Traders routinely fixate on short-term price movements in their chosen financial instruments. Longer-term investors need a wider focus on stocks, forex, indices, FED actions and commodities to gain a better market perspective. The performance of US markets is worthy of mention, particularly since the epic global meltdown following the financial crisis of 2009/10.

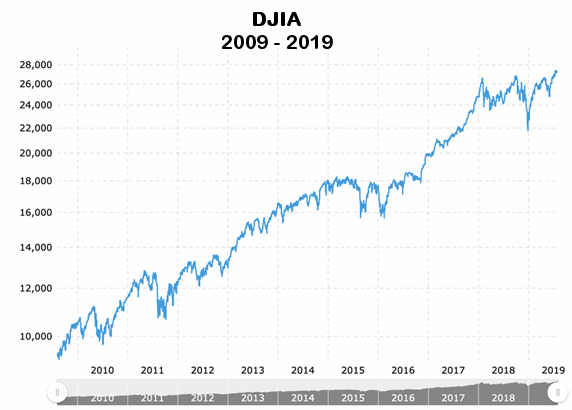

Source: Macrotrends Dow Jones Industrial Average last 10 years

As evidenced by the chart above, the Dow Jones Industrial Average (DJIA) has followed a relentless bullish trajectory, with the occasional hiccup thrown in for good measure. The march towards 28,000 seemed impossible barely a few years ago, yet here we are on the cusp of a truly historic achievement. As it stands, the Dow is there or thereabouts.

Precisely what drives markets to stratospheric heights and keeps them there is a great mystery to many people (often including the soothsayers of the financial realm). Suffice it to say, institutional investors, market sentiment, and speculative behavior are often drivers of overinflated market prices. The ability to sway investor opinion one way or the other is certainly a catalyst for inflating or deflating markets.

Current Market Perspective

Heading into December 2019, US investors find themselves in uncertain territory. Markets like the Dow Jones are inching ever closer to 28,000 while recording year-to-date gains of 19.54% (Mid-November 2019).

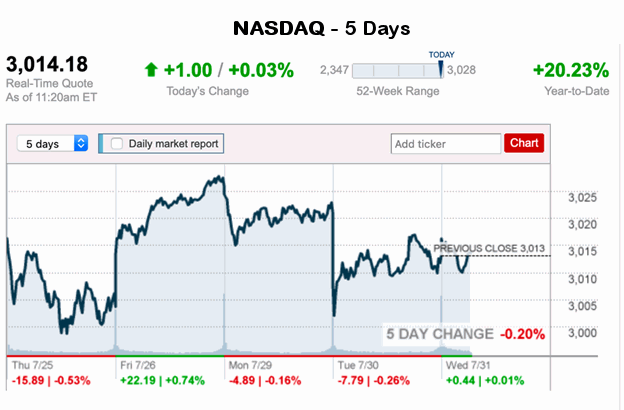

The tech-heavy NASDAQ has performed even more impressively in 2019. The year-to-date returns have already racked up 28.92%, as the NASDAQ closes in on its 52-week high of 8,589.76 (mid-November 2019). It is currently trading around 8550.

Source: MarketWatch

The broader S&P 500 Index has posted year-to-date gains of 24.29%. The index is fractionally off its 52-week high of 3,127.64, and currently hovering around 3,100.

What are the Experts Predicting?

Leading financial analysts describe the current market situation as cautiously optimistic. A variety of factors on the economic calendar has the potential to sway the markets, notably:

- Retail sales

- FOMC Minutes

- Inflation rate data

- Consumer sentiment

- Non-farm payrolls data

- The ISM non-manufacturing PMI

- The implications of the Fed interest rate decision

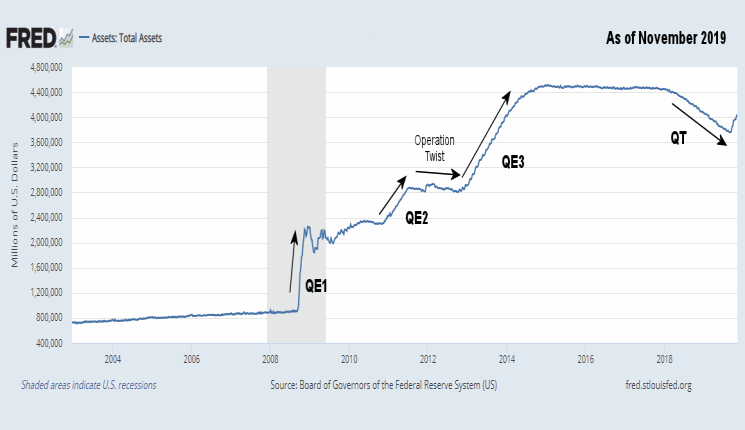

[Editor’s Note] See NYSE ROC for more commentary on the FED’s reversal of their Quantitative Tightening program.

Other geopolitical factors with the potential to sway investor’s perspective include US trade relations with Europe and China, ongoing tensions with world powers and Iran, and the level of uncertainty perceived by policymakers. Tensions remain to this day, but the more pressing issue is the ongoing political drama with impeachment proceedings against the President.

Indeed, one of the most important cogs in the wheel of global economic growth is the Fed itself. The Fed is headed by Jerome Powell, and 5 Federal Reserve Bank governors and 5 of 12 regional presidents in the Fed who have an equal vote on monetary policy matters. Their decisions vis-a-vis the size and scope of a rate cut are important, in that their projections for the economy matter.

An interest rate cut is likely to spur further economic growth, by making the cost of borrowing cheaper for businesses and individuals. This drives up company profitability since more investment results from cheap access to credit and less is spent on loan interest. As a result, prices of traded company stocks tend to rise when interest rates are cut.

All markets react to expectations and realities. If the market expects a large rate cut and these expectations are not met, markets will react unfavorably. This tends to stifle optimism and increase bearish sentiment. Global markets typically tend to take their cue from Wall Street. If Wall Street sneezes, the whole world catches a cold, and that’s precisely why the actions of the Fed are important.

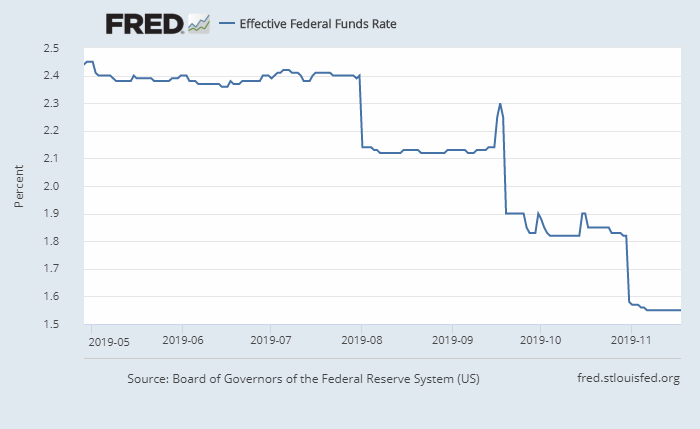

In 2012, the Fed had posted a 2% inflation objective. However, inflation was at 1.6% for the year through June 2019 which prompted the FED to embark on a less restrictive policy. Former Fed chair Janet Yellen stated that an inflation rate of 1.5% was more realistic. On a positive note, traders and investors are buoyed by the news of a rate cut, given that the Fed raised rates in 2018. The current levels of the S&P 500 index, the Dow Jones, and the NASDAQ are indicative of market approval regarding the rate cuts.

Generally speaking, most market watchers agree that small rate cuts will be insufficient to overheat the economy. But as we can see from the chart below the effective FED Funds rate has been falling over the last couple of months. Thus giving more confidence to the market.

You might also like:

- Bullish Signal Has Only Happened 10 Times in the Last 94 Years.

- Spotting a 178-Year-Old Firm’s Collapse… 2 Years in Advance

- Trade, Impeachment, and the Conviction of Buyers and Sellers

- Spotting High-Confidence Trading Opportunities