Recently I’ve been giving a lot of thought to the idea of global “empires”. Back in the 1970s one of my teachers discussed the parallels between the U.S. and the Roman empire and those parallels are even more striking today. A simple search on the term, “Parallels Between the U.S. and the Roman Empire” will generate pages and pages of results on this topic from such esteemed writers as Doug Casey, Seeking Alpha and even Salon.

In the U.S. we tend to bristle at the idea that we are an “empire” but a recent YouTube Video by Ray Dalio got me thinking about this subject once again. The characteristics of an “Empire” are fairly consistent and specific. Truth in History lists 36 characteristics of an empire. These include:

- Being the “World’s Policeman”.

- Meddling in the political affairs of foreign nations.

- Original citizenry becomes rich, lazy, fat and demands “bread and circuses”.

- Has an expanded immigration policy.

- Accepts foreigners into its realm as unskilled laborers.

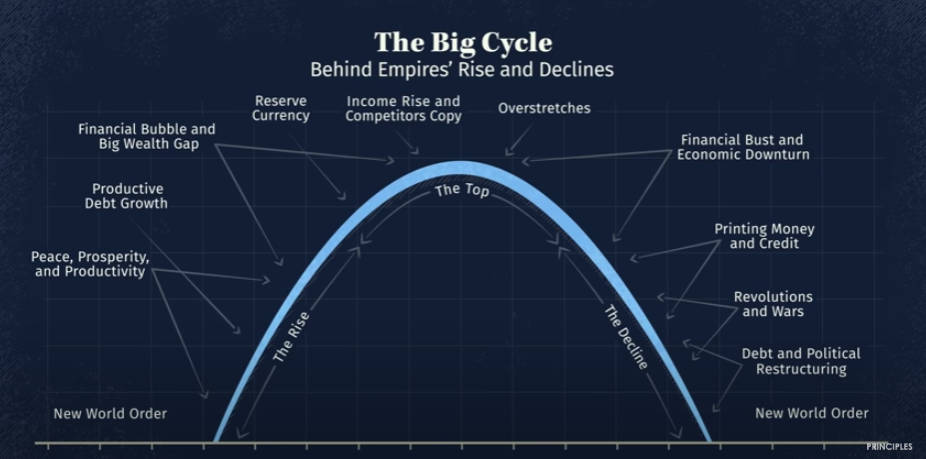

Ray Dalio’s video explains how the ascendency to Empire status occurs and he focuses on three recent “empires” including the Dutch, British, and the U.S. He calls this “the Big Cycle” and focuses primarily on the financial aspects of Empire.

Early factors leading to a country’s ascendancy include low corruption, an honest and strong work ethic, a good educational system, fair and efficient economic systems, and smooth transitions of power. These factors allow the system to consistently grow over several generations, while other countries without these foundations struggle and eventually self-destruct.

Reserve Currency

One of the key indicators that a country is on the verge of becoming (or has become) an empire is when its currency becomes the reserve currency of the world. Everyone is willing to accept it. Another indicator is when its language becomes the “trade language” and is spoken to a large extent worldwide. Interestingly, this is the first time in history that two successive empires shared the same language, i.e., English. This has had the compounding effect of making English even more widespread than previous trade languages.

One of the consequences of having a worldwide trade system is that you need to secure your trade routes, which leads to the role of “policeman of the world”. This benefits not only the most powerful country but also all other countries since they can also take advantage of the secure trade routes at little to no cost to themselves.

Peace and Prosperity

The transition from one world power to the next usually occurs during a time of war. For the U.S. this was WWII. While all the major countries of Europe were economically devastated by the War, the U.S. emerged stronger than ever. The Bretton Woods agreement made the U.S. the world’s reserve currency and U.S. factories were still intact and even expanded due to the war while European factories and infrastructure were in shambles.

But, a period of peace often follows the transition period because during the early ascendency period of the new empire, no one can financially afford to challenge the new leader. As time goes on other countries begin to “ride the coattails” of the ascending country. As it progresses the ascending country moves toward becoming the leading innovator in new technologies. During the Dutch empire’s ascendency, they were responsible for a full 25% of all new inventions in the world, including major advances in transportation and the invention of capitalism as we know it. Recently, the U.S. has been the clear technological leader.

This technological leadership results in strong capital growth which can be reinvested in more education, infrastructure, and research & development. Thus creating a “virtuous cycle” that increases productivity and profitability.

Developing Capital Markets

In order to continue to be successful, a country must have efficient capital markets including Lending, Bond, and Stock Markets. This allows savings to be reinvested in further ventures which generate more profits and increase the wealth of the country. At this point, other countries want to get in on the action and begin lending to the ascendant country, thus multiplying their productivity and creating the most efficient use of capital.

Peaking- The Top

At some point, other countries begin to copy the designs of the lead country and because they have a lower standard of living, (and don’t have R&D expenses), they are able to produce equivalent products more cheaply than the lead country. And so they start taking market share.

As people in the lead country become richer they want to enjoy the fruits of their labor, so they tend to not work as hard. They enjoy more leisure, pursue the “finer things of life”, and eventually become decadent. Those who inherit the wealth lack the same values as those who earned it, they become accustomed to the “easy life”, and thus more vulnerable to challenges. As they become more accustomed to success, they bet more on continued success which results in financial bubbles. But this also results in an increasing “wealth gap” which plants the seeds of class resentment and ultimately class warfare.

Doug Casey says, “Invariably, the last people to understand the collapse of an empire are those who live within it. As a British subject, I remember my younger years, when, even though the British Empire was well and truly over, many of my fellow Brits were still behaving in a pompous manner as though British “superiority” still existed. Not so, today. (You can only pretend for so long.)”

Reserve Currency

Having the world’s reserve currency inevitably results in excessive borrowing and large debts with foreign lenders. This boosts the country’s spending power in the short term but weakens the country’s financial health over the long term. Inevitably, the cost of maintaining and defending the worldwide empire becomes greater than the revenue it brings in. So having an empire ultimately becomes unprofitable.

The Cost of Maintaining the U.S. Empire

The U.S. has spent over $8 Trillion dollars on foreign wars since 9/11. And trillions more for other operations and supporting military bases in 70 countries around the world. Despite this, it still isn’t spending enough to maintain superiority in the area around China. Once the empire runs out of lenders (or lenders decide it is no longer profitable to lend to the empire) the whole pyramid begins to collapse and the strength of the empire begins to decline (often dramatically).

The Decline

The decline can result from internal “class warfare”, and/or costly external fighting. Typically the decline begins gradually but then accelerates. At some point, the empire can no longer fund its debts so it must choose between default and printing money. Typically, it takes the easy route and prints more money. Initially being the “reserve currency” allows the empire to export its inflation but as other countries begin switching away from the reserve currency that inflation eventually comes home to roost.

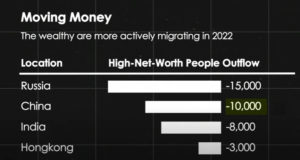

This results in inflation, declining living standards, and then civil unrest. At this point, wealth flees the country to “safer havens”. But this only makes the situation worse for those who remain. Economic productivity decreases, shrinking the economic pie and exacerbating the problem.

When external rivals sense this internal weakness they begin to seek ways to take advantage of these vulnerabilities, raising the risk of international conflict, i.e., war. In shades of Dalio’s picture of a country in decline, China has challenged the U.S. hegemony over Taiwan… perhaps in an effort to deflect attention from its own economic and COVID problems or perhaps in a trial test of U.S. weakness?

The Future

Dalio believes that China is the ascendant country destined to become the next empire. One reviewer of Dalio’s new book, Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail believes Dalio might have ulterior motives for his lavish praise for China, i.e., his investment firm Bridgewater Associates has raised $1.25 billion for its third investment fund in China. Although this investment in China could just as easily be Dalio “putting his money where his mouth is”.

But China tends to put tremendous pressure on those who want to do business there. Including things like forcing companies like Disney to edit their movies to suit the Chinese Communist Party (CCP). We have also heard rumors of the CCP putting pressure on Social Media companies like YouTube and Facebook and they censor other media entirely. All that to say Dalio might be trying to put a nice face on it for the benefit of his Chinese associates. Or he can truly believe that China is the next global empire… and he isn’t the only one to think so. Even the Middle East is singing China’s praises.

In an effort to counteract the U.S.’s reserve currency and “petrodollar” various countries including Russia and China have cobbled together agreements to avoid the use of the Dollar in energy and pipeline transactions particularly. Initially, the Euro was presented as an alternative to the Dollar, as was Bitcoin, and even a Gold-based Middle Eastern currency. So far none have succeeded in supplanting the Dollar but eventually…

China’s Problems

Back in the 1970s and 80s, the ascendant country was believed to be Japan, or maybe the U.S.S.R., followed by China. But then suddenly Japan’s rise faltered, the Soviet Union fragmented, but China continued to grow economically as it adopted more Capitalistic policies couched in Communist rhetoric. It has also used periods of relaxed control, interspersed with periodic crackdowns to maintain control. These tactics do not fully square with Dalio’s requirements of “low corruption, an honest and strong work ethic, a good educational system, fair and efficient economic systems, and smooth transitions of power” for a world empire. Dalio doesn’t mention China’s last failure (about 500 years ago) at its shot at becoming a world empire. (Instead, due to paranoid leadership China closed its borders and outlawed shipbuilding).

A new video by Casgains Academy hints that China’s current leadership could be making the same mistake all over again. They are currently experiencing their own version of our 2008 housing crisis. In the Chinese version, people got mortgages to buy “pre-construction” houses. The company was supposed to use the money to build houses but instead, in typical “Ponzi Scheme” fashion they used the money to market to other investors, and now the whole pyramid is about to collapse because developers have failed to meet building timelines. Only 60% of pre-sold homes between 2013 and 2020 were actually built.

One of the largest developers is Evergrande Group which was generating the equivalent of $74 billion in annual revenue. But it recently missed its deadline for restructuring its $300 billion debt. Evergrande could be China’s version of the 2008 U.S. bankruptcy of Lehman Brothers.

Mortgage holders have been protesting and withholding mortgage payments and the government has frozen 400,000 bank deposits. The government’s response has been primarily censorship and other heavy-handed tactics including falsely flagging protestors as having COVID in order to enforce MANDATORY quarantines in order to temporarily silence them. (A scary idea for the use of quarantine.)

Currently, 5 major Chinese banks are insolvent with hundreds of others teetering on the brink. 700 million square feet of property construction has been halted, property sales are down 20%, and the whole system could collapse because, like the U.S. banking system, Chinese banks use a fractional reserve system. This means that banks can lend out 90% of a deposit, so if everyone wants their money at the same time only 10% of them can get it resulting in a “run on the banks“.

Unlike the U.S. which is raising interest rates, China has cut its prime rate this year from 4.65% to 4.45%. So far the Chinese government has responded to the mortgage crisis by reducing or eliminating lending restrictions, which will only make the problem worse by encouraging more unscrupulous builders.

In addition to using COVID restrictions to limit protesting, China’s government has instituted a Zero COVID policy. For instance, after finding 4 asymptomatic cases in the Wuhan province, the government locked down a Million residents! This may be in an effort to “save face” because their previous response was to criticize the West’s inability to control COVID. This is having devastating effects on the Chinese economy overall.

But perversely, rather than flocking to China as you would expect in an ascendant economy, wealthy individuals are leaving as they would in a declining economy. This is happening despite the tremendous bureaucratic hurdles placed in their path by an autocratic government.

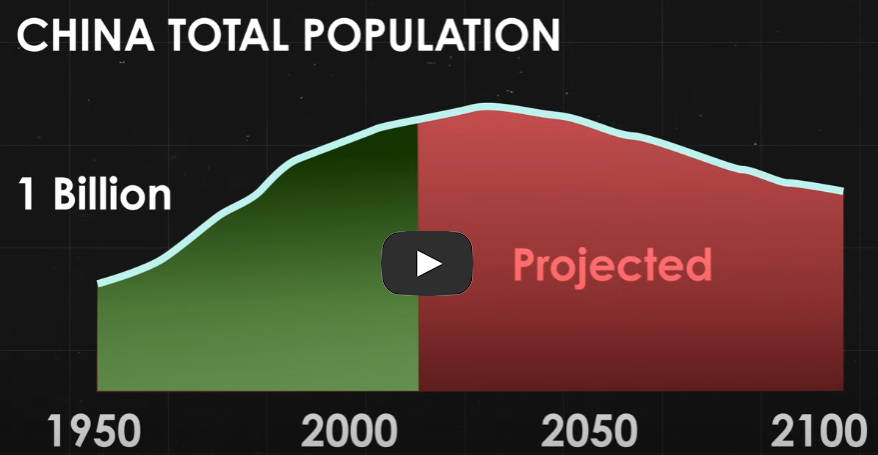

Another factor in an ascendant economy is a growing population, but China’s population is peaking due to its one-child policy which it recently rescinded in favor of a 2 child policy but that is not making much difference.

Conclusion:

Conclusion:

Even though the U.S. is exhibiting all the classic symptoms of an empire past its prime, and China looks to be the logical contender for its spot, due to inherent flaws in the Chinese system it may not work out that way.

You might also like: