China is risking more than a real estate collapse. China has turned its back on what created the Chinese Economic Miracle in the first place. Everyone is pontificating about China’s real estate bubble and whether Chairman Xi will do enough to stimulate the economy. Even though the media admits that so far a loose monetary policy hasn’t helped, they still believe that more of the magic cure-all monetary elixir will somehow eventually work.

But the Chinese economy is at greater risk than just a real estate collapse. The pundits are blinded to the facts because they are looking at the world through “Keynsian glasses”.

A Lesson for China from Reaganomics

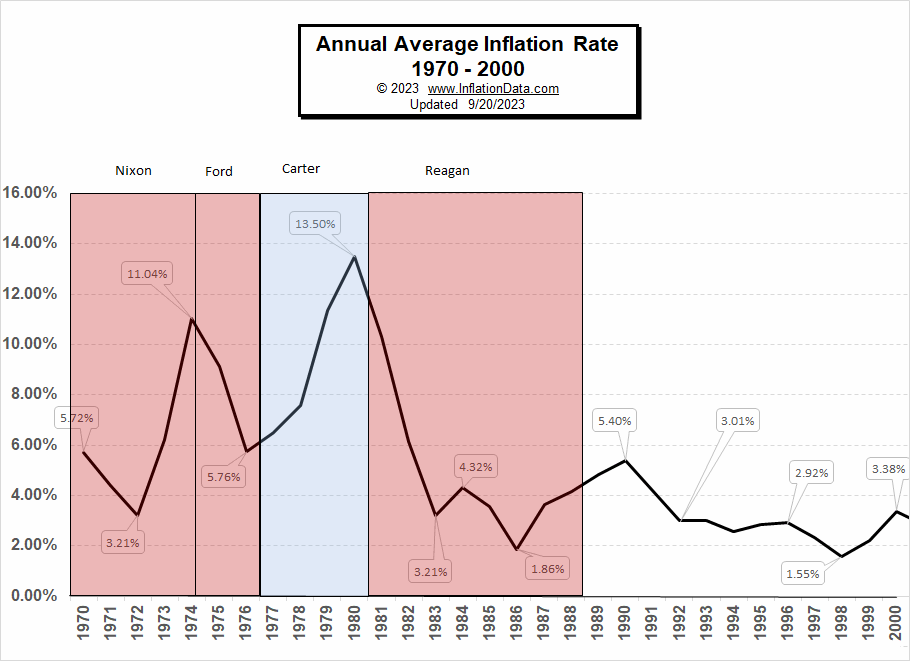

One of the main lessons pundits fail to grasp from Reaganomics is that fiscal policy always trumps monetary policy. They mistakenly believe that the Reagan miracle that ushered in two decades of economic growth was exclusively due to Fed tightening under Paul Volcker, i.e. monetary policy.

And the Reagan tax cuts are seen as simply a form of monetary stimulus. But that can’t be right because “monetary stimulus” is the exact wrong thing to do during times of high inflation. And inflation was almost 12% when Reagan took office and eight years later when he left office it was 4.4%. (Still high by today’s standards but a welcome sight at that time.)

In Reagan’s time, high inflation, onerous regulations, and 35% capital gains taxes meant there was no incentive to produce anything. So, investors shifted their sights to non-productive inflation hedges like gold, art, and real estate. Reagan’s fiscal policy including tax reforms unleashed a flood of capital investment that revitalized the productive portion of the economy. By reducing onerous taxes and regulations, it became profitable to run businesses again.

And That Brings Us to China

The Chinese economic miracle has similar roots in that China relaxed their regulations and instituted what they called “Chinese Communism” which was really Communism lite or perhaps Capitalistic Communism. This allowed for small entrepreneurs to flourish. A “shadow” banking system emerged, along with “micro” loans, and then came the “town-and-village enterprises” which were officially owned by the local governments but technically run by local entrepreneurs, which created the Chinese economic miracle. Another source of economic growth was foreign direct investment spurred by the relaxation of regulations.

But in November 2020 Chairman Xi began to crack down on the Capitalist roots starting with Jack Ma’s micro-loan empire Ant Financial and Amazon clone Alibaba. According to Yasheng Huang, author of Capitalism with Chinese Characteristics, “foreign-controlled or financed firms disproportionately contributed to China’s prosperity because they were largely exempt from the government interference and corruption that plagued indigenous firms.” Keynsians tend to miss the importance of this freedom of operation, says Huang, because they underestimate the extent of government control over Chinese-run businesses. Government control means inefficiency and corruption.

How much control does the Chinese government have? According to Jordan Peterson, “If a traffic cam catches you J-walking in China the digital ID system has you, has your blood and your genetic code, it can identify you by gait (how you walk), so even if it can’t see your face it can still identify you. It will convict you of J-walking, take money out of your bank account with no intermediary judiciary at all, and show a picture of you to the people in the neighborhood so they know you J-walked. And reduce your “social credit score”. If your social credit score falls below a certain level then you can’t buy drinks from a vending machine, you can’t play video games, you can’t go on a train, you can’t get out of your 15-minute city.”

China’s problem is not a lack of capital or liquidity, i.e., it isn’t a monetary issue but instead, it is a fiscal issue, i.e., they are cracking down on everything from business to Christians, and implementing an A.I. monitoring system ranking its subjects with a “Social Credit System” so draconian that if you don’t measure up to what they dictate you can be shunned, imprisoned, or sent to forced labor camps… along with your relatives. And unfortunately, as the following video shows the Chinese people have been brain washed into thinking this is a good thing… or at least something they can’t stop.

This draconian attack on freedom combined with a shrinking population and all the other problems facing China means that unless China relaxes restrictions its days as an economic powerhouse are numbered.

You might also like: