hasn’t been a catastrophe. During that same period the U.S. FED has also cut the supply of Treasuries it has held via Quantitative Tightening. If the FED was actually concerned with the excess supply of Treasuries China is adding to the market it would be buying them up rather than reducing its supply through attrition.

Chinese Holdings of U.S. Treasuries (in Billions)

As we can see from the above chart the Annual average holdings by the Chinese have been relatively steady since 2011 and the actual peak holdings occurred not in 2017 like CNBC would have you believe but in 2013 at $1,277.7 since then the Chinese have been gradually decreasing their holdings of U.S. Treasuries not for trade related reasons but probably because they have been spending the money on infrastructure projects to keep their population busy.

As we can see from the above chart the Annual average holdings by the Chinese have been relatively steady since 2011 and the actual peak holdings occurred not in 2017 like CNBC would have you believe but in 2013 at $1,277.7 since then the Chinese have been gradually decreasing their holdings of U.S. Treasuries not for trade related reasons but probably because they have been spending the money on infrastructure projects to keep their population busy.

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| 2019 | 1126.7 | 1130.9 | 1120.5 | |||||||||

| 2018 | 1168.2 | 1176.7 | 1187.7 | 1181.9 | 1183.1 | 1191.2 | 1171 | 1165.1 | 1151.4 | 1138.9 | 1121.4 | 1123.5 |

| 2017 | 1051.1 | 1059.7 | 1088.1 | 1092.2 | 1102.2 | 1146.5 | 1166.9 | 1201.7 | 1182.3 | 1189.2 | 1176.6 | 1184.9 |

| 2016 | 1238.0 | 1252.3 | 1244.6 | 1242.8 | 1244 | 1240.8 | 1218.8 | 1185.1 | 1157 | 1115.7 | 1049.3 | 1058.4 |

| 2015 | 1239.1 | 1223.7 | 1261 | 1263.4 | 1270.3 | 1271.2 | 1268.8 | 1270.5 | 1258 | 1254.8 | 1264.5 | 1246.1 |

| 2014 | 1275.6 | 1272.9 | 1272.1 | 1263.2 | 1270.9 | 1268.4 | 1264.9 | 1269.7 | 1266.3 | 1252.7 | 1250.4 | 1244.3 |

| 2013 | 1214.2 | 1251.9 | 1270.3 | 1290.7 | 1297.3 | 1275.8 | 1279.3 | 1268.1 | 1293.8 | 1304.5 | 1316.7 | 1270.1 |

| 2012 | 1166.2 | 1155.2 | 1144 | 1164.4 | 1164.0 | 1147.0 | 1160.0 | 1155.2 | 1153.6 | 1169.9 | 1183.1 | 1220.4 |

| 2011 | 1154.7 | 1154.1 | 1144.9 | 1152.5 | 1159.8 | 1307.0 | 1314.9 | 1278.5 | 1270.2 | 1256.0 | 1254.6 | 1151.9 |

| 2010 | 889.0 | 877.5 | 895.2 | 900.2 | 867.7 | 1112.1 | 1115.1 | 1136.8 | 1151.9 | 1175.3 | 1164.1 | 1160.1 |

| 2009 | 739.6 | 744.2 | 767.9 | 763.5 | 801.5 | 915.8 | 939.9 | 936.5 | 938.3 | 938.3 | 929 | 894.8 |

| 2008 | 492.6 | 486.9 | 490.6 | 502 | 506.8 | 535.1 | 550 | 573.7 | 618.2 | 684.1 | 713.2 | 727.4 |

| 2007 | 401.0 | 416.0 | 420.0 | 414.2 | 407.5 | 477.3 | 480 | 471.2 | 467.7 | 459.1 | 458.9 | 477.6 |

| 2006 | 313.9 | 318.4 | 319.2 | 321.1 | 324.5 | 372.3 | 378.2 | 386.5 | 389.7 | 392.2 | 393.8 | 396.9 |

| 2005 | 223.5 | 224.9 | 223.7 | 240.2 | 243.1 | 298 | 296.4 | 302.1 | 306.3 | 301.7 | 303.9 | 310 |

| 2004 | 157.6 | 155 | 158.7 | 163.9 | 165.8 | 194.3 | 196.4 | 201.6 | 209.4 | 214.8 | 220.2 | 222.9 |

| 2003 | 120.7 | 121.8 | 133.2 | 134 | 135.8 | 147.1 | 151.3 | 148.8 | 147.1 | 151.5 | 154.2 | 159 |

| 2002 | 77.5 | 76.5 | 84.5 | 82.4 | 81.3 | 96.5 | 96.9 | 102.3 | 104.7 | 106.5 | 112.4 | 118.4 |

| 2001 | 61.5 | 63.7 | 69.8 | 69.2 | 69.2 | 72.7 | 74.2 | 73.4 | 72 | 72.3 | 77.9 | 78.6 |

| 2000 | NA | 59.4 | 71.4 | 71.7 | 72.5 | 67.5 | 66.4 | 62.6 | 62.1 | 59.5 | 58.9 | 60.3 |

But what if China decides to dump them all “enmasse”?

That is easier said than done. In order to sell you have to have a buyer. If they wanted to sell quickly, it would drive the price down drastically and they would lose a ton of money so that isn’t a real possibility. Also Chinese investment bankers aren’t stupid and they aren’t buying Treasuries to be nice to the U.S. they are buying them because they feel they are the best investment for their purposes. So if they sell, then the overall integrity of their investment portfolio will be less than “optimal”, which they may accept but they know there will be a cost associated with that.

According to analyst Jim Rickards, “Some analysts say China can dump its large holdings of U.S. Treasuries on world markets. That would drive up U.S. interest rates as well as mortgage rates, damaging the U.S. housing market and possibly driving the U.S. economy into a recession… There’s only one problem. The nuclear option is a dud. If China did sell some of their Treasuries, they would hurt themselves because any increase in interest rates would reduce the market value of what they have left. Also, there are plenty of buyers around if China became a seller. Those Treasuries would be bought up by U.S. banks or even the Fed itself. If China pursued an extreme version of this Treasury dumping, the U.S. president could stop it with a single phone call to the Treasury. That’s because the U.S. controls the digital ledger that records ownership of all Treasury securities. We could simply freeze the Chinese bond accounts in place and that would be the end of that.”

What about Politics?

On the one side pundits like Sven Henrich of Northman Trader say, “all pressure rests upon the presidential shoulders of Donald J. Trump: Because for Trump there’s an election to worry about. The Chinese don’t have an election to worry about and that puts the time pressure on Trump, not the Chinese.” In addition, the Chinese leaders want to “save face” and so they will stick to their guns even if it tanks their economy or they will just print more money to paper over the problem.

Except it doesn’t work that way in the real world. One way that Chinese leaders stay in power is by appeasing the people with economic growth. If the economy isn’t growing the people become restless and billions of restless Chinese people causes political problems for leaders like the 1989 Tiananmen Square protests. So the Chinese leaders continue to grow the economy even if it is based on a lie like a giant Ponzi scheme. As much as 50% of Chinese growth is actually a phantom. They have built “ghost cities” with no people, and converted atols into artificial islands and then built naval ports, air force landing strips, anti-aircraft weapons and other defensive and offensive weapons systems on the islands. All of this uses up resources, racks up debt and although it creates temporary jobs, in the long run it produces useless non-productive waste. In a free market economy if production is non-productive or doesn’t make a profit (i.e. fulfills a demand at an economical price) the producer goes out of business and the inefficiency is eliminated. In a command economy the inefficiency can go on until the entire country is run into the ground as we saw with the Soviet Union prior to 1991.

So the Chinese leadership continues to goose the economy despite the possible long term consequences because if the Chinese economy contracts drastically there could be riots in the streets and a regime change that could result in “heads rolling” quite literally. So Chinese officials are worried about something much worse for them than losing an election.

So although it appears that China has the advantage it is mostly illusory when it comes right down to it, if you are actually willing to call their bluff. And apparently Trump is willing to do so. At this point China believes Trump is also bluffing but at some point they may be surprised.

You may also like:

- Is Saudi Arabia Still an 800 Pound Gorilla

- Don’t Count Your North Korean Chickens Before They’re Hatched

- Russia Looks to China as Relations with Europe Deteriorate

- The Socialist Time Capsule

- Why America is no Longer a Free Capitalist Country